Homebuilders ended Friday in the red.

The XHB homebuilder ETF, which holds stocks such as Home Depot and Lennar, fell more than 5% for the week, its worst stretch since January. That blow came despite better-than-expected data for the group – homebuilder confidence for December rose in the face of higher costs, while housing starts in November strengthened.

Matt Maley, chief market strategist at Miller Tabak, believes in the long-term bull run for the homebuilders. However, he is sounding the alarm on the potential for more pain in the short term.

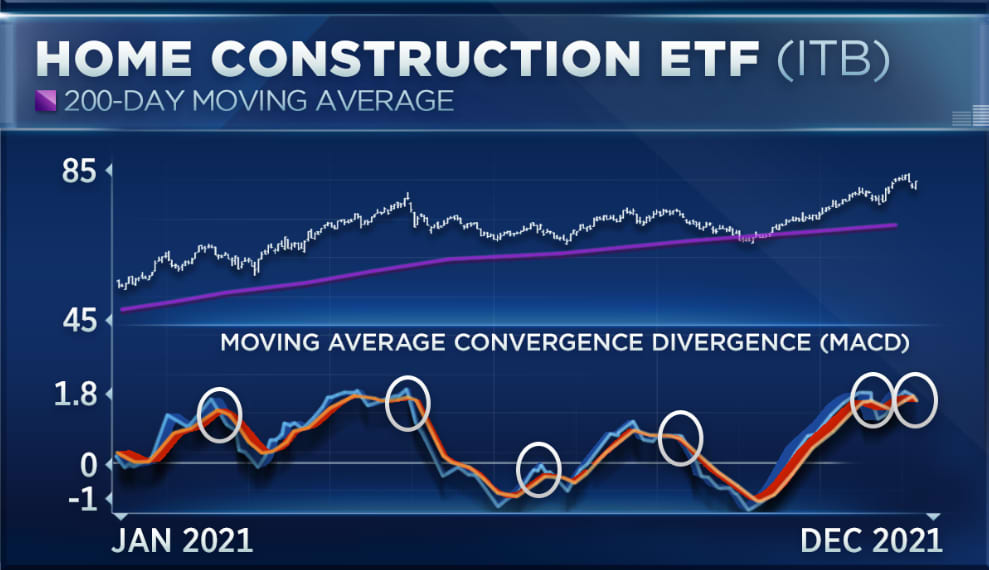

“On a near-term basis, you look at the chart on the ITB [home construction ETF], you look at what’s called the MACD chart, and that’s a measure of momentum, and it’s had this great run here but it’s starting to lose steam,” Maley told CNBC’s “Trading Nation” on Thursday.

“It’s having what they call a negative cross,” he said of the MACD indicator. “We’ve had several of those in the last year and each time it was followed by a near-term pullback that lasted a couple of weeks and so what I’m really saying here is not so much that this is a disaster for the group by any stretch, but … you don’t want be chasing the group. Let the group come to you.”

The Federal Reserve‘s eventual tightening and future rate hikes have also cast a cloud over the group. The central bank on Wednesday telegraphed the potential for three interest rate increases next year.

Gina Sanchez, CEO of Chantico Global and chief market strategist at Lido Advisors, does not see higher rates as a major headwind for the group just yet.

“This sector is sensitive to interest rates, but there’s still a huge shortage of inventory and so the need for housing is going to continue. And if you look at the last time we saw rising lumber prices, which was at the beginning of the summer, the homebuilders really shrugged that off and managed to end at higher highs,” Sanchez said Thursday.

Danielle Shay, director of options at Simpler Trading, sees multiple tailwinds driving the space to counteract the threat of rising rates.

“We have a really strong housing market right now. We still have low interest rates for the time being. We have millennials who are going out buying homes and, most of all, I mean, we’re seeing massive increases in home equity. And so that’s encouraging people to invest in real estate as well,” Shay told CNBC on Wednesday.

Shay holds the major players in the group including Home Depot, Lowe’s, D.R. Horton and the XHB ETF and intends to add to those positions throughout 2022.

Quint Tatro, president of Joule Financial, is betting on one homebuilder in particular.

“We like Toll. I think it’s best of breed here. It’s obviously the leader as far as price action, but it’s trading seven times forward earnings, and it has a decent balance sheet,” Tatro said Wednesday.

Toll Brothers has risen 58% in 2021, its best year since 2012. The XHB ETF, by comparison, has climbed 42%.

“The reality is even if we see a few hikes into 2022, historic interest rates are still extremely low and the demand for housing is just not going away. So I think any pullback in these stocks, we would favor the homebuilders really over the retailers just from a valuation standpoint,” he said.

Disclosure: Simpler Trading holds shares of Home Depot, Lowe’s and D.R. Horton.