10 quick money hacks to boost your retirement savings in 2022

If you want to get your new year off to a good start, try some quick and easy money moves to make yourself richer and fatten your retirement account.

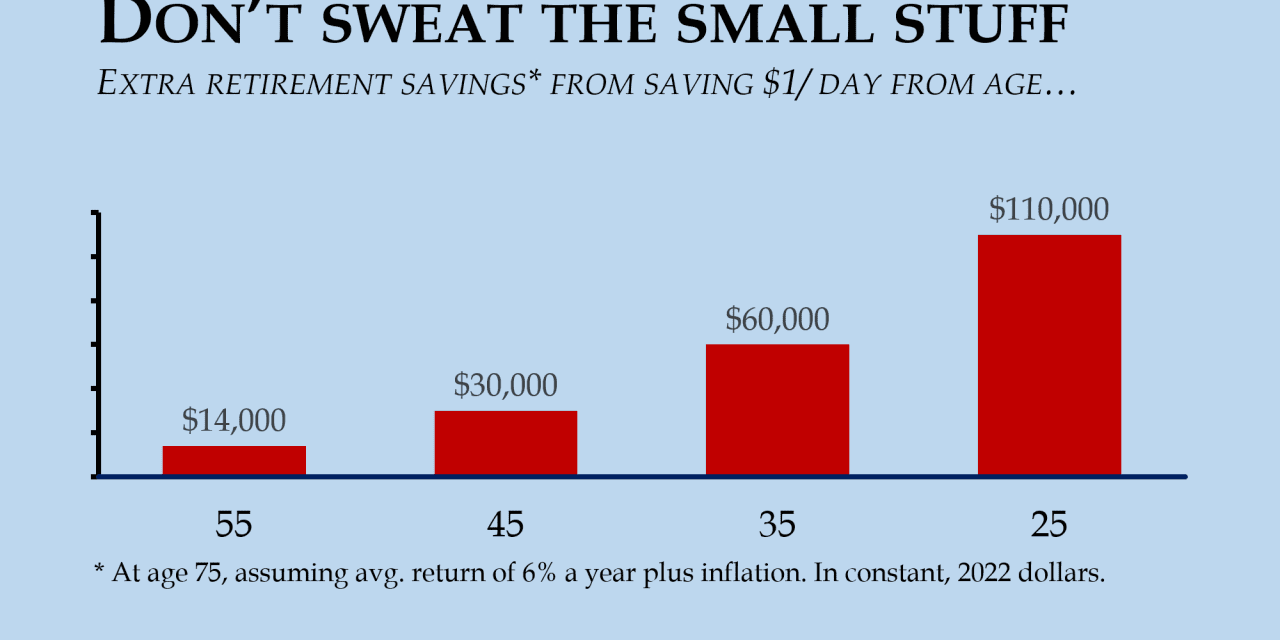

And don’t sweat the small stuff, because over time even minor savings can add up to big gains. Check out the chart above. It’s based on stock market history data and some simple calculations. It’s what you’d end up with at age 75 if you saved an extra $1 a day. That’s it.

And these numbers are adjusted for inflation.

I know someone who starts the year by putting all his leftover pennies in cardboard sleeves and taking them to the bank — not for the few dollars he gets back, but as a ritual, start-of-the-year reminder of the value of money. You don’t have to go that far to turn your pennies into retirement gold.

Want to become a better investor? Sign up for our How to Invest series

1. Change your cellphone plan

There’s a good chance you’re just burning money through your cellular plan. The average bill is about $70 per person per month, according to some estimates. As opposed to, say, this plan from RedPocket that costs $99 for an entire year. Estimated savings: $500 a year.

2. Stagger your streaming services

Remember when “cutting the cord” on the cable company was going to save you a ton of money? How many individual streaming services are you subscribed to instead. Each at $6 or $10 or $20 a month. None is costing the earth, but they add up. Meanwhile how many of us are spent clicking around on those awful new remote controls desperately trying to remember what we were watching where. Simple solution: Stagger them. Subscribe to one and only one each month. Estimated savings: $300 a year.

