Low- and middle-income earners stand to take the brunt of inflation—here’s what that really means

This article is reprinted by permission from NerdWallet.

As of December, prices across all goods and services had risen more in a single year than they had in nearly 40 years. The impact of that 7% increase stands to hurt already-vulnerable Americans the hardest.

A 7% markup can leave high earners unfazed. Others with even some savings and discretionary income can take action such as substituting cheaper products, driving less to save on gas or tapping their savings if necessary. This privilege makes it easy for financially comfortable Americans to minimize the impact of inflation. Many may think “if I don’t feel it or can make adjustments for it, it’s not a problem.” But it is a potentially disastrous problem for as many as 40% of Americans.

It’s those with the lowest incomes, the working poor and even middle earners who stand to take the brunt of inflation. These segments are less likely to have savings to fall back on, often have to spend more than they earn just to get by, and are spending a greater portion of their incomes on essentials like food and shelter than higher earners.

A look at spending and price data illustrates how.

Lower earners have fewer options for managing higher prices

Without the buffer of emergency savings, an unexpected car repair or a 25% increase in the cost of heating a home can be tough to take on.

While the average personal savings rate peaked during the pandemic, the lowest earners depleted those savings more quickly. Low-income households still had 70% more in their bank accounts in September 2021 than they did before the first round of pandemic-related stimulus payments, but that amounted to only a $1,000 surplus, according to data from JPMorgan Chase Institute. That surplus represents just one month of the typical rent and utilities, according to 2019 census data, when three to six months’ worth of basic living expenses is considered a robust emergency fund.

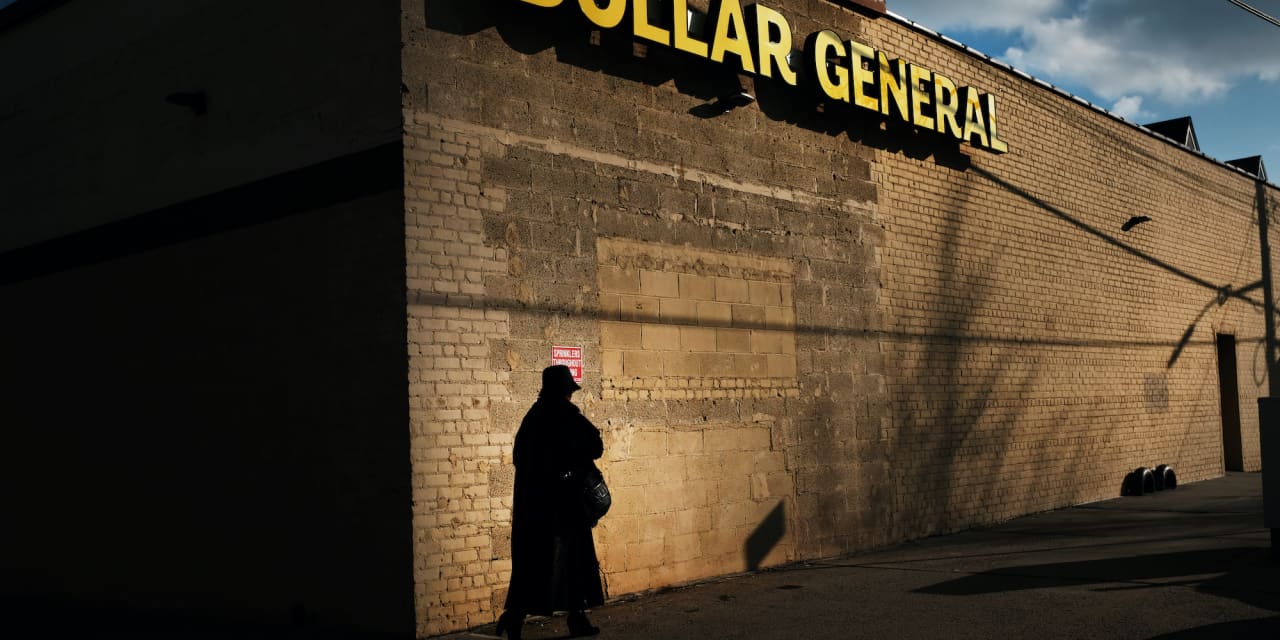

Further, when things get too pricey, many consumers can substitute lower-priced items. This isn’t the case if you’re already buying generic brands in order to save money on a tight budget. When you already bargain shop to stretch your grocery budget, for example, there are no lower-priced alternatives available.

Also see: Dollar Tree raises prices to $1.25, and it says it’s not because of inflation

Lower earners already spend all or more of their income

The highest-income households spend 65% of their after-tax income, according to 2020 consumer expenditure data from the Bureau of Labor Statistics. That allows them to save and invest more, not to mention travel, buy more things from their “want” list, and donate to charity. But when you’re spending nearly all or more of your income on the things you need, a significant bump in the cost of food, gasoline or any other necessary goods or service category can be detrimental.

