This real estate debt is roaring back to fund commercial properties thrown into flux by pandemic

Wall Street’s real estate CDO machine, shunned and largely idle since the global financial crisis in 2008, has come roaring back.

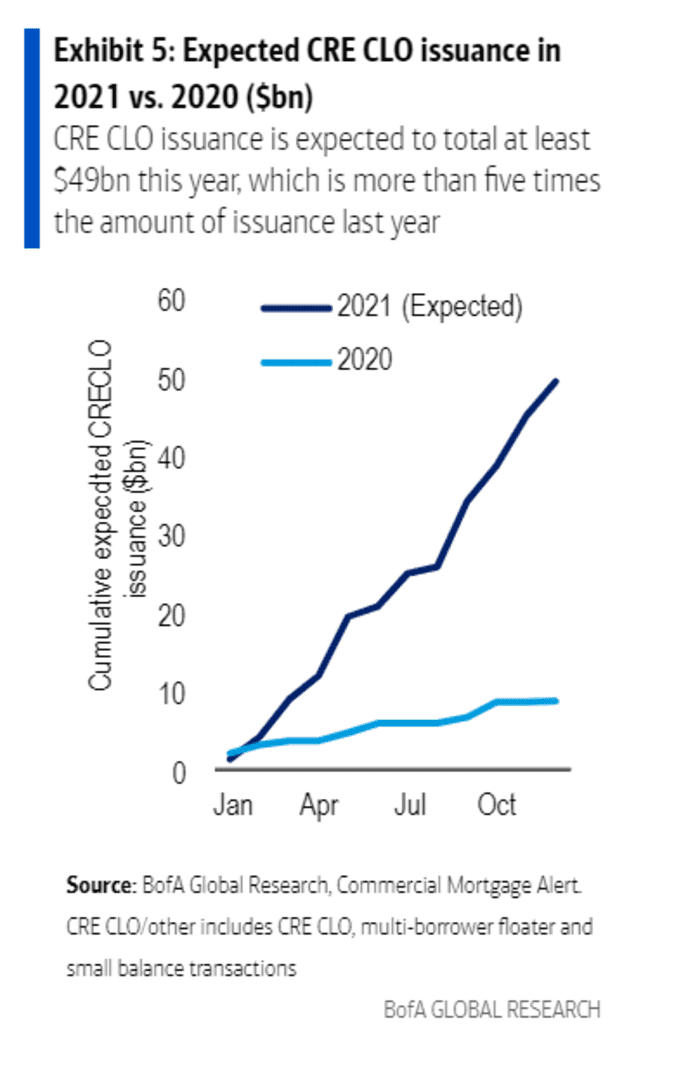

A record of nearly $50 billion of short-term “bridge loans” on commercial real estate properties are slated to be spun into bond deals called “CRE CLOs” this year, according to BofA Global, a record that also marks the sector’s more than fivefold increase from 2020 issuance levels.

The new breed of CRE CLOs, or collateralized loan obligations, this year are chiefly are anchored by loans on commercial real estate thrown into flux by the work-from-home trend, which emptied offices and drove city apartment dwellers to the suburbs during the pandemic. These are unlike the CDOs of yore, when Wall Street packaged up billions worth of increasingly hard-to-sell subprime mortgage bonds and derivatives as top-rated “collateralized debt obligations,” or CDOs that turned toxic.

The new bonds also give investors a way to bet that U.S. commercial real estate not only survives the COVID crisis, but with today’s low interest rates can land on more solid ground in the next five years.

“People were thinking commercial real estate was at the center of the storm,” said Tracy Chen, Brandywine Global Investment Management’s head of global structure credit investing, in a phone interview.

“The apocalyptic scenario that everyone was talking about didn’t happen.”

Instead, the pandemic has meant a second chance for a corner of Wall Street looking to move on from a bad past.

CRE CLOs are booming

BofA Global, Commercial Mortgage Alert

“Starting with early postcrisis CRE CLOs, the structures were updated and optics had to be differentiated from the optics of precrisis CDOs,” said Steven Kolyer, a partner in the global finance group at law firm Sidley Austin.

Kolyer was involved back when mortgage CDOs were first catching on 20 years ago, and in the past decade has helped incorporate reforms, including requiring CRE CLO sponsors, to stand by their deals by retaining some of the risks.

“These are different from the precrisis CDOs that suffered severe credit losses, mostly from subprime mortgage assets,” he said.

“The different, current credit structure comes at an opportune time, as underlying borrowers with ownership stakes in commercial real estate look for ways to transition their properties from prior uses to future uses.”

Bridge to the future

Many of the loans packaged into CRE CLOs this year have been floating-rate and used to finance relatively stable multifamily properties, where owners want flexible funding in the COVID era, including to sell if prices keep rising.

Others have gone to borrowers needing temporarily funds to repurpose an office building, retail property or hotel to attract new tenants.

Related: Shorter leases? Top real-estate executives Durst and Jones talk about the future of the office

“Typically, transitional loans were underwritten pre-COVID, with the expectation of cash flow disruptions,” said Greg Handler, Western Asset Management’s head of mortgage and consumer credit.

That meant reserving funds for “some period of renovation, re-leasing or repositioning of properties,” Handler said, which “helped to mitigate issues we saw form COVID,” including by keeping the share of delinquent loans in CRE CLOs low.

With the sector booming, Handler has been an investor, but also told MarketWatch his team has explored potentially creating its own pipeline of deals. Many of the sector’s top issuers so far have been REITs, including Arbor Realty Trust Inc. ABR,

“Clearly, there is going to be a need to redesign what the future of the office looks like,” Handler said, while also speaking to layouts of hotels and other property types that likely will change.

“Landlords and property owners are gong to need to rethink, and put more capital in,” he said.

Boom like no other

Analysts said the main risks would be sloppier underwriting taking hold as lenders compete for business, weakness in the skyrocketing multifamily sector, or plans for properties that don’t pan out.

Low interest rates TMUBMUSD10Y,

Barclays’ credit research team led by Lea Overby estimated in early December that roughly 67% of the year’s collateral for CRE CLOs was multifamily loans, with a smaller slice coming from the office sector.

But unknowns still cloud commercial real estate as the pandemic approaches its two-year mark, including around how much office space will be needed in big cities, what business travel will look like and other concerns.

While the anticipated wave of property distress hasn’t emerged, Brandywine’s Chen also tied “all risk assets” to central bank support, which until recently has meant keeping interest rates low and monetary policy accommodative.

“The rate is still at a historical low, and it takes time to hike it to a dangerous level,” she said. “That should benefit CRE CLOs.”

As the Federal Reserve turns more hawkish, Chen thinks real estate “should be a place to hide” if inflation remains high next year, particularly for investors with exposure to properties financed at ultralow rates that climb in a hiking cycle.

Check out: Will U.S. REITs beat the S&P 500 next year?