Abbott’s share price soared as COVID-19 testing demand surged. Here’s what that may mean for the company’s fourth-quarter earnings

Abbott Laboratories Inc.’s ABT,

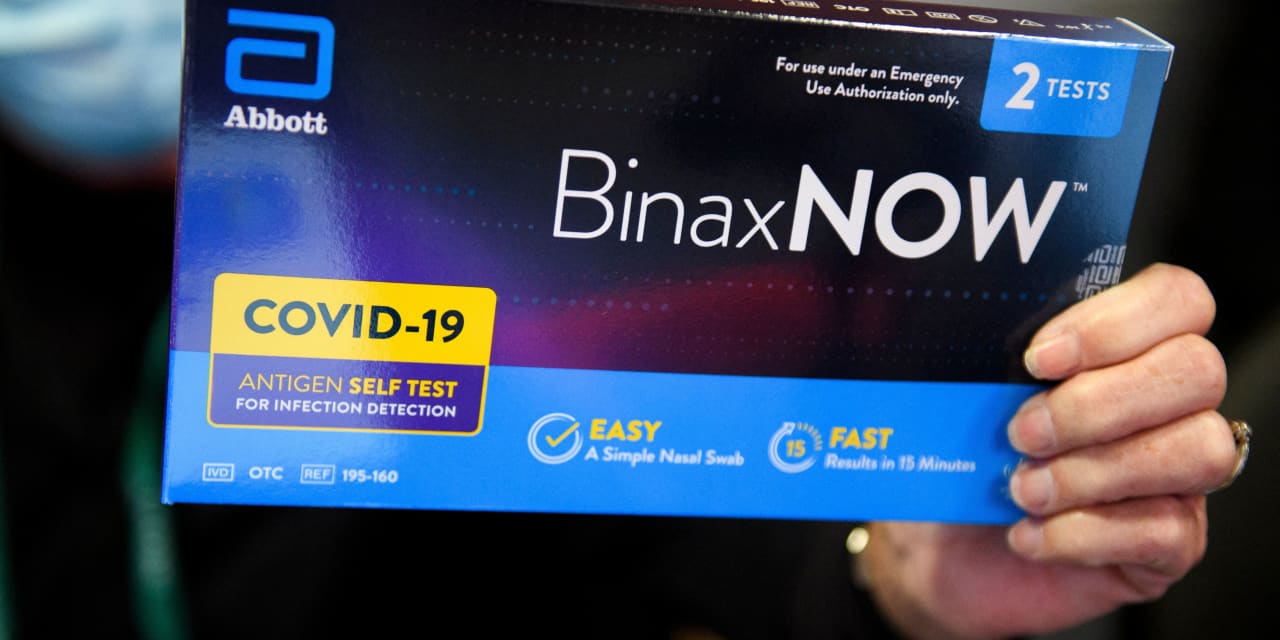

Abbott’s BinaxNow is one of the better-known brands of rapid, at-home COVID-19 tests available in the U.S. (The company markets a total of 12 molecular, antigen, and antibody COVID-19 tests worldwide, including several in the U.S.)

As case counts soared during the holiday season, access to COVID-19 testing suddenly became a major issue as it became increasingly difficult for Americans to locate rapid tests online or on store shelves or secure tests from health care practitioners.

Until recently, health officials have focused more on vaccinations and treatments, and less on testing. The company even reportedly had to lay off about 400 workers employed at a facility making COVID-19 tests last summer. However, last summer’s delta wave reignited testing demand, as did the more recent omicron surge.

“It took delta for us to ultimately realize that there is no silver bullet,” Abbott chair and CEO Robert Ford said Jan. 11 at the J.P. Morgan Healthcare Conference, according to a FactSet transcript. “You have to have vaccines, therapeutics, and testing.”

An Abbott spokesperson said the company is now making about 70 million of these tests a month, with plans to produce 100 million a month in March.

“Abbott is working nonstop,” Ford said. “We’ve obviously had a pretty strong last couple of months of testing, and we expect that to continue here in the more immediate future.”

The company’s diagnostics business now makes up more than one-third of total sales. This business generated about 24% of total sales in 2019, before the pandemic, and the development and authorization of these tests.

In some ways, this virus has served as a case study promoting the practicality of at-home testing and could lead to the development of new tests for a virus like the flu and respiratory syncytial virus, a common cold virus, that can be used “beyond the four walls of the hospital,” according to Ford.

“There will be a tailwind of upper respiratory infectious disease testing,” he told investors. “But then there’s an opportunity for us to develop new tests and add to those boxes. And that’s strategically what the team has been working on. As we’re ramping up on COVID, the R&D team has been working on new assays to put on those boxes.”

Beyond COVID-19, expect discussion about the FreeStyle Libre, the company’s continuous glucose monitoring system. Ford said sales of the device have increased 40% year-over-year.

The company is set to report its fourth-quarter earnings on Wednesday.

Here’s a quick look at Abbott’s financial performance so far this year:

• Abbott’s stock drops 3%, though earnings more than tripled for the medical test company in the first quarter (Q1, 2021)

• Abbott Labs stock gains after profit more than doubles, sales rise above expectations (Q2, 2021)

• Abbott Laboratories stock surges after big profit and sales beats, and upbeat full-year outlook (Q3, 2021)

Here’s what to watch in Abbott’s earnings:

Earnings: The consensus estimate of analysts polled by FactSet is for earnings per share of $1.21, similar to the $1.20 per share reported last year.

Estimize, which crowdsources estimates from a range of parties, including buy and sell-side investors, academics, students, and others, is expecting EPS of $1.29.

Sales: Expect sales of $10.7 billion in the fourth quarter of 2021, according to FactSet. That’s about what Abbott reported in fourth-quarter sales last year. FactSet estimates that medical-devices sales will reach $3.7 billion, while sales of diagnostics will likely hit $3.4 billion. Its nutrition business is expected to bring in $2.1 billion in sales.

Estimize is expecting sales of $10.8 billion.

Stock: Abbott’s stock is up 11.5% over the past year, while the S&P 500 has gained about 14.4% since this time last year.

An earlier version of this story incorrectly said Ford became CEO in December. He has been CEO since 2020 and formally became executive chair in December.