Bank of Canada puts credibility on line with hold on rates: economist

‘They are a little bit less credible now than they were yesterday’

Article content

One of Bay Street’s most prominent economists said the Bank of Canada’s decision to go against market expectations of an interest-rate increase this week could hurt the institutions credibility with traders and investors.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“They are a little bit less credible now than they were yesterday,” Jean-François Perrault, chief economist at Bank of Nova Scotia, said in an interview. Bank of Canada Governor Tiff Macklem, “would say they did move,” Perrault continued. “He said this a bunch of times: `This is a significant change in policy.’ So I guess there is a disagreement in terms of what he believes to be a significant change in policy and what folks like me think is a significant change in policy.”

Perrault, who previously worked at senior levels in the Finance Department, was among a large group of economists and analysts who were wrong-footed by Macklem’s decision to leave the benchmark interest rate at effectively zero, even though inflation has surged to its fastest pace in more than three decades.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

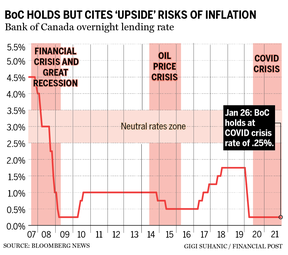

Macklem and his deputies ended a promise to leave interest rates unchanged until at least this spring, opening the door for an increase when central bankers next set policy in early March. But they decided doing more than that would be too abrupt, considering that Omicron still is disrupting the economy.

“We’re trying to cut through the noise so monetary policy is a source of confidence and it’s not another source of uncertainty,” Macklem said at a press conference.

Most traders had convinced themselves that the Bank of Canada would raise interest rates on Jan. 26, despite Macklem’s pledge to leave the benchmark interest rate unchanged until the “middle quarters” of 2022. Prices of financial assets linked to short-term interest rates implied a 70 per cent probability that Macklem would renege on that pledge and lift the benchmark rate by a quarter point.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Traders were being egged on by forecasters such as Perrault, who last week released an aggressive call for seven quarter-point increases in 2022, which would have put the benchmark rate at two per cent at the end of the year.

The U.S. Federal Reserve, “goes out of its way to hold the market’s hand,” Tom O’Gorman, director of fixed income at Franklin Templeton Canada, said in an interview. “There are no surprises. The Bank of Canada has never really been that way.”

Macklem and his deputies said in updated quarterly outlook that the slack created by the COVID recession had been absorbed, suggesting additional economic growth could be inflationary. The output gap, the difference between actual gross domestic product and non-inflationary potential GDP, closed during the final months of 2020 as economic growth accelerated to an annul rate of almost six per cent, according to the latest Monetary Policy Report.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The labour market also has fully recovered, the report said. The real-estate sector is seeing record levels of activity and prices, and the consumer price index jumped 4.8 per cent in December from a year earlier, the most since 1991.

-

Bank of Canada holds interest rates at 0.25% but hints of hike to come

-

Live updates: Why did the Bank of Canada hold and what’s next?

-

Fed to raise interest rates ‘soon’ as it pivots toward fighting inflation

-

What a Bank of Canada rate hike could mean for mortgages and the housing market

All are good reasons to raise interest rates.

“I’m hesitant to call it a policy mistake, but it certainly appears like the bank is on the back foot in the fight against inflation,” said Taylor Schleich, a strategist at National Bank, which had joined Scotia in predicting a January increase. He said he doesn’t think policy-makers’ credibility is yet hurt, conceding that the optics of a rate hike in the midst of a COVID-19 wave wouldn’t have been good, but he added that it would be “prudent” for the Bank of Canada to initiate rate increases in March.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Andrew Kelvin, chief Canada strategist at TD Securities, said the longer the central bank waits, the greater the risk that inflation expectations become un-anchored. That would cause wages and other costs to spike even more. Kelvin is expecting four interest rate increases in 2022 beginning in March.

Even if the Bank of Canada’s patience is ultimately proven correct, policy-makers will be facing a hostile crowd when they venture to Bay Street over the weeks ahead.

“I think they’re behind the curve,” Perrault said. “I’m not sure how they’re going to be able to justify that given what they’re saying today.”

• Email: [email protected] | Twitter: biancabharti

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.