Fed Hikes Seen Starting With Yield Curve Flattest in Generation

(Bloomberg) — The Federal Reserve is laying the groundwork for the start of a cycle of interest-rate hikes that the bond market warns might be unusually constrained in how far it can go, setting the two on a collision course where one will eventually have to give.

Most Read from Bloomberg

The Treasuries yield curve — or the spread between short-term and long-term interest rates — looks set to be the flattest at the beginning of a Fed tightening cycle in a generation if the central bank begins raising its benchmark overnight rate in mid-2022 as now forecast. The two-year, 10-year spread is about 83 basis points, with futures indicating 55 basis points in June.

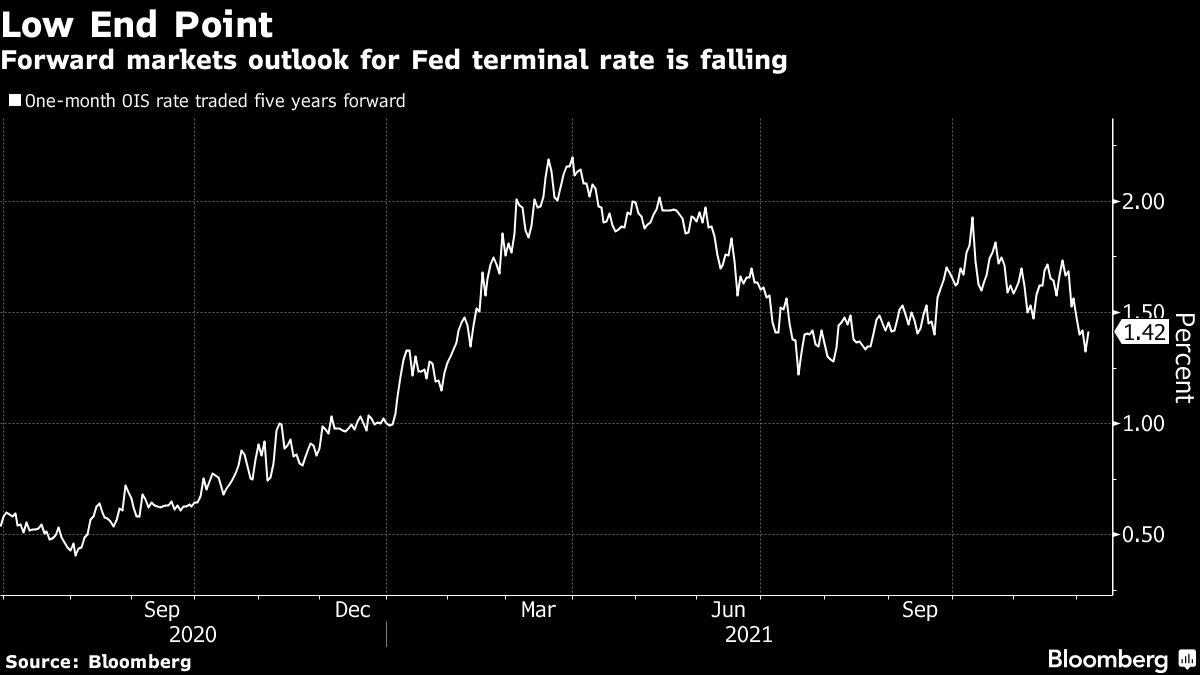

Both that flatness and the level of longer-term yields suggest investors see the central bank not being able to do too much before having to hit pause, or even reverse course if the economic recovery is in jeopardy. Yields across the curve are well below the Fed’s long-term policy rate estimate of 2.5% and even the 1.8% projection for 2024; Fed officials will be updating their forecasts on Wednesday.

Julia Coronado, president of MacroPolicy Perspectives LLC in New York, said the yield curve will be a factor for the Fed. “It is a leading indicator of the economy,” she said. “It doesn’t get everything right, but you wouldn’t, also, want to completely ignore it.”

Markets could have it wrong, and indeed would need a major shakeup if Fed Chair Jerome Powell begins telegraphing a steep or prolonged series of rate hikes to quell inflation that’s running at its hottest in four decades. Alternatively, inflation could quickly dissipate in 2022, lessening the need for Fed action and justifying low yields.

But unless inflation or long-term rates change dramatically, the yield curve suggests that a series of Fed hikes in 2022 could cause an inversion, where short-term yields are higher than longer-term ones. That’s something that precedes recessions and has caused policy makers to lean against further tightening.

For some, like former Pimco chief executive Mohamed El-Erian, the problem is the Fed didn’t start moving toward reining in stimulus sooner, before inflation reached current levels.

“When you start late, at some point developments on the ground force you to go faster than you would normally want to go,” El-Erian, chief economic adviser to Allianz SE and a Bloomberg Opinion columnist, said in a recent Bloomberg Television interview. “And if you go faster than you normally want to go, you risk breaking something,” he said.

Inflation Gauge

Another key gauge in the bond market — so-called breakevens, which measure the gap between yields on inflation-adjusted Treasuries and those on regular securities, and provide a measure of investor expectations for consumer prices — are suggesting that the Fed will be challenged to get inflation down toward its 2% target.

Five-year breakeven rates, which hit a record high last month, were at 2.80% Friday — signaling inflation over coming years that’s above policy makers’ 2% target. Such an outcome would leave investors effectively taking haircuts on regular Treasury securities, with 10-year yields currently below 1.5%.

Not since the late 1990s, when yields were notably higher than today, has the yield curve at the outset of a rate-hike campaign signaled such little tightening ahead.

“The term structure in the U.S. is already pricing cuts, even before the tightening cycle has started,” said Daniel Tenengauzer, head of market strategy at BNY Mellon in New York, noting that the gap between one-month rates traded three years forward and those traded just two years ahead has already turned negative.

The two-year, 10-year yield curve last inverted in mid-2019, by when the Fed had already pivoted toward providing greater accommodation. An inversion early in the coming cycle could be a red flag for policy makers.

“It will be a factor” for the Fed, said Coronado.

Investors and economists alike marked up the odds of substantial 2022 rate increases amid mounting risks of high inflation becoming persistent and a hawkish shift in communication from policy makers. Futures pricing suggests three quarter-point moves in 2022. JPMorgan Chase & Co. economists aligned their forecasts with that outlook on Friday.

Powell and his colleagues will unveil fresh — anonymously submitted — forecasts for the federal funds rate target and economic data on Wednesday, following a policy decision expected to result in a doubling in the tapering of the Fed’s asset purchase wind-down.

A notably hawkish turn could force a market reckoning, some observers say.

BI’s Ira F. Jersey and Angelo Manolatos:

The rates market is pricing in too few Federal Reserve interest-rate increases during the cycle, we think. At the moment, the market appears to believe the central bank may hike too early, slowing an already fragile economy, but this could shift by mid-2022.

The pivot toward faster tightening comes at a time when the growth forecast is positive: The U.S. will grow 5.5% this year, and advance another 3.9% next year — still well above the pre-pandemic trend — according to the median estimates in a Bloomberg survey.

But with a year-on-year consumer price gain of 6.8% in Friday’s November inflation data, the Fed is seen having little choice but to quickly start boosting rates after its asset purchases are wrapped up.

Policy makers had pursued a go-slow approach given that millions of Americans are still out of work thanks to the pandemic. Now, a rapid transition toward tightening could prove testing.

“Usually the Fed raises rates until they break something. And the flattening yield curve is suggesting it won’t take much to break something — maybe just a move to 1% and we’ll start seeing breakage,” Jim Bianco, president of Bianco Research, said on Bloomberg Television.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.