‘The bond market is not yet prepared’ — here’s what a Wall Street veteran fears

As the signals from the Federal Reserve become louder and louder that interest rates will be hiked next year, the question for markets becomes less about when and more about, how high.

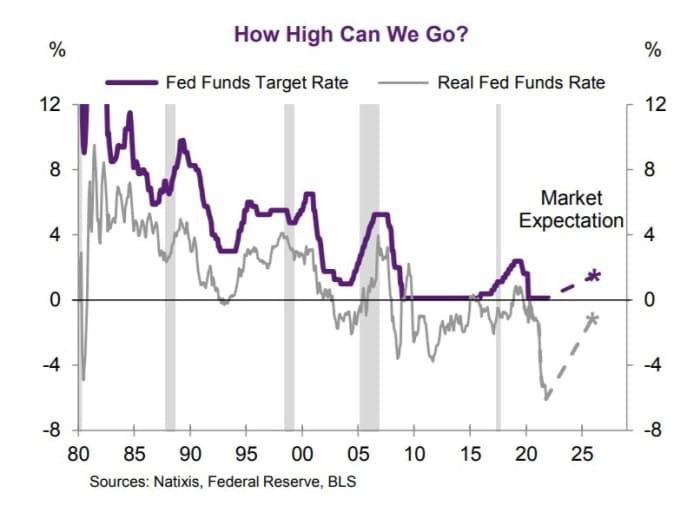

Nearly every rate-hike cycle since the 1970s has resulted in successively lower peaks. That’s logical, because inflation also has had lower peaks.

“In essence, a secular decline in inflation has mitigated the need for monetary policy makers to lift official interest rates as much as previous business cycles,” said Joe LaVorgna, the chief economist of the Americas for Natixis Corporate and Investment Banking, who also was chief economist for the White House National Economic Council in the latter days of the Trump administration.

Markets have learned. Measured by five-year overnight index swaps, traders expect the next rate hike cycle to peak at just 1.45%. And adjusted for inflation, real rates are forecast not to get into positive territory in this business cycle.

LaVorgna said markets may be in store for a rude awakening. “But unprecedented fiscal and monetary stimulus since COVID may have reversed the post-1980s secular downtrend in inflation. If this is the case, then the real fed-funds rate eventually needs to get back into positive territory to dampen inflationary pressure,” he said.

LaVorgna said the bond market isn’t yet prepared. And to MarketWatch, he said neither is the stock market. The end result for equities? “Eventually a serious compression in multiples,” he said in an email. The last reading for the Shiller price-to-equty ratio was a staggering 39.

Related: Charlie Munger says the market is ‘crazier’ than late 1990s

The buzz

The U.S. created just 210,000 nonfarm jobs in November, a gain far below estimates in the half-million range. The unemployment rate meanwhile fell 0.4 points to 4.2%, a lower level than anticipated.

U.S. stock futures ES00,

The Gauteng province of South Africa is expected to be declared to be in a fourth wave of coronavirus infections on Friday, as cases there have surged due to the omicron variant.

A late-night U.S. Senate vote prevented the government from shutting down.

Strategists at Citi moved their global equities stance to neutral and reduced their U.S. overweight stance by a notch, citing the more hawkish Fed and the omicron uncertainty. Strategists at Barclays set an S&P 500 SPX,

Chinese ride-hailing giant Didi Global DIDI,

Electronic-signature company DocuSign DOCU,

Zillow Z,

Sign up here to get Need to Know delivered to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Today’s tickers

As of 6 a.m. Eastern, here are today’s most popular tickers on MarketWatch.

| Ticker | Name |

| TSLA, |

Tesla |

| AMC, |

AMC Entertainment |

| GME, |

GameStop |

| DXY, |

U.S. dollar index |

| TMUBMUSD10Y, |

U.S. 10 year Treasury note |

| DJIA, |

Dow Jones Industrial Average |

| NIO, |

NIO |

| ES00, |

E-mini S&P 500 futures contract |

| GRAB, |

Grab Holdings |

| AAPL, |

Apple |

Random reads

How scientists can update their COVID-19 vaccines for omicron.

Antarctica is about to experience nighttime — for all of two minutes.

A wedding ring lost in a potato patch is found, 50 years later.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Listen to the Best New Ideas in Money podcast.