BMO Capital Markets ranked top mining M&A adviser of 2021 – report

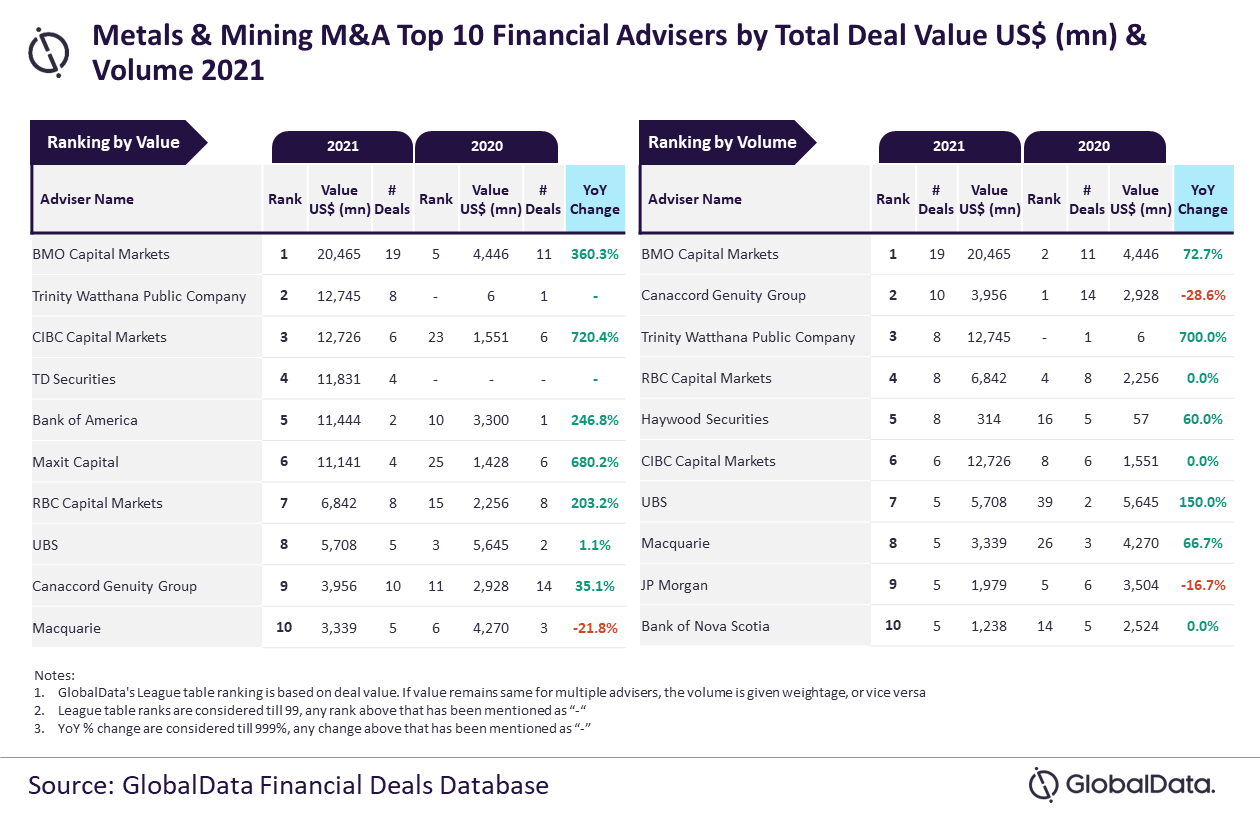

According to GlobalData’s estimates, total deal value for the metals & mining sector increased by 81.4% over the past calendar year, from $61.3 billion in 2020 to $111.2 billion in 2021.

“There was no competition for BMO Capital Markets in securing the top spot, both in terms of deal value and volume. MO Capital Markets was the only advisor to surpass the $20 billion mark, while the number of deals advised by firm was a little shy of touching the 20 mark,” Aurojyoti Bose, lead analyst at GlobalData, commented.

Trinity Watthana Public Company occupies the second position in terms of value, with eight deals worth $12.7 billion, followed by CIBC Capital Markets (six deals worth $12.7 billion), TD Securities (four deals worth $11.8 billion) and Bank of America (two deals worth $11.4 billion).

Canaccord Genuity Group occupies the second position in terms of volume, with 10 deals worth $4 billion, followed by Trinity Watthana Public, RBC Capital Markets (eight deals worth $6.8 billion) and Haywood Securities (eight deals worth $314 million).