Gas prices slide as tankers head for Europe – live updates

Gas prices slumped this morning as a flotilla of US tankers headed for Europe to help ease the continent’s escalating energy crisis.

At least 10 ships currently in transit are heading to Europe, according to data compiled by Bloomberg. Another 20 are crossing the Atlantic, but are yet to declare their final destinations.

The additional supplies will provide some much-needed respite ahead of looming winter shortages and as Russia fails to turn up the taps.

Benchmark European prices dropped as much as 10pc, while the UK equivalent has fallen 18pc. Both had hit record highs earlier this week.

12:11 PM

Third Point fund chairman quits after ‘personal threats’ in activist spat

The chairman of a fund linked to Dan Loeb’s Third Point has quit after he received “personal threats” amid an escalating row with rebel investors.

The Financial Times reports that Steve Bates, a former US equity analyst and JPMorgan executive, has stepped down from London-based Third Point Investors Ltd.

The company said Mr Bates, who has served as chairman since 2019, had decided that “circumstances have rendered his continued service as a director of the company untenable”.

It follows meetings between Third Point Investors and activists Asset Value Investors and Staude Capital. AVI owns about 10 per cent of the listed vehicle and is the largest shareholder behind Loeb.

It’s the latest twist in a spat between Mr Loeb — one of the world’s most aggressive activists — and a group of dissenting shareholders in his own company.

On Thursday, Mr Loeb called the activists a “stain on institutional investors” and said that their “juvenile antics smack of desperation and inexperience”.

11:52 AM

Supply chain tsar Dave Lewis calls for major infrastructure overhaul

The businessman drafted in by Boris Johnson to advise on supply chain troubles has concluded that a major overhaul of UK infrastructure is needed to avoid future crises.

In an email seen by Sky News, former Tesco boss Sir Dave Lewis says the “seismic move in consumer shopping habits… together with a global shipping challenge has shown the pressure on our existing supply chain infrastructure”.

He didn’t offer specific solutions to the problems, but said new work reviewing the future of the freight industry would emerge early next year.

He wrote: “The opportunity to step back and strategically consider infrastructure options which reflect the changing consumption habits of the population, the decarbonisation agenda and the need to enhance supply chain capacity and resilience is very real.”

Sir Lewis, who was this week appointed as chairman of GlaxoSmithKline’s consumer healthcare spin-off, was tapped by the Prime Minister to carry out a three-month review of supply chains.

11:28 AM

More than 35,000 retailers in financial distress

More than 35,000 struggling retailers are now in significant financial distress as they face a harsh winter amid the spread of the Omicron variant of coronavirus, according to new figures.

PA has the details:

New data from insolvency firm Begbies Traynor has also revealed that more than 20,000 bars and restaurants are also in a perilous financial position across the UK.

The figures come as firms across the UK witness reduced footfall and cancellations during a key trading period as coronavirus cases continue to soar past record levels.

The Chancellor Rishi Sunak announced a £1 billion package for affected firms earlier this week, focusing on the hospitality and leisure sectors, but industry leaders have already called for more to be done.

Begbies Traynor said its latest data for the final quarter of 2021 shows that 35,775 retailers, including both online and high street businesses, are considered in “significant financial distress”.

The figure represents an improvement on the fourth quarter of 2020, but also reflected a 2pc increase in retailers facing financial difficulty against the third quarter of 2021 as inflation and supply issues continue to bite.

Julie Palmer, partner at Begbies Traynor, described 2020 as “one of the toughest years ever experienced in the retail sector”.

10:46 AM

Putin’s puppets being blamed for ‘astronomical’ gas prices

Wholesale natural gas prices in the UK and EU have once again smashed through records, causing traders to fret about the energy squeeze gripping the Continent.

My colleague Matt Oliver takes a look at the energy crisis roiling Europe — and Russia’s role in it.

