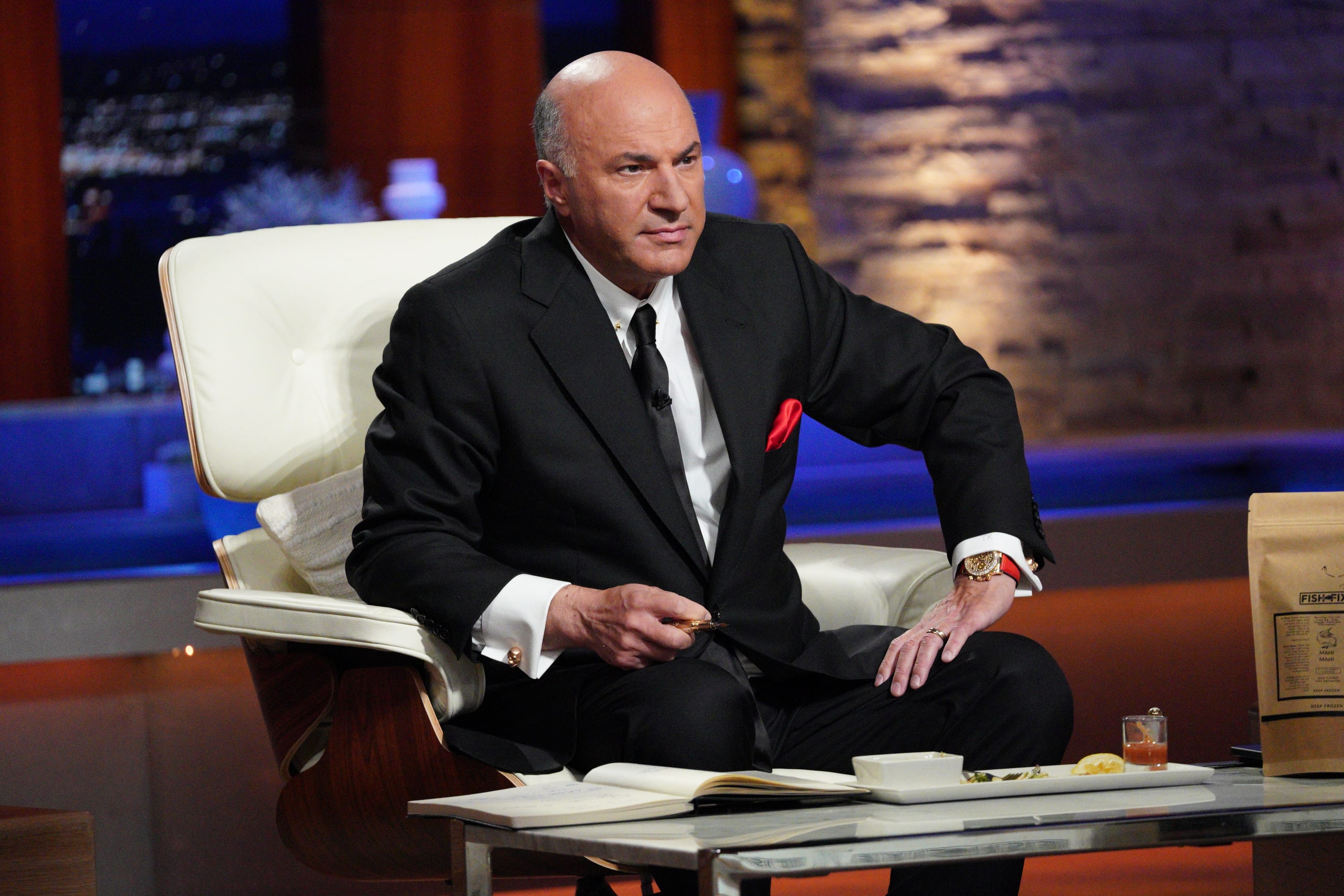

‘Boring’ is the new black – Kevin O’Leary on how he’s investing in a rising inflation environment

Rising rates and higher inflation have investors on high alert to begin the year.

The S&P 500 has fallen 6% in January so far, tracking for its worst month since March 2020 when the coronavirus pandemic and lockdowns became a reality in the United States, while the U.S. 10-year Treasury yield has spiked above 1.8%.

Kevin O’Leary, chairman of O’Shares and a well-known entrepreneur and businessman, has a few rules for how to invest in an environment when rates are on the rise.

“In inflationary times, all of a sudden quality really matters. Cash flow matters, distributions in the form of dividends matter, and [so do] sectors that have pricing power,” O’Leary told CNBC’s “ETF Edge” on Wednesday.

The key, he said, is to invest in high-quality companies across different sectors – investing only in technology, for example, would be a mistake given high valuations.

“If you’re going to be using an ETF, you want it to be something that has got diversity around sectors that are really strong in pricing power,” he added.

O’Leary is using his O’Shares U.S. quality dividend ETF as a hedge against inflation. That ETF’s major components include Procter & Gamble, Johnson & Johnson, Microsoft and Home Depot.

“It is an ETF that’s designed to have high-quality pieces of the S&P. So it’s a rules-based ETF that says ‘give me companies that do well in inflation that have pricing power.’ So do people pay for consumable goods in inflationary times? Yes, they do. They have to eat, they’ve got to buy health-care products, and they have to do things they do every day even though these companies have the ability to raise prices as inflation comes in,” O’Leary said.

The OUSA ETF has been caught up in the broader sell-off, though to a lesser extent. This week, for example, it has fallen 2% while the S&P 500 has dropped nearly 4%.

High-quality and high-dividend stocks are important in this environment, said O’Leary, but there’s one other attribute he’s on the lookout for.

“I like boring – big and boring, big fat cash flows. That’s what I like because at times like this when you have a portfolio of high-quality names, you reduce your volatility. That’s what OUSA is designed to do,” he said.

Sign up for our weekly newsletter that goes beyond the livestream, offering a closer look at the trends and figures shaping the ETF market.