After Calling China’s Crackdown, This Fund Is Going Big on Solar

(Bloomberg) — One of the few funds to predict Beijing’s clampdown on education companies is doubling down on its bets on China’s solar companies.

Most Read from Bloomberg

Ken Xu, Hong Kong-based chief investment officer at Strategic Vision Investment Ltd., withdrew from tutoring stocks in March after noting that state-backed media outlets and policy makers were echoing angst among parents about the societal impact of the industry.

Now his flagship $350 million Value Multiplier Fund is wagering that China’s green ambitions will see renewable energy stocks extend their advance, despite a jump in valuations. The fund returned more than 200% in 2020, and is up about 35% this year versus a gain of just 1.1% for the HFRX China Index that tracks the performance of China-focused hedge funds.

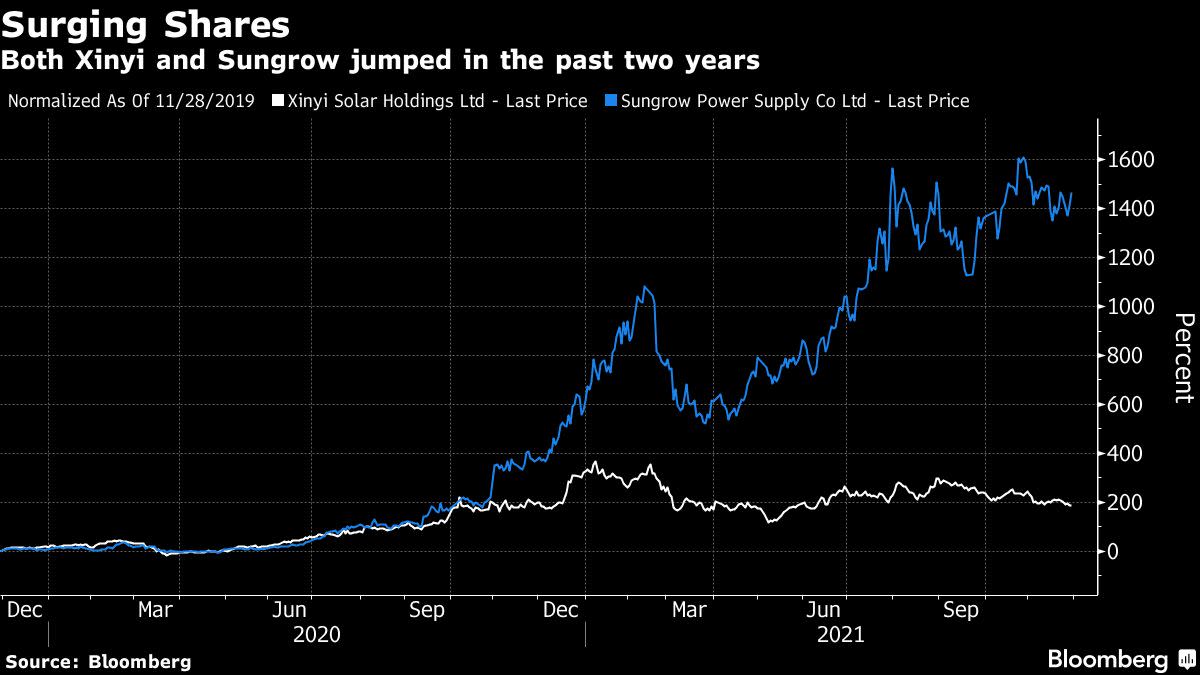

Its top two contributors — Xinyi Solar Holdings Ltd. and Sungrow Power Supply Co. — are riding a “mega trend” that shows no signs of ending, whereas big online technology names like Alibaba Group Holding Ltd. and Tencent Holdings Ltd. are becoming less attractive, according to Xu.

“The global internet is a good trend but it is a little bit mature now,” he said in an interview. “What we are actually more excited about is the energy revolution.”

Underscoring this point, the Hang Seng Tech Index dropped to near a record low Friday while ride-hailing giant Didi Global Inc. plans to delist from the New York Stock Exchange amid scrutiny from both American and Chinese regulators.

Xu expects solar power to account for as much as 60% of global electricity generation in the next 20 years, from just 3% last year. He also sees demand for solar energy and solar glass increasing as much as 30% and 45% per year, respectively, over the next few years. This will benefit Xinyi Solar, which makes solar glass, and Sungrow Power, which manufactures power inverters, he said.

Clean-energy has been a popular investment theme globally this year, evidenced by soaring share prices of electric-vehicle makers like Tesla Inc. and solar companies including Enphase Energy Inc. The enthusiasm has also been on show in Chinese stocks from lithium battery maker Contemporary Amperex Technology Co. to new energy vehicle maker Li Auto Inc., which have both surged.

China’s new-energy sector got a boost from Beijing’s commitment to achieve net zero emissions by 2060. It has also benefited from money flowing out of the technology, education and property industries as the government tightened regulations.

Still, there are challenges. China’s solar product prices have slipped recently due to some easing of demand, according to analysts at Citigroup Inc., while the Invesco Solar exchange-traded fund, which tracks a global solar industry gauge, is down about 16% this year.

Xu also identified biologics, new materials and car software as having huge potential for producing stock winners. A global shortage of battery and related equipment, and rising demand for these products, should help companies like Wuxi Lead Intelligent Equipment Co., he said. Wuxi Lead has jumped about 55% this year.

His confidence in renewable stocks comes as some investors wind back their wagers, with Xinyi Solar down about 25% from an August peak and Sungrow dropping around 11% after reaching a record high in October. Following the recent selloffs, Xinyi is one of the worst performers on the Hang Seng Index this year, while Sungrow still more than doubled.

Crackdown Plays

While Xu sold education companies New Oriental Education & Technology Group Inc. and TAL Education Group because of regulatory concerns, he sees the troubles in the real estate industry providing a good entry point for property service stocks, such as Country Garden Services Holdings Co.

The sector has many smaller firms that charge high fees and provide poor services, so scrutiny of the sector by Beijing is actually paving the way for leading players to grab more market share, Xu said.

When it comes to internet giants like Alibaba and Tencent, he said: “These are the winners in the past. We’d like to focus on the winners in the future.”

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.