10:19 AM

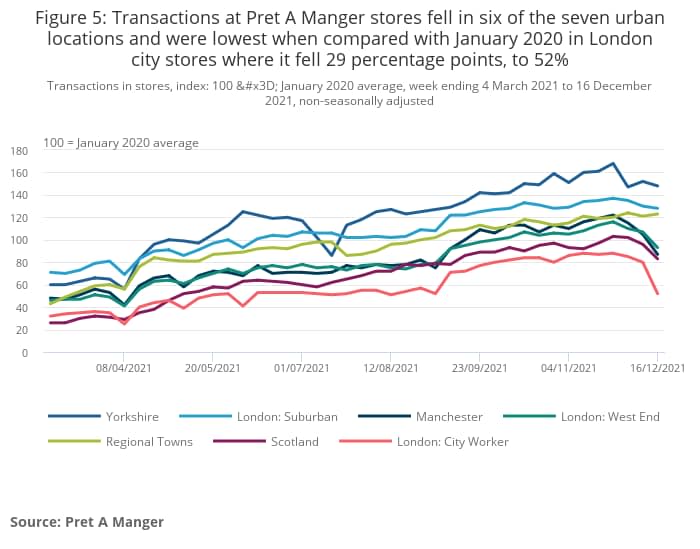

…and working from home hammers Pret

The ONS stats also contain everyone’s favourite pandemic metric — Pret sales.

Transactions at Pret A Manger stores in the week ending 16 December 2021 fell in six of the seven urban locations when compared to January 2020.

In London City stores transactions decreased 29 percentage points to the lowest level since the week ending 2 September 2021 as workers remained at home.

10:10 AM

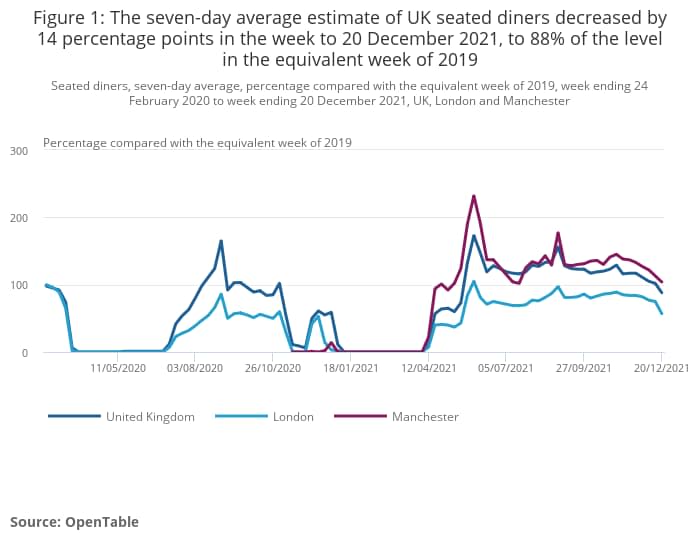

Diner numbers tumble as Brits steer clear of restaurants

Time for some more data highlighting the impact of the omicron variant…

It seems Britons have been staying away from restaurants, with seated diner numbers falling by 14 percentage points in the week to 20 December.

That’s 88pc of 2019 levels and the lowest this figure has been since the week ending 17 May, when indoor hospitality reopened, according to OpenTable data compiled by the ONS.

Overall retail footfall was at 81pc of the level seen in the equivalent week of 2019 — a slight dip on the previous week — showing even Christmas shopping couldn’t draw people to the high street.

09:46 AM

Balfour Beatty’s US arm hit with £49m fraud fine

Balfour Beatty’s US division that provides privatised military housing to America’s armed forces has agreed to pay £49m in fines and damages after pleading guilty to fraud.

Balfour Beatty Communities reached a resolution with the US Department of Justice following criminal and civil investigations into performance incentive fees improperly claimed between 2013 and 2019.

The firm pleaded guilty to one count of fraud and has agreed to the appointment of an independent compliance monitor for a three-year period, while it has also been placed on probation for three years.

The fraud related to maintenance work at certain US military housing installations.

The FTSE 250 group said:

The wrongdoing that took place is completely contrary to the way the company expects its people to behave. The company apologises for the actions of Communities to all its stakeholders.

