Crypto has had a rough few days. The biggest test is still to come, Morgan Stanley strategists say.

It wasn’t a great weekend in the cryptospace.

Bitcoin BTCUSD,

Still, the adage is to buy when there’s blood in the streets, and El Salvador President Nayib Bukele said he got on the phone (yes, the phone) to buy 150 bitcoin for his country, at an average price of $48,670.

Nicholas Colas, co-founder of DataTrek Research, said it’s no accident the big decline came during the weekend, which he said was likely the result of forced selling. “Worth noting: there is no common global regulatory framework for financial leverage associated with virtual currency trading. We’ve heard of 50:1 and even 100:1 leverage for those day trading these assets. No wonder you can get a random sale at inopportune times when prices start to move around unexpectedly,” he said.

Putting the last week’s events to the side, crypto is heading to a challenging time — a Federal Reserve rate-hike cycle. Morgan Stanley strategist Michelle Weaver said it’s one of the four major investment debates the broker’s analysts identified for the next year.

“Bitcoin came from the aftermath of the global financial crisis and was a response to the Fed’s quantitative easing policies and poor sentiment around traditional banking. Some retail customers are choosing cryptocurrency as they want to transact in a decentralized system without banks. However, if capital no longer remains cheap, can preferences for cryptocurrency-based transactions persist if they remain higher cost, higher risk, and less convenient than existing payment systems,” she asked.

The buzz

The early reports from South Africa, which first reported the existence of the omicron variant of coronavirus, are encouraging, with relatively low levels of high-level care needed for those who were infected, according to the South Africa Medical Research Council. Strategists at Goldman Sachs say the medical evidence so far is consistent with a scenario where the virus spreads quickly but immunity against hospitalizations declines only slightly, in which case they see a 2.5 point annualized decline in global growth for the first quarter.

The People’s Bank of China said it would cut reserve requirements by a half-point. Chinese property developer Evergrande 3333,

Chinese internet-services giant Alibaba BABA,

Hedge fund Engine Capital is pushing Kohl’s KSS,

BuzzFeed is going public Monday, after shareholders of the special-purpose acquisition company 890 Fifth Avenue Partners approved their merger.

Electric-vehicle maker Lucid LCID,

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

The markets

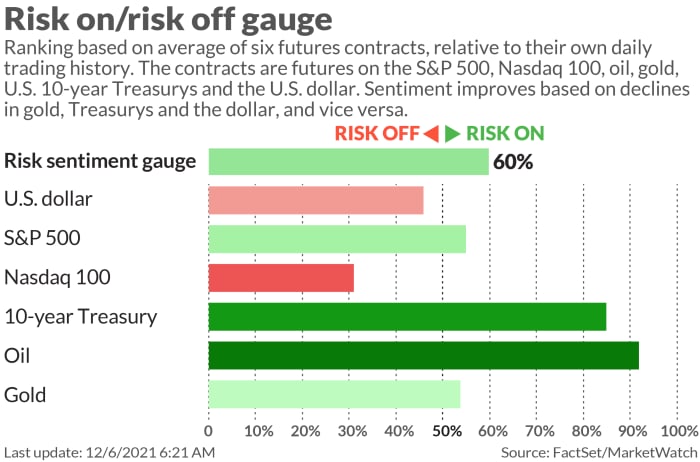

U.S. stock futures were mixed on Monday, with the S&P 500 ES00,

The yield on the 10-year Treasury TMUBMUSD10Y,

Top tickers

Here are the most active tickers on MarketWatch, as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| GME, |

GameStop |

| NIO, |

NIO |

| ES00, |

E-mini S&P 500 futures |

| TMUBMUSD10Y, |

U.S. 10 Year Treasury note |

| DXY, |

U.S. dollar index |

| BABA, |

Alibaba |

| NVDA, |

Nvidia |

| NQ00, |

E-mini Nasdaq-100 futures |

Random reads

This index you’ve never heard of tracks $1.3 trillion in funds.

An African-American couple improved their home-price appraisal by $500,000 — by having a white friend pretend to be the home’s owner, and hiding their photos.

A study finds China modified the weather ahead of a political celebration.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.