Chip stocks are on the up after Samsung and STMicro issue positive updates

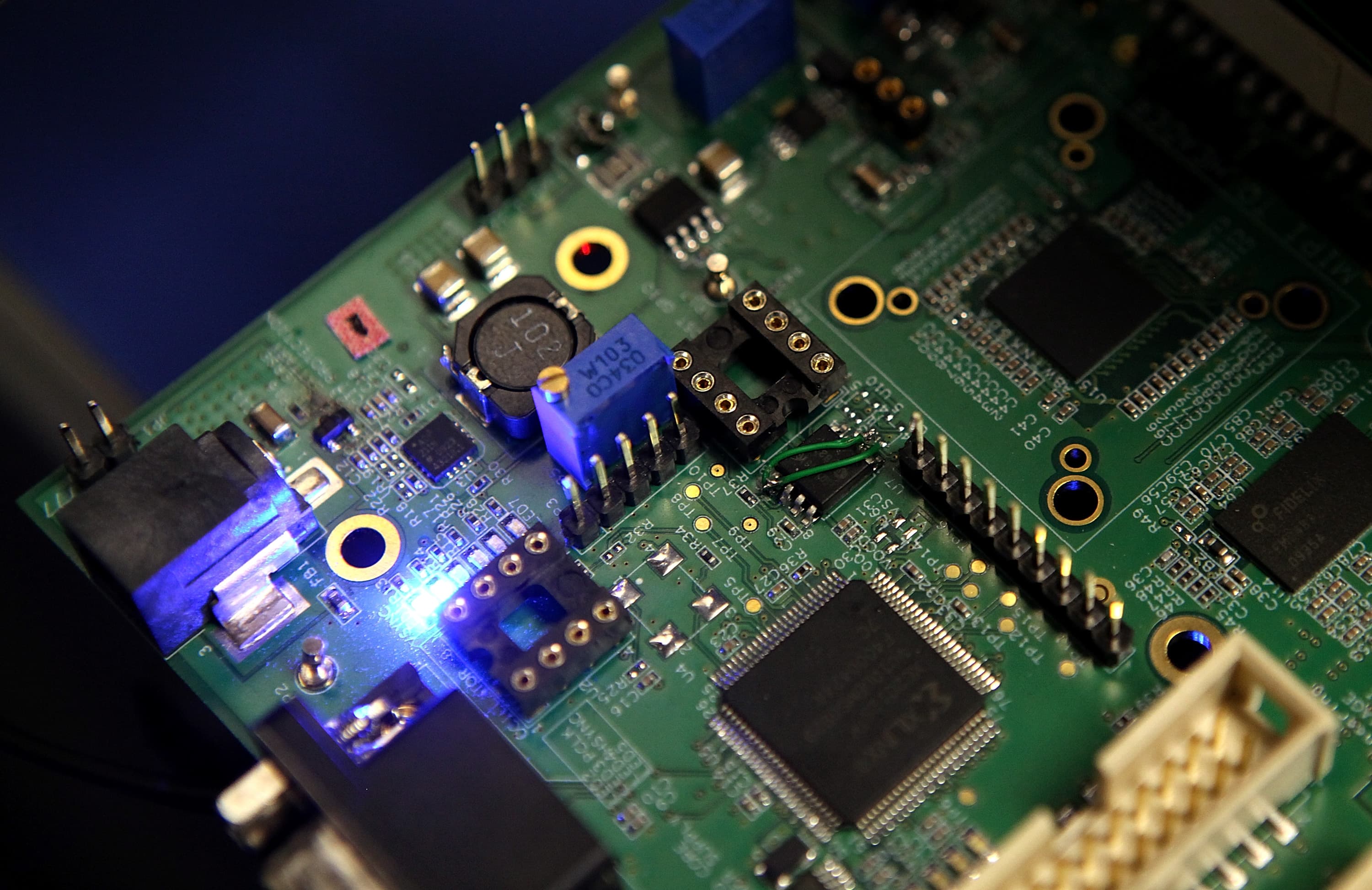

Semiconductors are seen on a circuit board.

Justin Sullivan | Getty Images

European semiconductor stocks edged higher Friday after two of the biggest companies in the industry — Samsung Electronics and STMicroelectronics — issued positive fourth quarter updates.

German chipmaker Infineon, Dutch semiconductor machine manufacturer ASML, and Austrian sensor maker Ams AG all saw their share prices rise by over 2% in morning trading on European stock markets.

Meanwhile, STMicro saw its own share price rise by over 4% after it published higher-than-expected fourth quarter sales on Friday.

The French-Italian chipmaker announced preliminary fourth-quarter revenue of more than $3.5 billion, which was above a company forecast of $3.4 billion.

STMicro sales for the full year came in at $12.76 billion, which is up 24.9% on last year.

Elsewhere, Samsung estimated Friday that its fourth-quarter operating profit jumped 52% as a result of strong demand for its memory chips and rising orders for its contract chip manufacturing services.

If the predictions are accurate, the last quarter would be the South Korean tech giant’s best final quarter since 2017.

The world’s largest smartphone and memory chip maker said it expects to log nearly $11.5 billion in profit for the final quarter, which ended in December. It will release its full set of numbers later this month.

Demand for chips has surged over the last two years after the coronavirus pandemic led to a global chip shortage. This resulted in increased delivery times on a range of products including cars and the new PlayStation 5.

It has led some semiconductor companies’ shares to rise significantly during the chip shortage.

For example, ASML, which sells highly-complex “lithography” chip-making machines to the likes of Samsung, Intel and TSMC, has seen its share price on Amsterdam’s stock exchange rise 66% over the last year.