It has been made clear to all employees that breaches of policies, procedures or law will not be tolerated.

09:30 AM

ICYMI: ‘Unprecedented’ gas price surge threatens national crisis

Energy chiefs have warned that Britain is facing a deepening national crisis after gas prices soared to record levels following a sharp fall in European imports from Russia.

Rachel Millard has more:

Executives at EDF, Good Energy and the trade body Energy UK urged ministers to step in following a surge in wholesale gas prices that has left the industry on the brink of disaster.

Prices rose to 470 pence per therm this week after months of unprecedented highs which analysts predict are at risk of continuing in 2023.

The energy price cap for households is expected to climb above £2,000 in April in the wake of the surge, up 56pc on current levels and 75pc higher than it was in September in a blow for millions of consumers.

Meanwhile 26 UK retail energy suppliers have gone bust since August because the cap prevents them from passing higher costs on to their customers, while a host of other businesses in energy and beyond are struggling.

Russia has been accused of adding to pressure on prices by withholding extra spot market supplies, with the amount of gas piped to Europe down a third from 2019 levels this month.

Read Rachel’s full story here

09:09 AM

Boris Johnson ‘won’t announce new restrictions this week’

Boris Johnson isn’t expected to announced post-Christmas Covid restrictions this week, Sky News reports, citing a senior Government source.

There’s growing optimism after recent studies shows the omicron variant is much less severe than delta, reducing the risk of hospitalisation.

However, cases are continuing to rise, with a record 100,000 reported on Thursday — the highest since the start of the pandemic.

The FTSE 100 swung back to a 0.1pc rise, with thin trading fuelling volatility.

09:00 AM

Pound hits one-month high as traders bet on interest rate hike

Sterling has rallied to its highest level in almost a month as traders step up bets on another interest rate increase from the Bank of England.

The pound gained 0.3pc against the dollar to hit $1.3388 — its highest level since Nov 24. Against the euro, it’s down as much as 0.3pc at 84.6p.

It comes after traders ramped up their expectations for more rate rises, predicting the base rate will hit 1.25pc by the end of 2022.

The Bank of England last week surprised markets by lifting rates for the first time since the start of the pandemic.

08:44 AM

FTSE runs out of steam

Well, that was short-lived. After rising as much as 0.2pc at the open, the FTSE 100 wavered and is down 0.1pc

Investor sentiment was lifted late on Wednesday after a new study showed the omicron variant was much less severe than its delta predecessor, but the optimism appears to have worn off.

Heavyweight stocks British American Tobacco, GlaxoSmithKline and Unilever are all weighing on the index. AstraZeneca is down 0.3pc even after saying its Covid jab was effective against omicron with a third dose.

More positive signs are coming from British Airways owner IAG, which has jumped 3.7pc, while Flutter has gained 2.5pc on its £1.6bn Italian takeover deal.

The domestically-focused FTSE 250 is performing better. It’s up 0.5pc, led by strong gains for Wizz Air and easyJet.

08:33 AM

Flotilla of US gas cargo ships heads for Europe

As the energy crisis rips through Europe, a flotilla of liquefied natural gas cargo ships has been dispatched from the US.

With a winter shortage looming and little relief from Russian supplies, UK and European gas prices have surged to an all-time record high.

As a result, a fleet of container ships have been sent from the US to the fuel-starved continent.

Out of 76 cargoes in transit, 10 tankers carrying a combined 1.6m cubic meters of the heating and power plant fuel have declared destinations in Europe, according to shipping data compiled by Bloomberg.

Another 20 tankers carrying an estimated 3.3m cubic meters appear to be crossing the Atlantic Ocean and are on a path to the continent.

08:19 AM

Flutter shares rise on £1.6bn takeover

Shares in Flutter have pushed 2.4pc higher this morning after the gambling giant announced a £1.6bn takeover of Italian rival Sisal.

08:03 AM

FTSE 100 edges higher

The FTSE 100 has inched higher at the open, building on gains late in Wednesday’s session after new data showed the omicron variant was significantly less deadly that delta.

