Do 401(k) plans unfairly help the wealthy?

As claims go, it’s a bold one.

Over the course of 82 pages, Michael Doran, a much-beloved but press-shy professor at the University of Virginia School of Law who also worked for the Office of Tax Policy at the U.S. Treasury Department under two different administrations, makes the following case:

“Over the past twenty-five years, Congress has enacted several major reforms for employer-sponsored retirement plans and individual retirement accounts (“IRAs”), always with large bipartisan, bicameral majorities.

“In each case, legislators have claimed that the reforms would improve retirement security for millions of Americans, especially rank-and-file workers. But the supposed interest in helping lower-income and middle-income earners has been a stalking horse for the real objective of expanding the tax subsidies available to higher-income earners.

“The legislation has repeatedly raised the statutory limits on contributions and benefits for retirement plans and IRAs, delayed the start of required distributions, and weakened statutory nondiscrimination rules – all to the benefit of affluent workers and the financial-services companies that collect asset-based fees from retirement savings.

“The result has been spectacular growth in the retirement accounts of higher-income earners but modest or even negative growth in the accounts of middle-income and lower-income earners.

“Despite the benign but misleading rhetoric about enhancing retirement security for everyone, the real beneficiaries of the retirement-reform legislation have been higher-income earners, who would save for retirement even without tax subsidies, and the financial services industry, whose lobbyists have driven the retirement-reform legislative agenda.”

Doran politely declined to talk on the record about his essay, The Great American Retirement Fraud.

But the question is worth asking. Is Doran on to something or not?

To be fair, Doran isn’t the first to suggest that the current retirement system doesn’t work for everyone and that it has more than its share of shortcomings.

In 2004, for instance, Alicia Munnell, the director of the Center for Retirement Research at Boston College, and Annika Sunden, the chief economist at the Swedish International Development Cooperation Agency, published Coming Up Short: The Challenge of 401(k) Plans. In their book, Munnell and Sunden argued that 401(k) plan participants, among other things, are forced to become adept at investing strategies and figure out what to do with the lump-sum payment they receive when leaving an employer.

In 2014, the Bipartisan Policy Center launched the Commission on Retirement Security and Personal Savings as part of an effort to address the challenges facing Americans saving for retirement. The Commission, for instance, called for improving access to workplace retirement savings plans, long a shortcoming or 401(k) plans.

And Teresa Ghilarducci, a labor economist and professor at the New School, and her co-authors found in this 2017 paper that one-third of older workers have neither retirement savings through a 401(k) or IRA, or a defined benefit pension.

But those interviewed for this column were disinclined to call the current retirement system a “policy scam” and instead referred to Doran’s thesis as a “by-lawyers-for-lawyers” “rant.”

“An 82-page rant deserves a rant in response,” said Nevin Adams, the chief of content officer for the American Retirement Association, who penned this article in response to Doran.

And Andrew Biggs, a senior fellow at the American Enterprise Institute, had this to say: “I’m not a big fan of law review articles on policy; they tend to make broad pronouncements and ad hominem attacks, coupled with a zillion footnotes referencing other law review articles. Very few have much effect on policy discussions; they’re mostly a by-lawyers, for-lawyers kind of thing.”

According to Adams and Biggs, there’s plenty that Doran gets wrong (and ignores) in his treatise.

Not tax-exempt

For starters, Doran refers to retirement accounts as tax-exempt, nothing more than “federal pork to well-heeled Americans and the financial services industry.”

But retirement accounts are not tax-exempt. You’re either paying ordinary income taxes on the contribution in the case of Roth IRAs and Roth 401(k) or on the distribution in the case of traditional IRAs and 401(k). “Deferral isn’t forbearance; those pretax dollars become taxable,” said Adams.

Biggs also said Doran treats the retirement savings tax preference as a deduction rather than a deferral, he said.

“An individual in the top federal tax bracket – currently 37%– derives $370 of economic value from every $1,000 excluded or deducted from gross income,” wrote Doran. “An individual in the lowest federal income tax bracket – currently 10% – derives only $100 of economic value from every $1,000 excluded or deducted. And an individual whose income does not exceed the standard deduction or the sum of the individual’s itemized deductions has an effective tax bracket of 0% and derives no economic value at all from an exclusion or an additional deduction.”

But what Doran ignores is that you pay taxes on withdrawals, and high-income households pay higher taxes in retirement than low-income households. “What matters is the net,” said Biggs. “Some research finds that, dollar for dollar, the tax preference is progressive; the reason most of the dollar value of the tax preference goes to high earners is a) they save more due to their higher earnings; and b) on top of simply having higher earnings, their lower Social Security replacement rates means they have to save a larger percentage of their earnings to reach the same replacement rate from total retirement income, say, 70% of preretirement earnings,” Biggs said.

