From tech to financials, here are dozens of inflation-sensitive stocks that crush it when prices are rising, from Credit Suisse.

China’s interest-rate cuts and some easing of the bond selloff seem to have cheered up investors — at least for now — who have been hitting the sell button over Federal Reserve rate-hike fears.

A day after Chinese President Xi Jinping warned of fallout from Fed tightening, the country’s central bank has cut benchmark lending rates for a second month (Alibaba shares BABA,

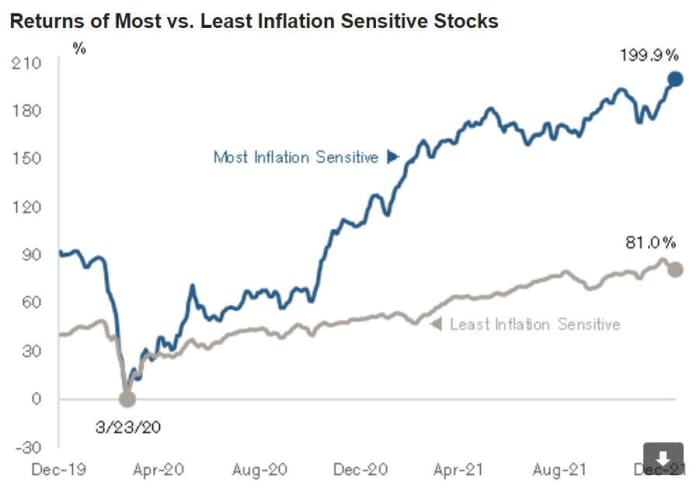

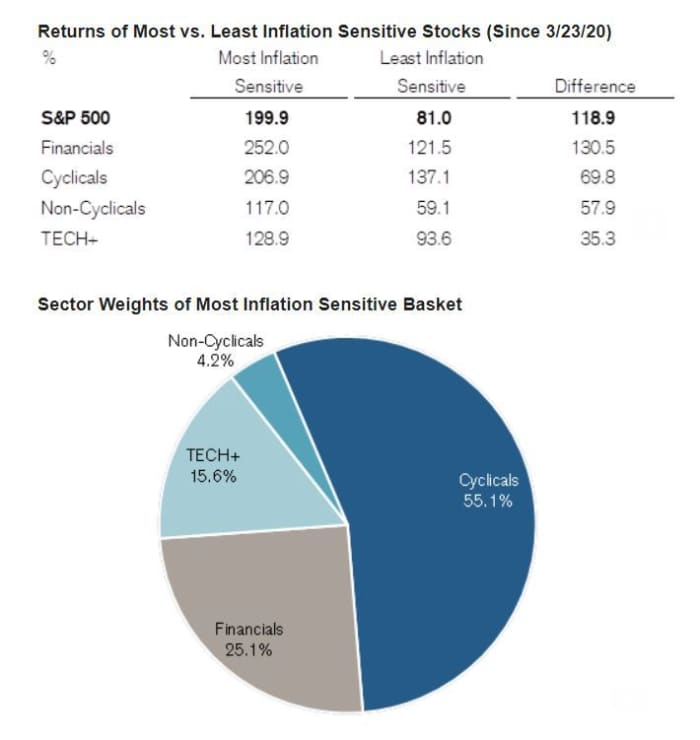

How much inflation fear is merited for equity investors? Keep it in check, says our call of the day from Credit Suisse strategists, who note that since the COVID-19 pandemic’s onset, “the most inflation-sensitive stocks have substantially outperformed,” and often traded at a big discount.

Jonathan Golub, chief U.S. equity strategist, and Patrick Palfrey, senior equity strategist, told clients that they expect inflation will move higher and stay there longer, due to several factors, including a strong economy and higher commodity and home prices.

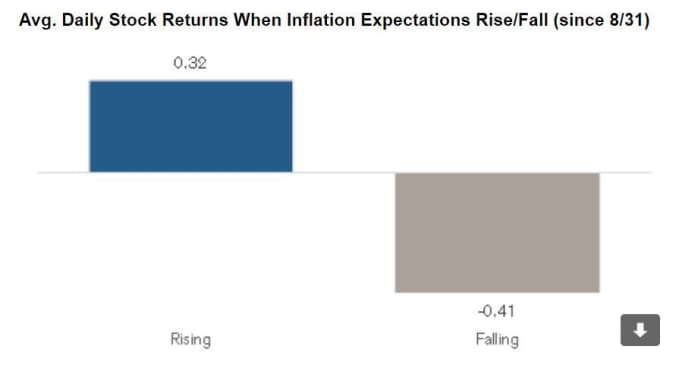

“Historically, earnings and stock prices have moved directionally with inflation. As the exhibit below shows, over the past 4½ months, stock prices have risen an average of 32 bps on days when inflation expectations rise, and fall -41 bps on down inflation expectation days,” said Golub in a note.