3. Switch banks for free money

A bank robber hit my neighborhood a few months ago. He got away with about $300 before being chased down the street by a security guard. Meanwhile one of the banks he tried to rob was offering $600 cash bonuses for new customers. True story. But it’s not only bank robbers missing out on a freebie in plain sight. These kinds of offers are everywhere if we look for them. Banks want new customers and they are prepared to bribe us with cash to cross the road and fill out some forms. Estimated savings: $600 a year.

Read: Help your teenager turn $500 into nearly $2 million

4. Go on a money fast

We all know about these so-called “fast” diets, where you don’t eat for one or two days a week, or for even longer. A money fast involves a similar principle. Some people make a resolution, say, to go for one week a month without spending any money. (Obviously this relates to discretionary spending, and doesn’t involve skipping utilities or rent.) Some nutritionists argue that food fasting isn’t really a miracle way of getting healthy, it’s just a disciplined way of making yourself eat less. It’s the same with a money fast. Go a week without spending a nickel and we quickly realize how much less we could spend the rest of the time too. Estimated savings: $300 a year.

5. Go vegetarian

Voters are getting so mad about rising meat and chicken prices that President Biden has just announced an investigation into alleged profiteering by the big meat companies. Whether this leads to anything is anyone’s guess. If U.S. meat giant Tyson Foods TSN,

6. Sign up for a new credit card

Banks aren’t giving away free money just for new checking and savings accounts. They’re also eager for new credit card customers. Offers come through the mail of $200 or $300 sign-up bonuses if you sign up for the latest card. (And if they don’t come through the mail you can find them online). Watch out for annual fees, and make sure you don’t end up carrying over a balance from month to month, or you’ll end up paying the bank more than they pay you (which is, of course, what they want). But do it right and it’s free money. Estimated savings: $300 a year.

7. Stop lending your money free to the richest guy in the world

If you’re like 120 million other taxpayers, or about three out of every four, you are paying too much tax every pay cycle. Over the course of the year you are paying about $2,900 too much, and you get the money back when you file your taxes in the form of a refund. Congratulations. You just lent money to Uncle Sam. For free. Meanwhile, of course, you are probably borrowing money from your mortgage provider, credit card company and other places, maybe paying as much as 30% interest. And if you are like most taxpayers, you are doing this every year.

Simple solution: File a new W4 with your employer and lower the amount of taxes “withheld,” or paid up front, from each paycheck. Result: You get to keep your money when you earn it. That can pay off debt, or, if your credit cards are paid off, it can go into your 401(k) or IRA, where instead of earning you 0% it can earn, on average, inflation plus about 6%. Estimated savings: $200 a year.

8. Open an (other) IRA

Do you contribute to a tax-advantaged IRA as well as the 401(k) at work? If you have a spouse who is not in paid employment, are you contributing to a spousal IRA for them too? And if you have any kind of side gig or hustle, are you contributing to a SEP-IRA out of those earnings as well? If not, you are probably leaving money on the table. You can contribute up to $6,000 each a year to your own and to a spousal IRA (and an extra $1,000 for the over 50s). And SEP-IRA limits are up to 25% of your self-employed income up to $61,000 a year. Estimated savings: Thousands.

9. Change your insurance

You know those commercials telling you that you can save hundreds of dollars if you switch from Insurance Company A to Insurance Company B? And those other commercials saying the exact opposite? They’re all true. You can pretty much always get a better deal if you shop around, whether it’s on household or car or other types of insurance. Just as the mustard king used to say he made his money from what people left on the plate, insurance companies make their money from the people who don’t switch. It’s such a hassle, after all. And it is a hassle. But it’s also money. And money saved, unlike money earned, is free from federal, state and city taxes. Estimated savings: $300 a year.

10. Stop paying someone else to give you caffeine in the morning

No money tips are complete without mentioning David Bach’s so-called “Latte Factor.” But the daily giant money drain continues. Americans gave Big Latte about $20 billion last year. (Actually, that was the number for just one company). And this, even though it is getting easier and easier to make your own great coffee or tea at home — and even as the lattes costa a latte more. Estimated savings: $300 a year.

Total savings: $3,000. OK, so it’s notional and some can save way more, and others way less. But every dollar counts. And if you save $3,000 a year for 30 years and invest it in stocks, on average you’d end up with an extra $240,000. Not bad for very little work.