This simple strategy of picking cheap stocks has been a repeat winner. Here are a few dozen names to get you started.

Wall Street kicked off the last week of trading for 2021 with a pretty decent start to that Santa Claus rally, with more gains ahead for Tuesday, by the looks of it.

Still, there’s little to explain the rise in stocks, given volumes are drying up, wrote Michael Kramer, founder of Mott Capital Markets. “You have to go back to late August to find lower trading volumes. It seems like a combination of volatility selling and lower market participants causing buyers to just trip over themselves,” he said in a blog post.

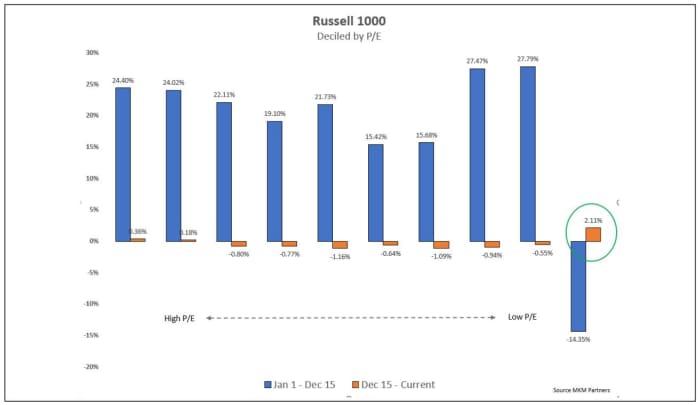

Our call of the day is about less tripping and more of a simple path forward for investors in 2022. “There has been a longer-term trend where managers start to rotate into cheap stocks (attractive valuations) at the start of each calendar year,” wrote JC O’Hara, chief market technician at MKM Partners, in a note to clients.

“We ran a simulated trading model where we bought the lowest P/E [price/earnings] decile of stocks within the S&P 1500 and rebalanced each month. This simple strategy has outperformed the benchmark over the years. We found the returns were heightened over the first quarter of each year on average,” said O’Hara.

And using a simple P/E ratio for the valuation measure, shows a rotation into “attractive valuation names” is clearly already under way, he said. “Cheap stocks saw very little inflow this year until recently. We believe this rotation will continue into 2022.”

The research found attractively valued stocks within every sector, showing what MKM Partners found were attractive technical setups. So here goes a sampling of those stocks, sector by sector:

Consumer discretionary: Ford F,

Consumer staples: There are plenty of cheap companies breaking out across the board within that defensive sector. Constellation STZ,

Energy. MKM has a equal-weight ranking on the sector, but sees plenty of upside in 2022. Halliburton HAL,

Financials. “Banks have been under pressure given the recent movement of yields. Other areas within this sector offer better charts in our technical opinion,” said O’Hara. Wintrust Financial WTFC,

Healthcare: The strategist said MKM is warming up to the sector amid expansion of “positive breadth” — more stocks advancing than declining. AbbVie ABBV,

Industrials: Northrop Grumman NOC,

Technology: While the sector is generally expensive, there are plenty of bargains, especially within chip and communications equipment makers, said MKM’s O’Hare. Among the stock picks were Lumentum LITE,

Materials: Look for strength in chemicals, said MKM, with AdvanSix ASIX,

Real estate: MKM has an overweight rating on the sector. Attractive valuation picks include Plymouth Industrial PLYM,

Finally, industrials, the worst performing sector year to date, noted O’Hare, but “with plenty of charts we feel comfortable owning into next year.” Edison International EIX,

The buzz

The Centers for Disease Control and Prevention has shortened its recommended COVID-19 isolation time to five days, from 10, if you are symptom-free. That’s as global cases hit a record on Monday of 1.44 million. Some good omicron news? Catching that coronavirus variant could mean enhanced immunity against the delta one, according to a study from South Africa.

Meanwhile, Apple AAPL,

Holiday flight disruptions are set to continue on Tuesday, not helped by a batch of winter storms.

Tesla shares TSLA,

Shares of Flotek Industries FTK,

Videogame developer Riot Games, a unit of China’s Tencent 700,

Investors will get the S&P Case-Shiller U.S. house price index for October ahead of the market open.

The markets

Stock prices were mostly edging higher Tuesday morning, with the S&P 500 on track for a record close—its 70th of 2021—as investors look toward 2022 with optimism, despite record COVID-19 cases, aided by the spread of the omicron variant. The S&P 500 index SPX, +0.03% was trading up less than 0.1% but that gain was enough to help it carve out an intraday record high at 4,797.77, while the Dow Jones Industrial Average DJIA, +0.29% was climbing 0.4% at 36,432. The Nasdaq Composite Index COMP, -0.26% was trading 0.2% lower at 15,850. In a light week for U.S. economic data, the S&P CoreLogic Case-Shiller 20-city price index posted a 18.4% year-over-year gain in October, down from 19.1% the previous month.

The chart

Blogger The Market Ear provides this (Refinitiv) chart that shows some late chasing going on among investors and the tech sector. The index is highs of a short-term range that has held since October. “Chasing the break out in a low liquidity tape isn’t what we do. Time to book some of those mean reversion short term trades and relax…” writes the blogger.

Random reads

Researchers will crack the lid on a much-sought after time capsule from 1887 later Tuesday.

“Digitally unwrapping” an Egyptian Pharaoh after 3,500 years.

Legendary rocker Ozzy Osbourne will launch his “CryptoBatz” nonfungible token collection in the new year.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.