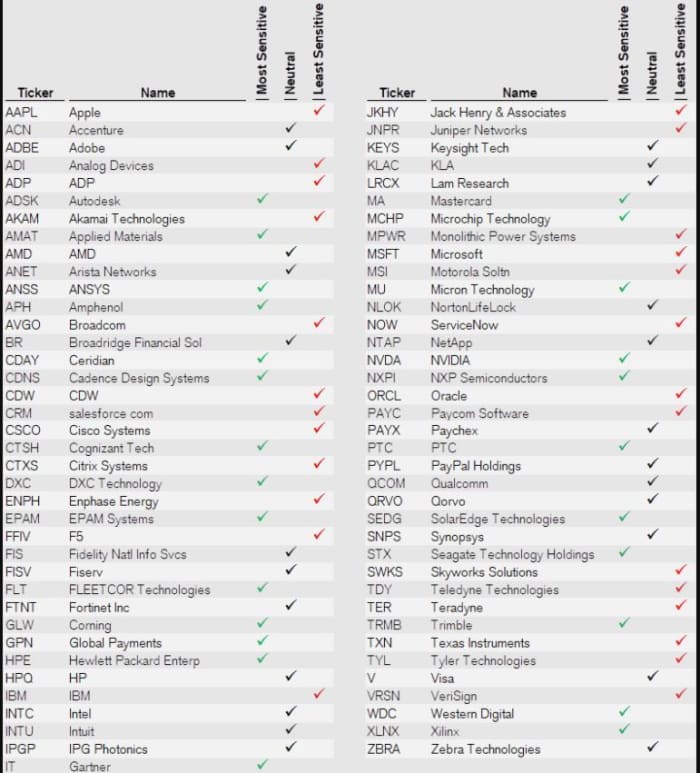

Golub and the team have come up with exhaustive lists of companies that are most sensitive to inflation. Here’s a rundown of tech names, including Apple AAPL,

Across other sectors, they highlight other highly inflation-sensitive stocks. For example, in energy, that includes Marathon Oil MRO,

American Airlines AAL,

For staples, Archer Daniels ADM,

Read: At least 7 signs show how the stock market is breaking down

The buzz

Weekly jobless claims came in higher than expected, while a Philadelphia Fed manufacturing survey rebounded to 23.2 in January. Still ahead are existing-home sales.

HSBC has cut its overweight rating on U.S. stocks, partly on rising rate expectations, saying China may be one place to hide.

Casper Sleep CSPR,

Travelers Cos. TRV,

Netflix NFLX,

Read: Here’s what’s coming to Netflix in February 2022 — along with a price hike

The end of President Joe Biden’s first year in office was marked by defeat, as Democrats failed to change Senate filibuster procedures to push through election legislation because two party members sided with Republicans.

And geopolitical worries are in focus, with eyes on Russian troops along the border of Ukraine.

Scientists are warning that antimicrobial resistance has become a leading cause of global deaths, killing 3,500 people daily and more than from malaria or HIV/AIDS.

In a bid to boost vaccination levels, Austria is kicking off a lottery for those who have the COVID-19 shots, offering handouts worth 500 euros ($568) for perks such as hotels and restaurants.

The markets

Led by the Nasdaq COMP,

Read: Oil could break the stock market’s back if crude ‘goes parabolic’ — How to prepare

The chart

Commodities are off to a strong start this year, but it isn’t just about oil and metals, notes Chris Weston, Pepperstone’s head of research.

“We’ve seen some big moves in AG’s [agriculture] and soft commodities too and I have an eye on coffee and hogs — lean hogs could be starting something beautiful. I know this isn’t a market that comes onto everyone’s radar too often, but for trend-followers or momentum players, when this goes it can go and will often be traded by CTAs (systematic trend followers),” he told clients.

The tickers

Here are the most active tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

| TSLA, |

Tesla |

| GME, |

GameStop |

| AMC, |

AMC Entertainment |

| BBIG, |

Vinco Ventures |

| NIO, |

NIO |

| AAPL, |

Apple |

| BABA, |

Alibaba |

| NVDA, |

Nvidia |

| LCID, |

Lucid |

| SOFI, |

SoFi Technologies |

Random reads

A disabled Tongan man swept away during the island’s deadly tsunami, survives 24 hours in the ocean.

Insights from a man who read all 27,000 Marvel superhero comics.

The museum at the end of the world has finally reopened.

Some Wharton students think the average American makes $800,000 a year.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.