Mark Cuban-backed banking app Dave begins trading on the Nasdaq after completing SPAC merger

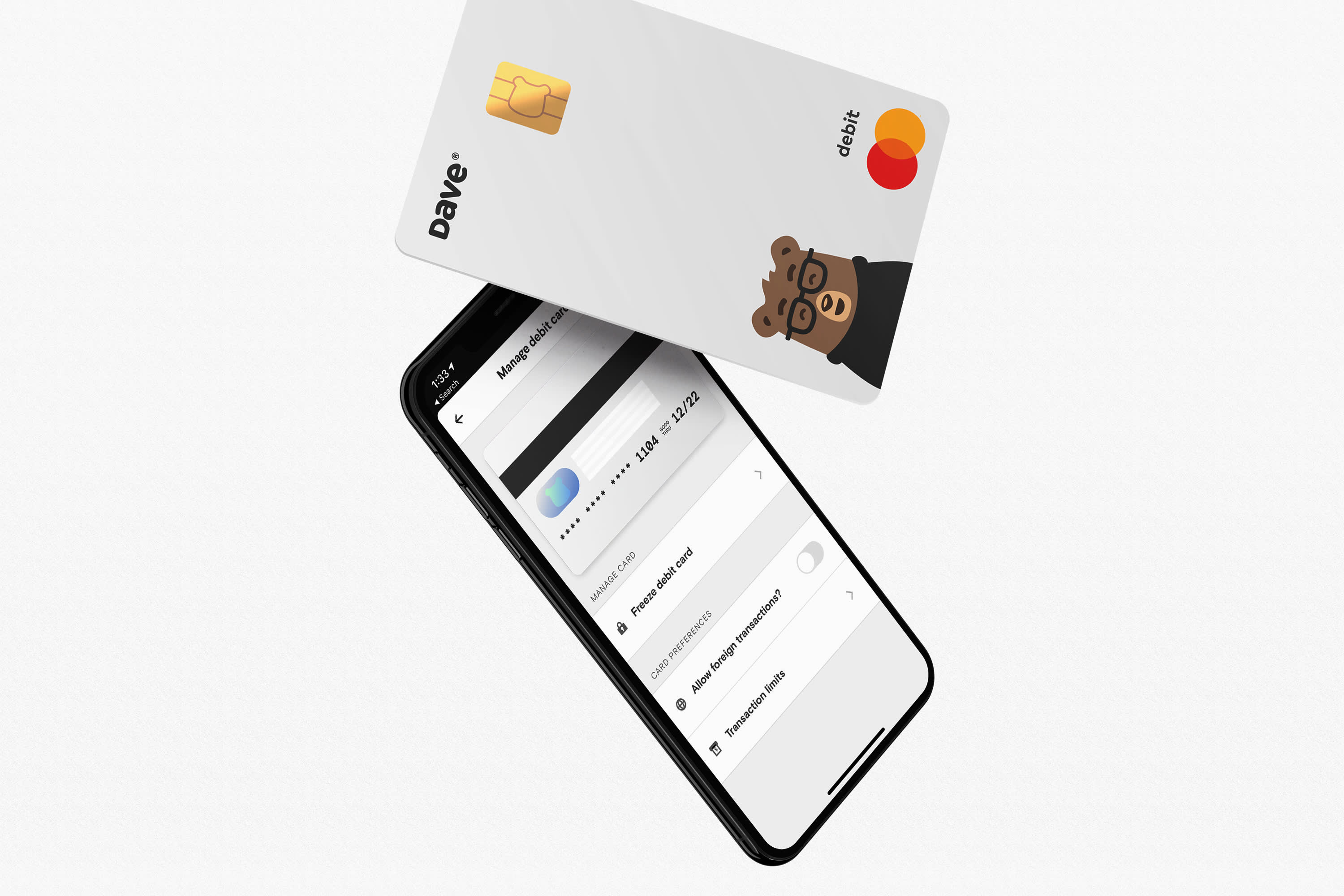

Dave banking app

Source: Dave

Los Angeles-based banking app Dave began trading on the Nasdaq on Thursday, becoming one of the first companies to close a SPAC merger and go public in 2022. At the opening price of $8.27, the fintech’s implied market cap was approximately $3.1 billion, according to SPAC Research data. Dave shares were lower by as much as 8% in early, light volume trading, with its market cap dipping below the $3 billion level.

Dave ranked No. 26 on the 2020 CNBC Disruptor 50 list.

Victory Park Capital, a global investment firm headquartered in Chicago, has a long track record of debt and equity financing transactions in fintech, and has been a longstanding investor in Dave, most recently providing a $100 million credit facility to the company in January 2021. VPCC completed its initial public offering in March 2021.

Dave — shorthand for the hero in the David vs. Goliath tale — is designed to eliminate many of the features customers can’t stand about legacy banks. The company started with overdraft fees. For a $1-per-month membership fee, users can access checking accounts with no fees and up to $100 in overdraft protection without fees or interest. Members who sign up for direct deposit also get automated budgeting and the ability to build up their credit scores through the reporting of rent and utility payments to credit bureaus.

The company says it has helped millions of customers avoid overdraft fees through its ExtraCash feature, and helped gig workers earn hundreds of millions of dollars from side hustles through its sharing-economy job board, Side Hustle. Third-quarter revenue for the company was up 30% from $120 million in 2020 to roughly $158 million in 2021, according to its prospectus.

The deal included a $210 million private placement led by Tiger Global Management. So-called PIPE financing is a mechanism for companies to raise capital from a select group of investors that make the final market debut possible. Wellington Management and Corbin Capital Partners are also participating.

The funds raised via U.S. SPACs totaled a record of $162 billion in 2021, almost doubling the $83.4 billion issuance in 2020, according to SPAC Research data. Still, despite being red-hot in 2021, the SPAC market has cooled down amid a multitude of challenges, spanning from regulatory pressure to the prospect of higher interest rates and to the increasingly competitive deal-making environment.

Sign up for our weekly, original newsletter that goes beyond the list, offering a closer look at CNBC Disruptor 50 companies like Dave before they go public. CNBC will begin accepting nominations for the 10th annual Disruptor 50 list next week.