For the record, Biggs is not a “huge defender” of the tax preference. “The net annual cost according to the Congressional Budget Office is around $275 billion, which is the upfront cost minus the future taxes that will be received upon withdrawal,” he said. “That’s a ton of money and about half goes to households in the top fifth of the population who can clearly save for retirement on their own — and if they don’t, it’s not exactly a pressing governmental problem. There’s a lot you could do with that money, including help shore up Social Security.”

Retirement savings are increasing

Doran also states that “the retirement savings of middle-income earners have remained flat or increased only modestly, and the retirement savings of lower-income earners have actually decreased, despite tens of billions of dollars of federal revenue spent under the retirement-reform project.”

But that’s not the case according to Biggs, whose work using Fed data shows that since 1989, retirement savings have increased among every age, income, education and race/ethnic group.

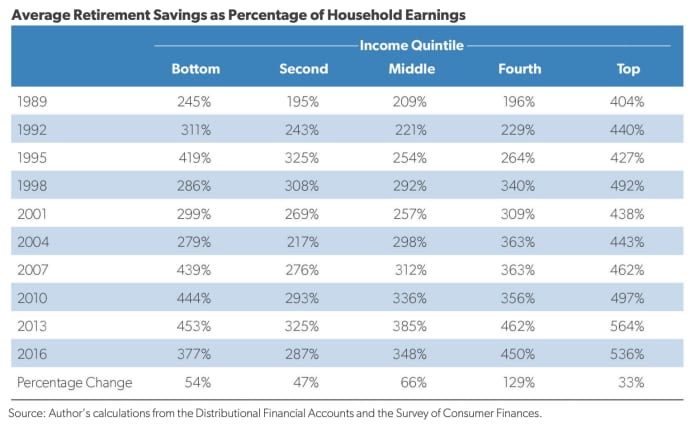

This report and the table below show total private retirement savings in defined benefit, defined contribution and IRA plans as a percentage of annual earnings by income level. “Everyone is up,” said Biggs.

Adams acknowledges that higher-income individuals do have higher account balances. However, those balances are in rough proportion to their incomes, he said. Read ‘Upside’ Potential.

Retirement plan participation is up

Biggs also noted that retirement plan participation is up. “Back in the ‘70s when defined benefit participation peaked, under 40% of private-sector workers had a plan and the majority of those nominal ‘participants’ actually failed to vest,” he said. “Today, between 50-60% of private-sector workers are participating in a plan, depending on the data source, and nearly all will receive a benefit from their plan because most are defined contribution. Although the historical data aren’t good quality, it’s hard to believe that much of that increase wasn’t among low-wage workers.”

In 1981, a Social Security Administration survey of new retirees found that nearly no one in the bottom half of the income distribution received any benefit from a private retirement plan. “Today, over 60% of all retirees do,” said Biggs. “So, the increase will be predominantly among low/middle-income households.”

Among other things, employers matching employee contributions is spurring many lower-income workers to save, according to Adams. “Indeed, because of the nondiscrimination rules that apply to contributions to employer-based plans, employees who are not ‘highly compensated’ may get significant employer contributions even though they are not contributing on their own behalf,” he said.

What’s more, Adams noted that roughly two-thirds of all 401(k) savers make less than $100,000/year

Room for improvement

Is there room for improvement in the current retirement system?

Yes, according to Adams. “The only thing ‘wrong’ with the 401(k) is that not enough people have access to one,” he said. “We keep improving and enhancing it (the most common default deferral rate is now 6%), but those who have one, and who take advantage are, I think, doing pretty well.”

For his part, Doran doesn’t offer any solutions to the quagmire he’s detailed in his manifesto.

But he does promise us more to come.

“There is a better path forward,” he wrote. “As I intend to show in future work, genuine reform of retirement policy, structured around longstanding insights about tax subsidies, would look very different from the type of limit-increasing, deferral-extending, and discrimination-facilitating reform pursued over the past twenty-five years.”

“Genuine reform,” he wrote, “would curtail retirement-savings subsidies for higher-income earners, who do not need those subsidies as incentives for retirement savings. Genuine reform would convert tax deductions, tax exclusions, and nonrefundable tax credits for lower-income earners into direct, government-funded enhancements of retirement security – preferably through Social Security but otherwise through private retirement accounts. And genuine reform would leave the status quo in place for middle-income earners, who respond as expected to the marginal incentives of retirement-savings subsidies and who likely would not save in the absence of those subsidies.”