Bet against tech and these other winners from the Fed’s loose policies, says Bank of America strategist

It’s time to bet against the winners from the Federal Reserve’s unprecedented monetary easing during the pandemic, a top Bank of America strategist.

Michael Hartnett, chief investment strategist at Bank of America, said the Fed will be very hawkish the next nine months after inflation soared, reaching 7% in December.

That means, “short the winners of Fed’s liquidity supernova…tech, IG, private equity.” The Fed has taken its balance sheet to nearly $9 trillion, and other central banks, as a percentage of their GDP, have been even more aggressive.

Investors already have started to punish the winners from low interest rates. The Nasdaq Composite COMP,

Investment-grade bonds, and private-equity, are less talked about during the current worries over likely Fed interest rate hikes this year.

The iShares iBoxx $ Investment Grade Corporate Bond ETF LQD,

The Invesco Global Listed Private Equity ETF PSP,

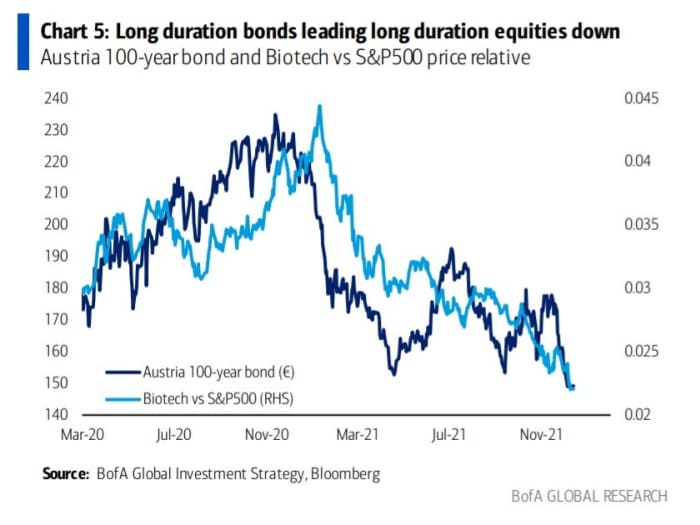

Hartnett said the interest rate shock will be global this year. The G7 unemployment rate is near a 40-year low of 4.5%, and the price of the Austrian 100-year bond has tumbled.

In terms of what he recommends on the long side, Hartnett said high quality, defensive stocks should benefit on tighter financial conditions; oil, energy, and other so-called real assets should gain due to inflation; European and emerging market banks may do well as economies recover; and distressed Asian credit may offer opportunities.

One other note he made was that the U.S. dollar DXY,

The dollar has slipped 1% while the yield on the 10-year Treasury TMUBMUSD10Y,