The lowest-earning households, those in the bottom 20%, spend about 190% of their after-tax income each year, according to the BLS. This group receives more in public assistance, income tax refunds and pandemic stimulus money, according to the data, but those sources are included in the income calculations. Those earning about $24,000 to $45,000, more likely to be defined as the working poor, spend 110% of their after-tax income each year. Middle earners, those earning about $45,000 to $76,000, on average, spend 89%.

How do people spend more than they earn? Particularly when tapping savings isn’t an option, the answer is: by taking on debt. Amassing debt can have long-term, compounding effects, especially when you’re unable to pay it down quickly, or at all. Even those spending close to 90% of after-tax income are one unexpected medical bill or steep gas price increase away from resorting to using credit cards or high-interest loans for essential expenses. They’re left with little or no choice, and the costs of many essential expenses are on the rise.

Food prices

Lower-earning households spend less on food out of necessity. However, because these households are working with smaller budgets, food accounts for about 14% of total spending among the lowest-income households, compared with 12% among the middle-income households and 11% among the highest-income households.

“An extra $30 a month on groceries, due to inflation, would be two days’ worth of meals for a family that spends $500 a month on food.”

When prices go up, those spending the greatest portion of their money on something are most likely to notice the change.

Food prices have increased 6.3% over the past 12 months, according to the December Consumer Price Index from the Bureau of Labor Statistics. This is the largest year-over-year growth rate since 2008, and before that, since 1990.

What this looks like in practice: A family that spends $500 per month on groceries, for example, would spend $530 after a 6% increase. At $500 per month, daily meal costs work out to about $17. The additional $30, due to inflation, would be two days’ worth of meals.

Shelter and utilities

Shelter costs have not grown as sharply, at 4.1% over the past 12 months, but this represents the highest inflation in this category since 2007 and is higher than the Federal Reserve’s target inflation rate of 2% or less. While this slight pace-quickening might be tolerable when other prices remain constant, we know that wasn’t the case in late 2021 and isn’t now.

Utilities account for 9% to 10% of spending among the two lowest-income groups, according to the BLS, compared to 7% to 8% among middle incomes and 5% among the highest incomes. Prices for energy services (including gas and electric) have grown 10% over the past 12 months. For those relying on natural gas for their utilities, the increase is 24%. This is particularly detrimental now as winter makes it harder for cash-strapped households to keep their homes warm.

More: Why did almost no one see inflation coming?

Gas prices

The highest earners spend about 2% of their income on gasoline, compared with 3% across other income groups. While that’s a relatively low portion of expenses, across the board, gasoline prices have increased 50% over the past year. December was the ninth consecutive month of increases greater than 40%, the longest stretch of price growth that high since 1980.

Workers who depend on public transportation will likely see increased costs passed down to them in the coming year, but that category has thus far been protected from significant price growth. However, for lower- and middle-income earners who currently depend on gasoline to get to and from work, the price increases are significant.

If a commuter spent $100 a month on gasoline a year ago, they’d spend $150 now, and that money has to come from somewhere — unlikely it’s the stretched grocery budget or energy bill.

Don’t miss: How real Americans are living the ‘Nomadland’ life

Lower-income workers are also less likely to have options to work from home. They’re disproportionately represented in industries where their physical presence is a requirement: retail, hospitality and production and manufacturing, for instance. In fact, higher earners were significantly more likely to work from home because of the pandemic, according to census Household Pulse Survey data.

Dealing with financial crisis

Inflation, unexpected bills or a drop in income — any one of these things can put a middle- or low-earning household in a precarious situation. If you’re well-insulated from the effects of inflation, consider supporting a local food bank or other local charitable organizations. If you find yourself unable to pay the bills and expenses:

- Prioritize essentials. Food, housing and medical care should be top priorities when your budget is at the breaking point. You can rebuild your credit; it’s more difficult to recover your physical and mental well-being.

- Call your creditors. Don’t wait for them to call you. Whether it’s a utility or credit card bill you can’t pay, you may be able to work out a payment arrangement or at least avoid the worst outcomes.

- Don’t be afraid to ask for help. There are government, private and charitable resources available for people in financial crisis. The website 211.org, a service of the United Way, is a good place to start. You can also call 211 for the same services.

- Start small with savings. Once you’re out of the danger zone, setting aside even a few hundred dollars as an emergency fund can help insulate you from unexpected bills. Every little bit helps, and if building up several months of expenses seems overwhelming or impossible, smaller goals get you started in the right direction.

More From NerdWallet

Elizabeth Renter writes for NerdWallet. Email: elizabeth@nerdwallet.com. Twitter: @elizabethrenter.