The blue-chip index ticked up 0.1pc to 7,349 points.

07:48 AM

Paddy Power owner Flutter snaps up Italian rival for £1.6bn

FTSE 100 betting giant Flutter has taken a £1.6bn punt on Italian rival Sisal as it looks to expand in Europe’s second largest regulated gambling market.

Flutter, whose brands include Paddy Power and Betfair, said the deal would increase its market share in Italy to around 20pc and boost its customer base by 300,000 online monthly players and over 9.5m retail customers.

Milan-based Sisal is the biggest gambling firm in Italy — Europe’s second largest market over the UK. This year it’s set to generate profits of £211m, with 58pc coming from its online offering and the remainder coming from a combination of retail and lottery operations.

Peter Jackson, chief executive of Flutter, said:

I am delighted to add Sisal, Italy’s leading gaming brand, to the group as we look to attain a gold medal position in the Italian market. For some time we have wanted to pursue this market opportunity via an omni-channel strategy and this acquisition will ideally position us to do so.

Sisal has grown its online presence significantly in recent years, aided by its proprietary platform and commitment to innovation. I’m excited to see how Flutter can complement these capabilities through our scale, differentiated products and operational capabilities.

07:37 AM

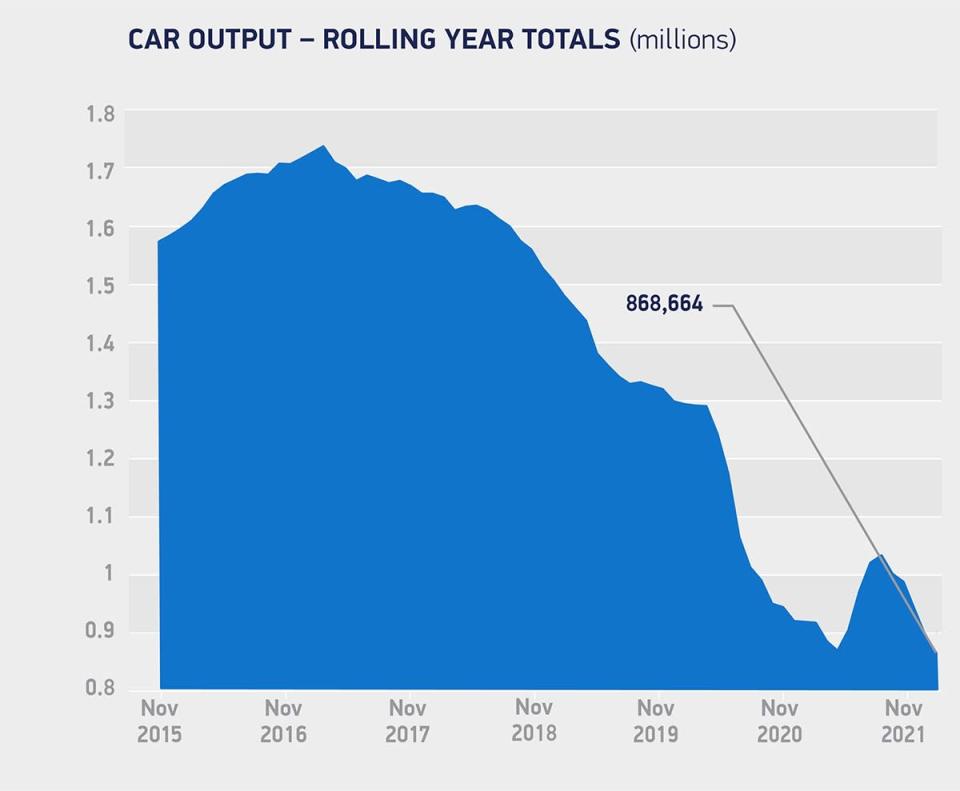

Expert reaction: Car output will never return to pre-Covid levels

Richard Peberdy, UK head of automotive at KPMG, says supply issues have likely sparked a permanent shift in car production.

Despite investment going into increasing chip production, the backlog of demand for the variety of sectors and goods that require them means that supply challenges will persist in the automotive industry throughout 2022, albeit these will probably ease as the year goes on.

As component supply issues ease, production will increase to meet pent-up vehicle demand. But I’d argue that we are entering a ‘new normal’ for car manufacturing and we won’t again see the levels of over-production and discounting that we did pre-pandemic.

Instead, manufacturers will focus volume on more profitable vehicles and markets. Demand will change too and in light of sustainability concerns and hybrid working, consumers will be rethinking what they drive and how they access and pay for mobility more widely.

07:32 AM

SMMT: Falling car output ‘incredibly worrying’

Mike Hawes, chief executive of the SMMT Chief Executive, describes the November output as “incredibly worrying figures, underscoring the severity of situation facing the automotive industry”.

Covid is impacting supply chains massively, causing global shortages — especially of semiconductors — which is likely to affect the sector throughout next year. With an increasingly negative economic backdrop, rising inflation and Covid resurgent home and abroad, the circumstances are the toughest in decades.

With output massively down for the past five months and likely to continue, maintaining cashflow, especially in the supply chain, is of vital importance. We have to look to government to provide support measures in the same way it is recognising other Covid-impacted sectors.

The industry is as well prepared as it can be for the implementation of full customs controls at UK borders from 1 January but any delays arising from ill-prepared freight or systems will place further stress on businesses that operate ‘just in time’. Should any problems arise, contingency measures must be implemented immediately to keep cross border trade flowing smoothly.

07:27 AM

Output falls despite electric vehicle boost

While the overall picture for car production is concerning, the growth of electric vehicles shows no signs of slowing down.

Battery electric, plug-in hybrid and hybrid cars took a record share of production, accounting for around a third (32.7pc) of all cars made in the month, and more than a quarter over the year to date.

In particular, battery electric vehicle output was up by 52.pc to 10,359 units, hitting a new high of 13.7pc of all production — more than double the level a year ago.

07:22 AM

Car production tumbles

Good morning.

We start with the latest figures from the SMMT, which show the UK’s car industry recorded its worst November for output since 1984.

Output dropped 28.7pc last month to 75,756 units as manufacturers struggle with the global shortage of semiconductors.

Production for both domestic and overseas markets declined, down -18.8pc and -30.4pc respectively, as 30,487 fewer cars rolled off factory lines.

But electric vehicles remained the bright spot, growing as a share of overall production once again.

5 things to start your day

1) Daily Mirror owner faces action over pension fund deficit Reach’s refusal to make bigger contributions to its retirement scheme leads trustee to seek intervention by the Pensions Regulator

2) Sri Lanka sends Ceylon tea to pay $250m Iranian oil bill Unconventional payment method avoids sanctions imposed on Iran by the UN and US as no sanctioned banks will be involved

3) Amazon finds consumers losing interest in Alexa as privacy fears mount Online giant predicts a slowdown in sales of its Echo devices after its research finds many go unused

4) Tesla faces new safety probe into dashboard video games ‘Passenger Play’ feature allows games to be played while the vehicle is moving

5) Taylor Wimpey drops ‘unfair’ contracts that double ground rents every decade Housebuilder agrees to changes following an investigation by the competition regulator

What happened overnight

Asian markets rose on Thursday following Wall Street’s lead as concerns over inflation and Covid eased with US data showing optimism about the economy.

New cases of the highly mutated omicron strain continued to soar, but market watchers are becoming more confident the health effects will be milder than with earlier strains.

Even a Covid lockdown in the Chinese city of Xian failed to dampen enthusiasm, with Shanghai up 0.1pc to 3, 627.19 and Hong Kong 0.2pc higher at 23,136.99. In Tokyo, the Nikkei 225 was up 0.3 percent at 28,651.46.

Coming up today

-

Corporate: Cintas (Interim results)

-

Economics: Consumer confidence (UK), CBI Monthly Growth Indicator (UK), durable goods orders (US), jobless claims (US), non-defence capital goods orders (US), personal income (US), Michigan consumer sentiment index (US), new home sales (US)