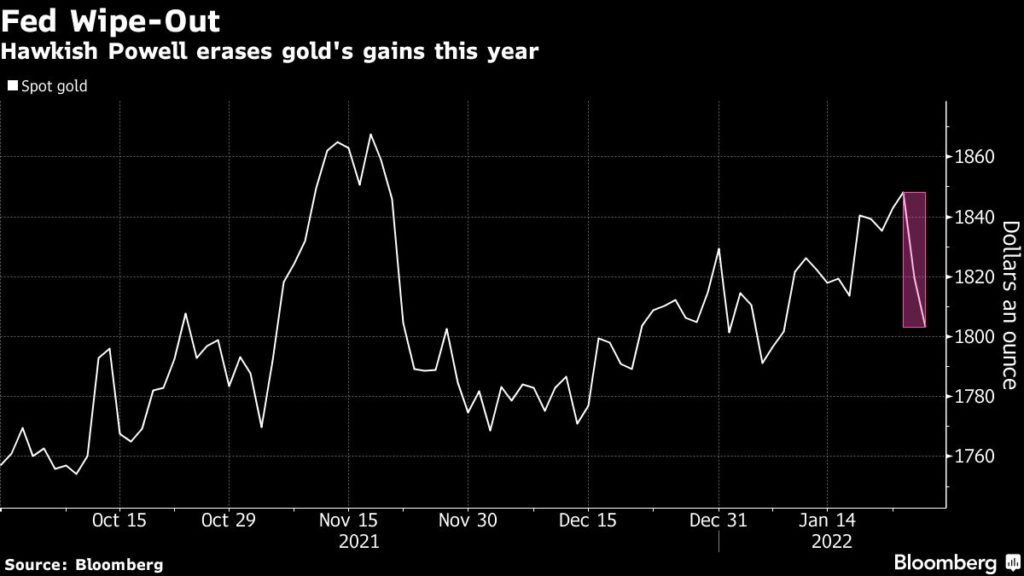

Gold price back below $1,800 on hawkish signals from Fed

[Click here for an interactive chart of gold prices]

Fed Chair Jerome Powell made clear on Wednesday that the US central bank would act as needed to cool the hottest inflation in almost 40 years.

That includes a possible interest-rate liftoff in March and more frequent, larger hikes than anticipated. Money markets are now fully pricing in five Fed hikes this year, pushing interest rates to 1.5% by year-end.

Gold tumbled soon after the Fed announcement, falling back to where it was in the beginning of the year. Before that, the precious metal had been rallying during the first weeks of January, driven by investor bets on inflation continuing to outpace bond returns, even with the expected rate hikes.

The hawkish pivot has challenged that narrative, with 10-year real US bond yields spiking to the highest close in 19 months after Powell’s speech.

Adding further pressure to bullion is the US dollar, which soared its highest levels since July 2020, reducing the appeal of safe-haven gold for overseas buyers.

“The market will remain nervous until yields and the dollar settle down,” Ole Hansen, head of commodity strategy at Saxo Bank A/S, told Bloomberg. “In the short term, the market will be looking for support in the $1,805-to-$1,800 an ounce area.”

Despite the latest setback, Goldman Sachs Group Inc. has raised its 12-month outlook for gold to $2,150 from $2,000 following Powell’s comments, on expectations for slower US growth, a rebound in emerging markets excluding China and faster inflation.

“This combination of slower growth and higher inflation should generate investment demand for gold, which we consider to be a defensive inflation hedge,” analysts including Mikhail Sprogis wrote in a note.

(With files from Bloomberg)