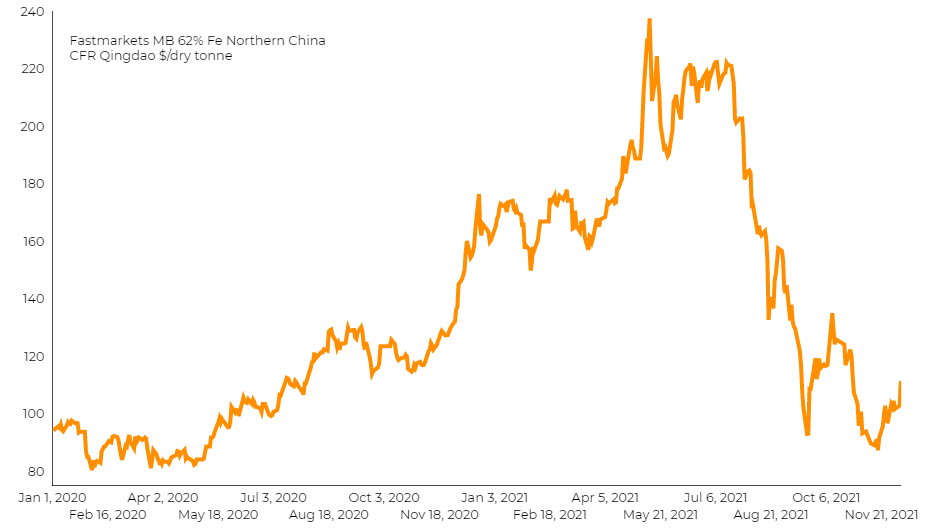

Iron ore price rockets as China imports hit highest in 16 months

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $111.34 a tonne, up 8.8% from Monday’s closing.

“November imports data could be affected by the customs clearance factor,” said Tang Binghua, an analyst with Founder CIFCO Futures in Beijing, adding that shipments and arrivals of iron ore did not change significantly in recent months.

“But it is unlikely that high levels of imports will continue, as consumption is weak after China stepped up output controls on mills during the heating season and ahead of the Winter Olympics.”

“The surprise in import growth was driven by a rebound in commodity volume, probably reflecting improving infrastructure capex demand as local governments stepped up stimulus toward the turn of the year,” said Michelle Lam, greater China economist at Societe Generale SA in Hong Kong.

Stocks of imported iron ore at Chinese ports grew for 10 straight weeks, jumping last week to 155.5 million tonnes, the highest since mid-2018, data from consultancy Mysteel showed.

In the first 11 months of the year, China imported 1.04 billion tonnes of iron ore, down 3.2% from the corresponding period a year earlier.

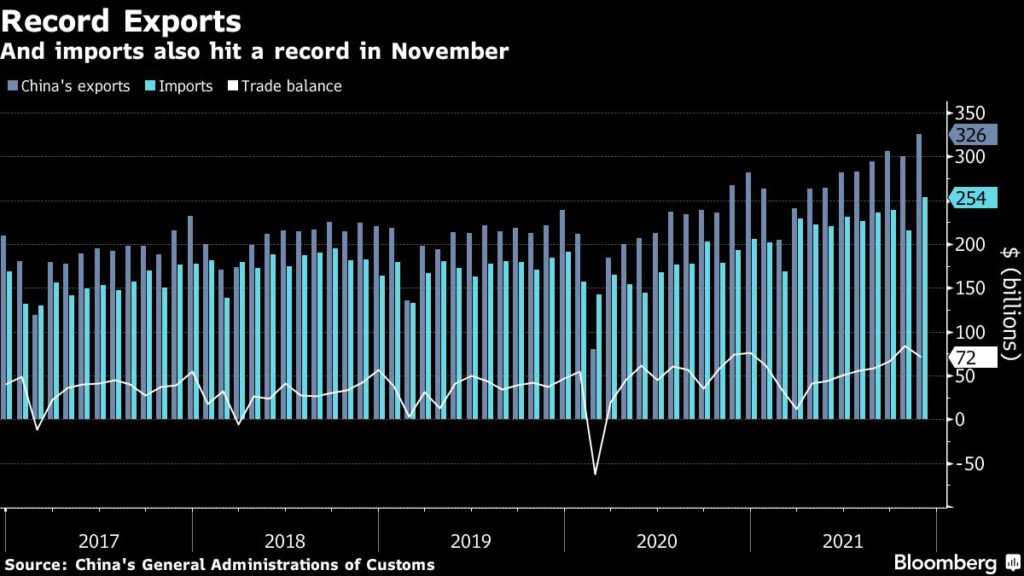

China’s total imports grew almost 32% to about $254 billion. Economists had forecast imports to increase by 21.5%.

Exports also rose 22% in dollar terms from a year earlier to almost $326 billion.

(With files from Reuters and Bloomberg)