Since March 27, 2020, payments on federal student loan payments have been paused and the federal student loan interest rate has been set to 0%. This student loan moratorium is currently set to expire Jan. 31 2022 and payments are set to resume Feb 1.

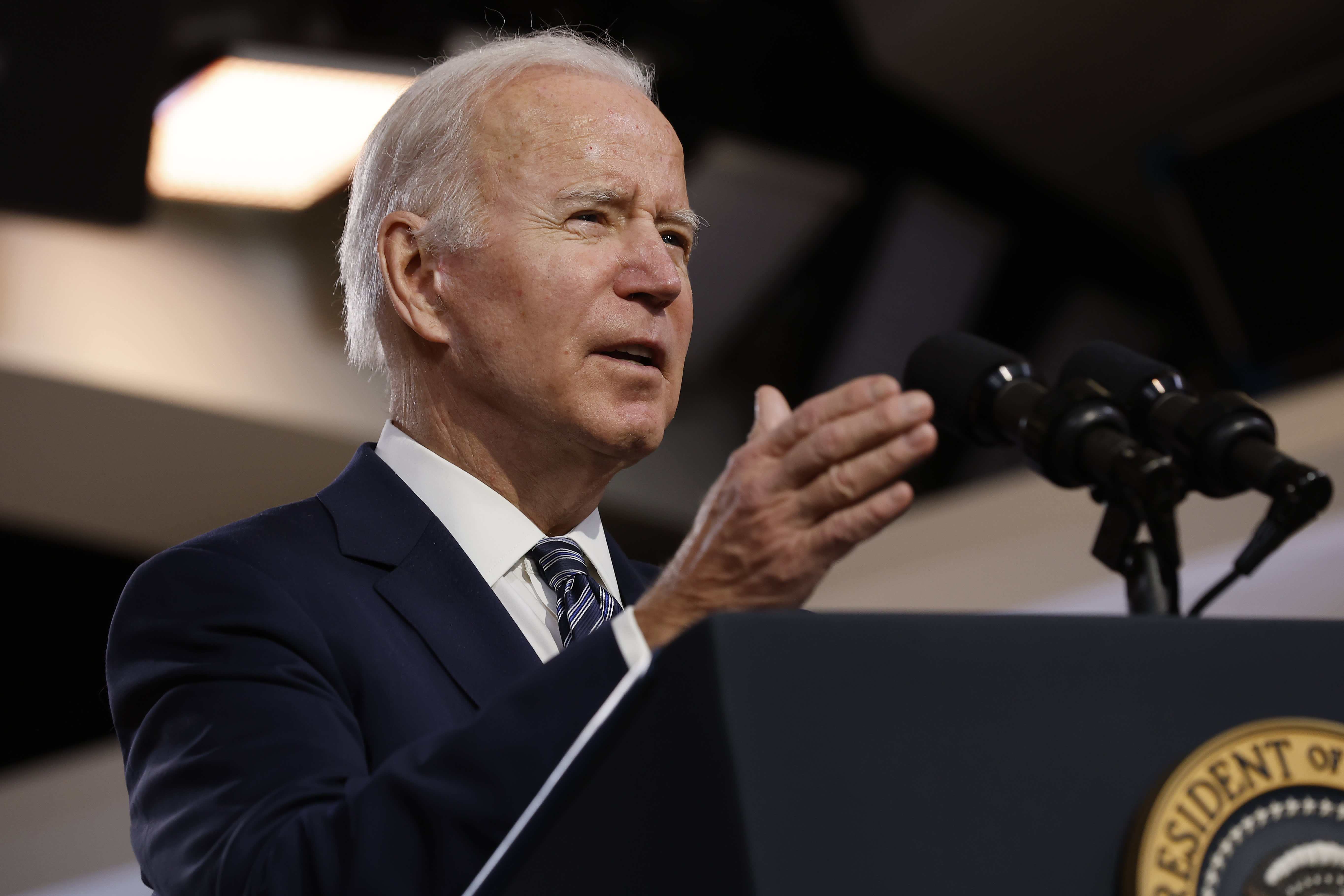

Recently, politicians such as Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren as well as hundreds of organizations such as the American Civil Liberties Union, the American Federation of Teachers, the NAACP and the Student Borrower Protection Center have asked President Biden to extend the pause — arguing that borrowers and servicers are not prepared for loan payments to resume.

On Dec 11, White House Press Secretary Jen Psaki indicated payments would resume as planned on Feb 1.

“The Department of Education is already communicating with borrowers to help them prepare for return to repayment on February 1,” said Psaki in a press conference. “41 million borrowers have benefitted from the extended student loan payment pause, but it expires February 1, so right now we’re just making a range of preparations.”

She also said the Biden Administration “will engage directly with federal student loan borrowers to ensure they have the resources they need and are in the appropriate repayment plan” and that they are “still assessing the impact of the Omicron variant.”

Ultimately, “a smooth transition back into repayment is a high priority for the administration,” stressed Psaki.

How to prepare

A recent survey of 33,703 student loan borrowers by the Student Debt Crisis Center found that even among student loan borrowers with full-time employment, 89% say they’re not financially secure enough to begin making payments after Feb 1. And 21% say they will never be financially secure enough to resume payments.

Ashley Boucher, director of corporate communications for Sallie Mae, has previously told CNBC Make It that “looking ahead” will be key for borrowers as the pause deadline nears.

“Understand how your finances may have changed as a result of the pandemic,” she says. “Are you changing your living scenario? Has your job changed? Has your income changed? What is your new budget?”

While each borrowers’ circumstances vary, Boucher stresses that the biggest thing any borrower can do right now is to check their balances so they have all of the information they need to make the right decision for them.

“The key, regardless of when you make payments again, is to know who you owe, know how much you owe,” she says. “And know how everything is going to fit into this new budget that you may have for yourself.”

Scott Buchanan, executive director of the Student Loan Servicing Alliance, previously told CNBC that one small thing borrowers can do to make sure they are prepared for payments to resume is to check if their lender has up-to-date contact information since many borrowers have moved during the pandemic.

“You can confirm we have the right info by just logging in to your account online,” he says. “That way, you will hear directly from your servicer with all the relevant information on when you will resume repayment.”

Additionally, over 10 million student loan borrowers will have their servicer changed by the end of 2021. Servicers should notify borrowers if their loans have been transferred but some borrowers miss this notification. Borrowers can check the federal student aid dashboard before the pause ends to make sure they don’t miss payments, or send payments to the wrong location.

And if borrowers want to pursue debt relief through the Public Service Loan Forgiveness program, they should enroll in an income-driven repayment plan before payments resume.

Of note, the Department of Education is offering a limited PSLF waiver so that borrowers can have their previous payments counted, “regardless of loan type or repayment plan.” Borrowers have until October 31, 2022 to complete this temporary waiver.

Don’t miss: