Futures, Stocks Tumble on Hawkish Fed Outlook: Markets Wrap

(Bloomberg) — U.S. and European equity futures slid with Asian stocks Thursday after Federal Reserve Chair Jerome Powell signaled a March interest-rate liftoff and stoked speculation about the possibility of unexpectedly aggressive policy tightening.

Most Read from Bloomberg

Euro Stoxx 50 futures tumbled as much as 3.1% before paring some losses, while contracts on the S&P 500 and Nasdaq 100 also slid. An Asia-Pacific share gauge sank to the lowest in 14 months, with South Korea entering a bear market, China getting closer to one and Australia off 10% from an August peak. The Fed fallout erased a Wall Street rally Wednesday.

Powell reinforced the Fed’s determination to quell the highest inflation in a generation amid a robust recovery from the pandemic. The central bank also said it expects to begin balance-sheet reduction after starting rate hikes.

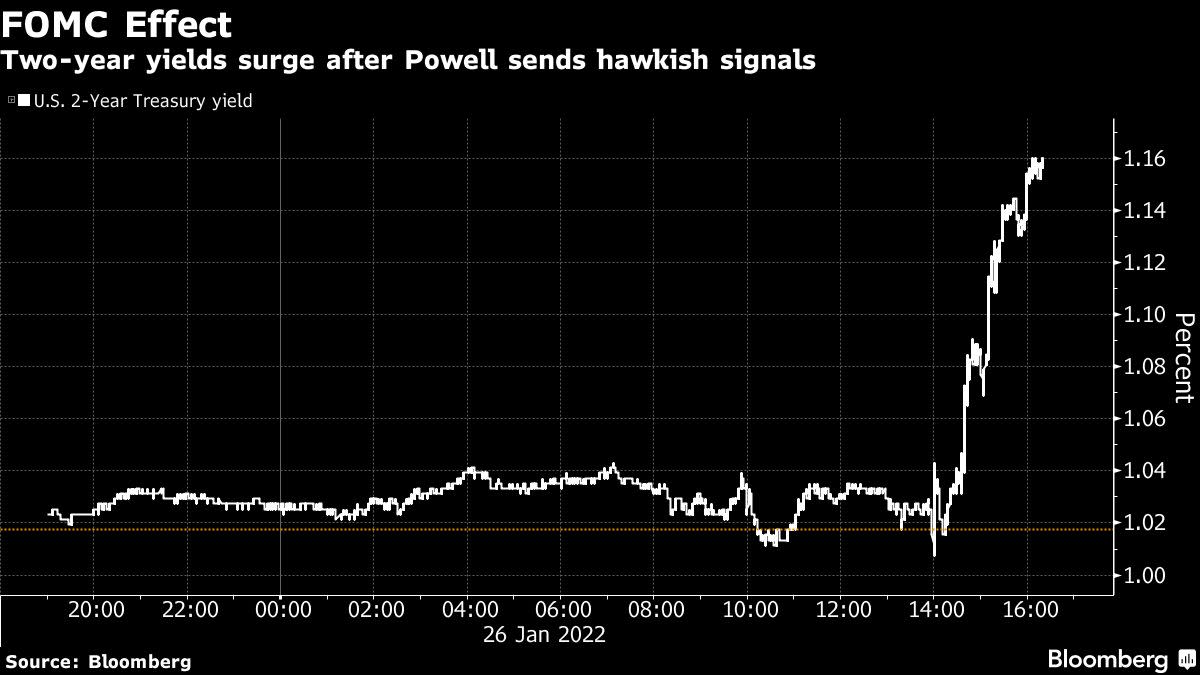

Two-year Treasury yields — acutely attuned to Fed policy — jumped in the U.S. session and were at the highest levels since the pandemic’s emergence. Those on 10-year Treasuries fell. A key part of the yield curve was around the flattest since early 2019, hinting at concerns for growth as the Fed dials back economic support.

The dollar was at a one-month high, while commodity-linked currencies weakened. Oil dipped, gold extended a decline and Bitcoin — whose fortunes have been tightly correlated with stocks of late — wavered around the $36,000 level.

Bonds in Asia succumbed to losses, including in New Zealand and Australia.

The Fed’s flip to a hawkish stance has roiled stocks and bonds this month. Investors fear that price pressures and receding stimulus will squeeze economic growth and company profits. Markets ramped up pricing of Fed hikes, pointing to a 94% probability of five quarter percentage-point moves in 2022.

The FOMC meeting “played out more hawkishly than we expected,” Steven Englander, global head of G-10 FX research at Standard Chartered Bank, wrote in a note. “The FOMC statement was largely as anticipated, but Fed Chair Powell emphasized upside risks to inflation, pointing to a steady pace of policy withdrawal.”

Investment Rethink

Powell endorsed rate liftoff in March and opened the door to more frequent and potentially larger hikes than anticipated. Strategists and investors were left reassessing the market outlook.

Jian Shi Cortesi, a portfolio manager at GAM Investment Management in Zurich, argued a better monetary backdrop in Asia could support the region’s equities. Inflation pressure “is lower in many Asian markets, and interest rates will not need to be hiked as much as in the U.S,” she said.

Meanwhile, the earnings season continues after an uneven start that’s sapped investor sentiment. Shares in Samsung Electronics Co. — South Korea’s biggest company — fell after profit missed estimates.

Electric-vehicle maker Tesla Inc. set a record for profit but warned of supply chain problems. Tech giant Intel Corp. fell on a disappointing forecast.

‘Policy Mistake’

On the geopolitical front, the U.S. has handed over its written response to Russia’s security demands, the latest step in the high-stakes diplomacy over Moscow’s buildup of more than 100,000 troops on Ukraine’s border.

Elsewhere, China is considering a proposal to dismantle indebted China Evergrande Group — poster child of the nation’s property slump — by selling the bulk of its assets. A gauge of Chinese real-estate stocks slid.

But the market mood was dominated by the Fed and worries of a possible policy error unfolding.

“The policy mistake we’re seeing play out is one where the Fed has allowed inflation to run too hot for too long and are now having to go hard to smash the breaks,” Chris Weston, head of research with Pepperstone Financial Pty Ltd., wrote in a note.

What to watch this week:

-

South African Reserve Bank rate decision Thursday.

-

U.S. initial jobless claims, durable goods, GDP Thursday.

-

Euro zone economic confidence, consumer confidence Friday.

-

U.S. consumer income, University of Michigan consumer sentiment Friday.

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

-

Futures on the S&P 500 fell 1.1% as of 7:19 a.m. London time

-

Futures on the Nasdaq 100 fell 1.4%

-

Futures on the Dow Jones Industrial Average fell 0.9%

-

The MSCI Asia Pacific Index fell 2.5%

-

The MSCI Emerging Markets Index fell 2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.2% to $1.1214

-

The Japanese yen was little changed at 114.69 per dollar

-

The offshore yuan fell 0.3% to 6.3560 per dollar

-

The British pound fell 0.3% to $1.3424

Bonds

-

The yield on 10-year Treasuries declined three basis points to 1.83%

-

Germany’s 10-year yield advanced three basis points to -0.04%

-

Britain’s 10-year yield advanced three basis points to 1.20%

Commodities

-

Brent crude fell 0.5% to $89.49 a barrel

-

Spot gold fell 0.3% to $1,814.33 an ounce

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.