Rates Market Calls Fed’s Bluff After Historical Hawkish Pivot

(Bloomberg) — Two days after one of the Federal Reserve’s most hawkish pivots in recent years, the rates market is already calling the central bank’s bluff.

Most Read from Bloomberg

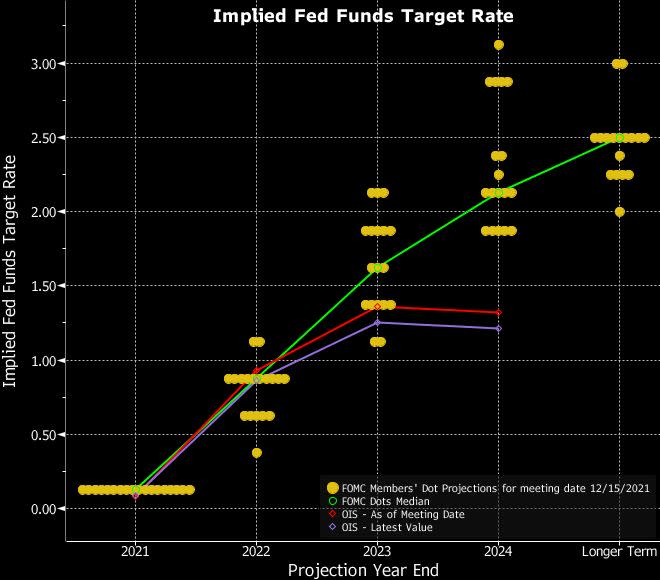

While the the median forecast of the Fed’s dot-plot showed that policy makers expect to raise the benchmark rate eight times to 2.125% by end-2024, overnight indexed swaps signal investors are betting that borrowing costs will peak a full year earlier, at about 1.25%. Even the most dovish Fed forecasts for 2024 are 67 basis points higher than what’s priced in the market.

Over the past few months, investors questioned the Fed’s narrative that inflation is transitory, bringing forward their rate-hike expectations for next year, even as Fed Chair Jerome Powell pushed back and called for patience. Ironically, now that the Fed has shifted toward the markets’ view for 2022, traders are betting that the capitulation will result in a shallower and shorter tightening cycle.

“The Fed is correct to assume that the next six months are unlikely to differ dramatically from the last six which will be characterized by an improving labor market and steady upward pressure on consumer prices in the new year,” Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, wrote in a note. “It’s the degree to which the real economy is vulnerable to shocks once the warm blanket of accommodative policy is removed that is the primary question, and the one that we expect will continue to reinforce the bid in the longer end of the U.S. rates market.”

Ten-year Treasuries gained for a second day Friday, with yields falling six basis points since the Fed meeting, back below 1.4% to the lowest in almost two weeks. On Wednesday, Powell announced the Fed would double the pace of tapering asset purchases to pave way for rate hikes next year. The median dots showed Fed officials expect three rate hikes next year. In September, officials were evenly split on the need for any rate increases at all in 2022.

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.