Asia-Pacific stocks mixed as uncertainty about omicron lingers; Razer shares plunge in Hong Kong

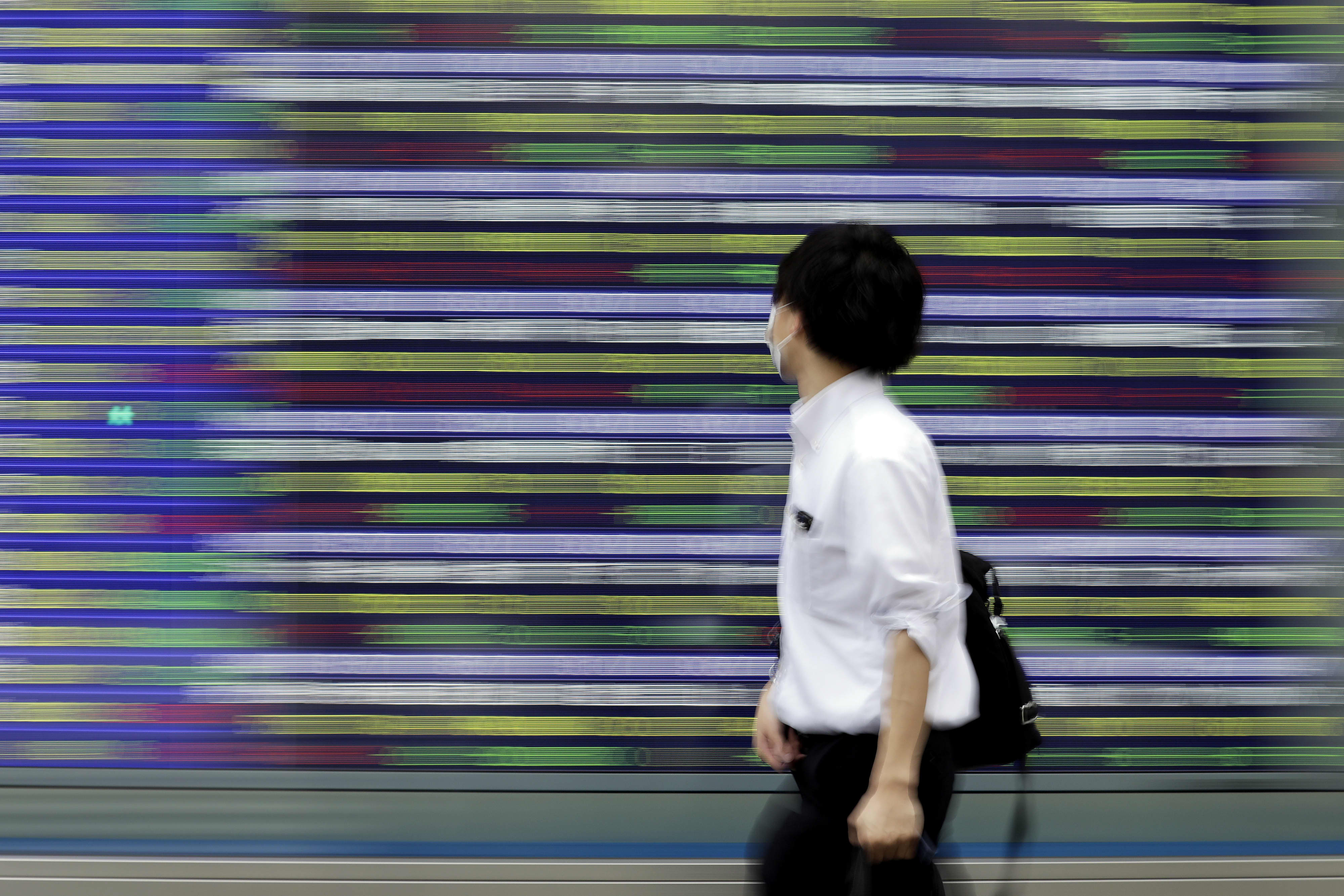

SINGAPORE — Stocks in Asia-Pacific struggled for direction in Thursday trade, as concerns over the economic impact of the omicron Covid variant continue to weigh on investor sentiment.

Hong Kong’s Hang Seng index rose 0.2%, reversing earlier losses. Shares of Razer in the city, however, dropped more than 8% in choppy trade. The company said a consortium has offered to take it private at 2.82 Hong Kong dollars each, about 5.62% higher than Razer’s Wednesday close.

Mainland Chinese stocks were mixed, with the Shanghai composite hovering above the flatline and the Shenzhen component slipping 0.197%.

Elsewhere, the Nikkei 225 in Japan declined 0.4% while the Topix index shed 0.3%. South Korea’s Kospi rose 1.2%.

In Australia, the S&P/ASX 200 fell slightly below the flatline. Australia’s October trade surplus came in at 11.22 billion Australian dollars (about $7.97 billion) on a seasonally adjusted basis, according to official data. That was against expectations in a Reuters poll for an 11 billion Australian dollar surplus for October.

MSCI’s broadest index of Asia-Pacific shares outside Japan traded 0.31% higher.

Wall Street reversal

Stocks on Wall Street saw a sharp reversal overnight after the Centers for Disease Control and Prevention confirmed the first case of omicron in the U.S.

The Dow Jones Industrial Average dropped 461.68 points to 34,022.04 while the S&P 500 declined 1.18% to 4,513.04. The Nasdaq Composite fell 1.83% to 15,254.05.

The CBOE Volatility Index or “VIX,” widely known as Wall Street’s “fear gauge,” surged to 31.12 on Wednesday, as compared with levels below 27 seen earlier in the week.

U.S. stock futures traded in positive territory following Wednesday’s declines. Dow Jones Industrial Average futures rose 237 points. S&P 500 futures and Nasdaq-100 futures also both traded in positive territory.

Oil rises 1%

Oil prices were higher in the morning of Asia trading hours, with international benchmark Brent crude futures advanced 1.42% to $69.81 per barrel. U.S. crude futures gained 1.39% to $66.49 per barrel.

The U.S. dollar index, which tracks the greenback against a basket of its peers, was at 95.963 after briefly spiking above 96.5 earlier in the week.

The Japanese yen traded at 113.06 per dollar, still stronger than levels above 113.4 seen against the greenback earlier this week. The Australian dollar was at $0.711 after recently dropping from above $0.715.