Derivatives Data Shows Softening Crypto Enthusiasm

Several months ago, investors facing FOMO – the fear of missing out – worried that the ship had sailed when it came to crypto. Now, however, while that ship may have left the harbor, the wind is out of its sails as it floats directionless for the time being. Perhaps it’s because of upcoming Fed tightening; enthusiasm seems to have dampened. That sentiment is backed up by some market data showing market activity has fallen and that could take prices with it.

1. Funding rates have gone negative.

Rates from several major exchanges compiled by analytics firm CryptoQuant show that the cost of borrowing to buy crypto on leverage has fallen to the point where it’s slightly negative. That implies that demand for money to make leveraged bets has taken a hit. Traders aren’t in any rush to add to their positions.

2. Open interest (OI) in bitcoin futures is down slightly since the last week of December.

It’s currently $16 billion, according to data site Skew.com, down from just shy of $19 billion around Christmastime. During bitcoin’s November peak, open interest was roughly $26 billion.

3. Ether futures also have seen declining open interest.

Since its own November peak of $13 billion, open interest for the smaller ether futures market is currently around $8 billion.

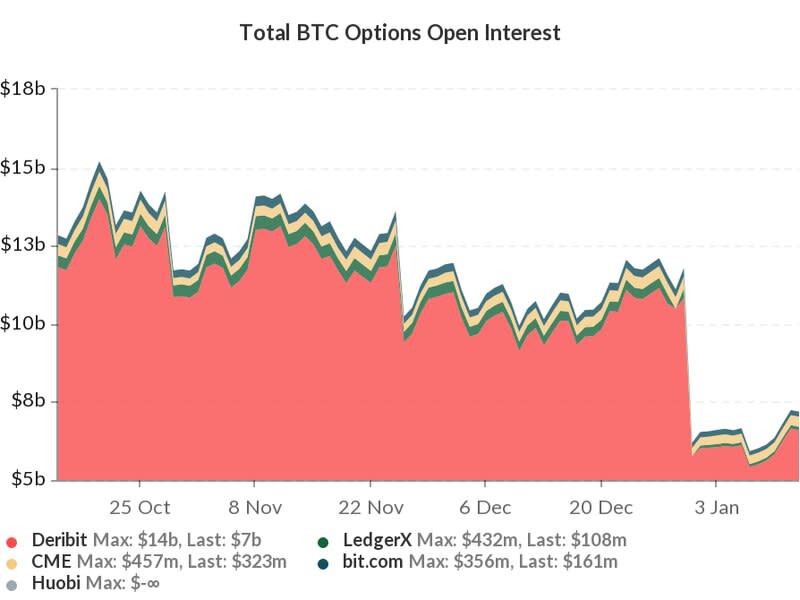

4. Options open interest on bitcoin and ether are down to where they were in early October.

OI for bitcoin options is now at $7 billion and $5 billion for ether. Back in December, those figures were around north of $10 billion and $7 billion, respectively.

Some of the falloff can be attributed to year-end bets taken throughout the course of 2021. While current OIs are still significantly larger for both cryptocurrencies than where they were last year, they are still roughly where things were in October, before the big run-up in prices.

5. Implied volatilities on bitcoin are falling precipitously.

Implied vols, which are calculated off options premiums and gauge the market’s view of future risk, are down to levels not seen since October 2020. To be sure, regular levels in crypto implied volatilities would signal alarm and panic in the equity market, but since the second week of December, crypto’s implied vols have drifted down. In the past couple of days, that drop has accelerated. One-month at-the-money implied vols are now at 60%; they had been hovering in the 80% range since the summer. When demand for options falls, implied volatilities fall with it.

6. Ether’s implied vols are also down.

Now at 69%, implied volatilities on one-month at-the-money options on ETH had been around the 100% level since June. It has been over a year since they were regularly below 70%.

The list goes on and on.

Of course, this doesn’t mean muted markets can last forever, but in the coming days or weeks, one shouldn’t be surprised if prices drift south.