Iron ore price jumps as Fortescue, BHP and Rio Tinto face labour shortage

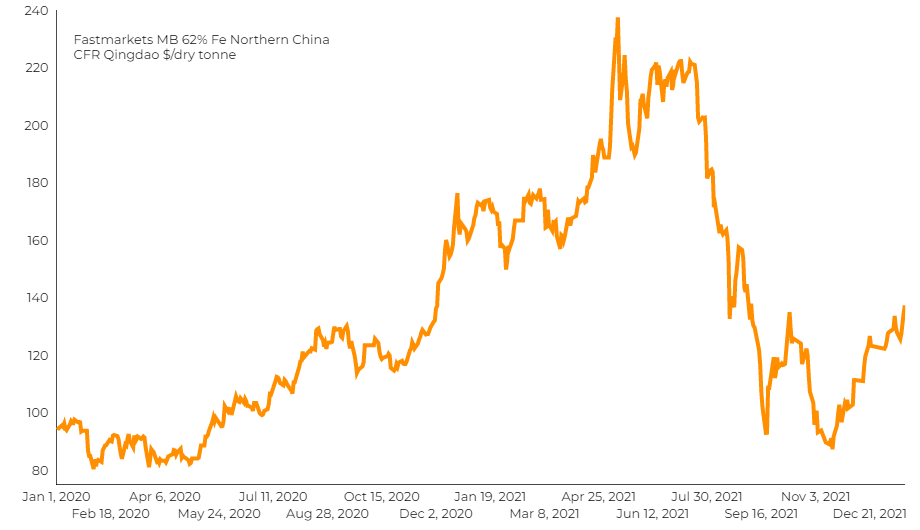

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $138.39 a tonne during morning trading, up 3.7% compared to Monday’s closing.

Iron ore’s most-traded May contract on China’s Dalian Commodity Exchange ended daytime trading 1.4% higher at 766.50 yuan ($121.14) a tonne, rising for a fifth straight day after overnight gains erased Monday’s daytime losses.

Mining stocks slid, with Fortescue down more than 4% from the previous week, Rio Tinto Group down 0.6%, and BHP down 1.2%.

Fortescue, the world’s fourth-biggest iron ore miner, posted a 2% rise in second-quarter shipments, but flagged pressures from strong demand for labour and resources, as well as supply chain constraints due to the pandemic.

“The release of Fortescue’s production report should shed light on whether recent iron ore supply disruptions have been overcome,” ANZ commodity strategists said in a note.

Related Article: 2022 – a year of rebalancing for metals and mining

(With files from Reuters)