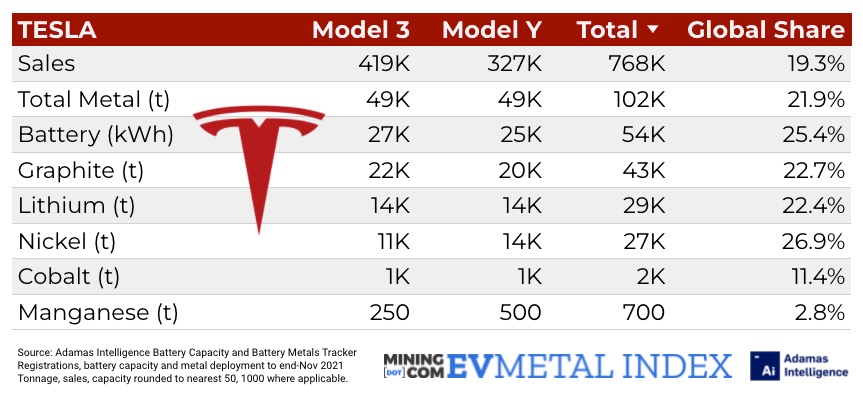

CHARTS: Tesla v Volkswagen v BYD – battery power, lithium, nickel, cobalt use

Last year the Texas-based company was responsible for every fifth full-electric car leaving showrooms. The kind of dominance last seen during Model-T days.

Despite the emergence of popular sub-$5,000 cars like the Wuling Hongguang MINI, the Model 3, which sells for 10-times that in most configurations, is the bestselling EV worldwide. The 3 is also no 1 in Europe outselling its nearest rival the Renault Zoe 2:1. And that’s before the opening of Tesla’s first factory on the continent.

Its dominance is even more noticeable in terms of raw battery power. Tesla accounts for more than a quarter of all the battery power found in passenger cars hitting the road last year.

It’s also double the kWh of its nearest competitor Volkswagen (XETRA: VOW) across all of the German company’s brands. In fact, last year Model 3s alone dispensed as much battery-power as all the Volkswagens (including those built by FAW and SAIC under Chinese JVs), Porsches, Audis, Skodas and Seats combined.

Against world number two car badge, BYD (OTCM:BYDDF), Tesla also remains streets ahead. The lead is made more remarkable by the fact that the US company delivered more LFP-battery powered cars last year than BYD, which is the world’s number two manufacturer of the cobalt and nickel free power units and is credited with much of the advance in the technology.

BYD, backed by Warren Buffet through a 21% stake, has gone all in on LFP vowing to use the technology across it’s range. In 2021 it got 85% of the way there considering its overall sales mix.

As for battery metals, Tesla CEO Elon Musk is right to be worried about nickel. Tesla deployed 27% of the world’s battery nickel, despite the fact that overall LFP accounts for more than a quarter of the kWh hours in all of its vehicles sold last year. Tesla still does not sell LFP-powered models in North America.

Despite selling half the number of BEVs than Tesla thanks to the absence of LFP in its line-up, Volkswagen deployed more cobalt and on a relative basis more metals across its brands. That’s in part due to high-performance vehicles like the Porsche Taycan and Audi e-tron, some of which come equipped with NCM 7 and 6-series cathodes where cobalt represents up to 20% of the metal mix.

Note:

Data supplied by Adamas Intelligence Battery Capacity and Battery Metals Tracker which tracks demand for EV batteries including hybrids by chemistry, cell supplier and capacity in over 100 countries. Only full battery-electric vehicles are considered, Volkswagen and BYD’s hybrids and plug-in hybrids are excluded. Additionally, in order to produce the most accurate data, the battery metals deployed numbers in the tables do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain, only end-user registered vehicles. As such the tonnages reflected in the end-product are fractions of what would’ve been procured upstream.