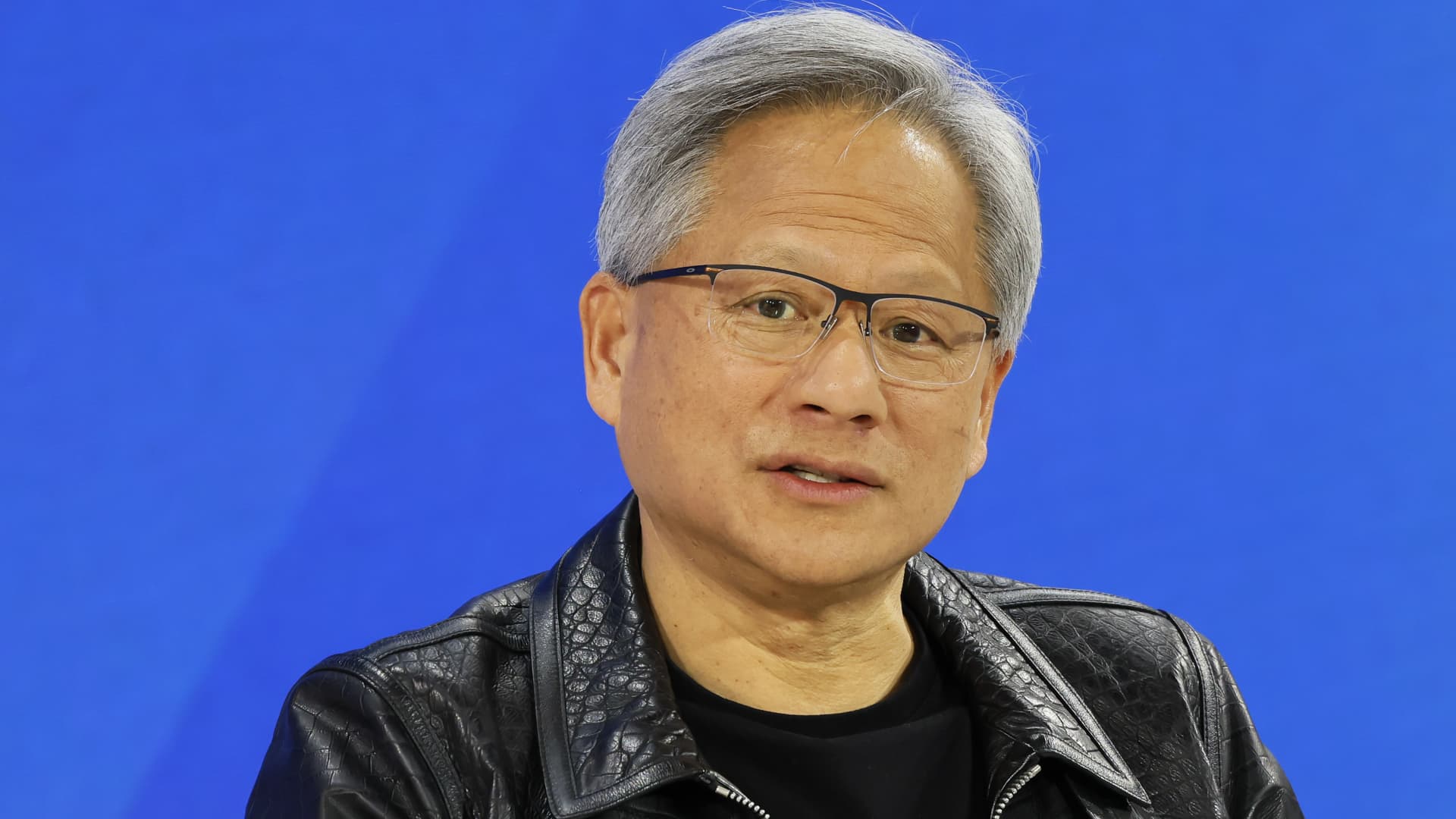

Jim Cramer on CNBC’s Halftime Report.

Scott Mlyn | CNBC

(This article was sent first to members of the CNBC Investing Club with Jim Cramer. To get the real-time updates in your inbox, subscribe here.)

After you receive this email, we will be selling 100 shares of Union Pacific (UNP) at roughly $251.95. In addition, we will be selling 125 shares of United Parcel Service (UPS) at roughly $216.82.

Following the trades, the Charitable Trust will own 300 shares of Union Pacific and 600 shares of United Parcel Service. UNP’s weighting in the portfolio will decline from about 2.37% to about 1.78% and UPS’s weighting will decline from about 3.72% to 3.1%.

We are ringing the register and booking profits in a couple of transport stocks that have had a good run since reporting third-quarter earnings in October (+10% for UNP and +6% for UPS) and started the new year trading at or near their all-time highs.

We still think new highs are ahead for both stocks.

- Union Pacific has one of the best operating ratios in the industry and should benefit from continued economic growth with abating pressures in the supply chain.

- United Parcel Service is all about pure execution of CEO Carol Tome’s “Better, Not Bigger” strategy. We are also anticipating a large dividend boost out of UPS next month.

Loading chart…

But we don’t want to be greedy either, which explains why these sales are less about any change in our long-term thinking and more about our philosophy around prudently locking in gains as stocks go higher. By making these two sales, this is what we will accomplish. We will cash out some stock at their highs and raise cash for the additional flexibility to buy new opportunities that will most certainly be created by future volatility in the market.

We will realize a solid gain of about 18% on Union Pacific shares purchased in March 2021. For UPS, we will realize a gain of about 30% on stock purchased in the fall of 2020.

Loading chart…

The CNBC Investing Club is now the official home to my Charitable Trust. It’s the place where you can see every move we make for the portfolio and get my market insight before anyone else. The Charitable Trust and my writings are no longer affiliated with Action Alerts Plus in any way.

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. See here for the investing disclaimer.

(Jim Cramer’s Charitable Trust is long UNP and UPS.)