Ontario housing shortage is worst in the country and threatens to exacerbate affordability woes

Ontario would need to build 650,000 more homes just to get to the national average

Article content

A “chronic” national housing shortage that is most pronounced in Ontario is threatening to exacerbate Canada’s affordability crisis, at a time when home prices are already surging to record highs across the country.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

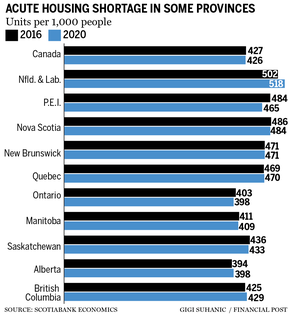

Canada’s most populous province, along with Alberta and Manitoba, fall well below the national average in housing stock per capita, Bank of Nova Scotia chief economist Jean-François Perrault said in a report published on Jan. 12. While comparing provinces to a national average will naturally involve some falling short and some exceeding the mean, the results aim to show how acute the undersupply is, he said.

“Ontario very much stands out in this respect. For Ontario to have the same level of homes per capita as the average in other provinces, over 650,000 additional housing units would be required,” Perrault wrote in the report.

Among the G7, Canada has the lowest average housing supply per capita with 424 units per 1,000 people, which places the country behind the United States and the United Kingdom. France, by comparison, leads the G7 at 540 units per 1,000. The pandemic, which allowed households to accrue record savings and saw unprecedented stimulus measures, stoked the country’s hot housing market and has pushed it into frothy territory over the past two years.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Though housing starts have exceeded their pre-pandemic run rate in 2021, housing prices have continued to surge, climbing more than 17 per cent year over year in the fourth quarter to $779,000, according to a report published on Jan. 14 by Royal LePage. Given the size of the structural housing gap, the increased pace of construction is unlikely to meaningfully close it and expectations of strong immigration once pandemic restrictions let up will exacerbate the upward pressure on demand and prices, Perrault said.

Alberta would need to build 138,000 more units and Manitoba, 23,000 more units, to meet the national average. It’s important to note that while Ontario, Alberta and Manitoba fall short nationally, that doesn’t mean housing stocks in other provinces are adequate.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Canada, overall, would need 1.8 million more dwellings to have the same number of homes per capita as the rest of the G7. The higher-than-normal housing supply in other provinces could also be a sign of shifting migration patterns, as people depart for other areas of the country, boosting the availability of housing in their provinces of origin. Newfoundland, for example, has had its population decline by 10 per cent since the mid-1990s while housing units have increased over that time.

Royal LePage reported that 87 per cent of the 62 markets it surveyed across the country posted double-digit price increases last year, underlining the short supply of housing inventory.

“Everywhere, in our largest urban centres, and in the nation’s small and medium-sized towns and cities, new homes are not being built fast enough to satisfy growing demand,” Phil Soper, president and CEO of Royal LePage, said in a statement. “Construction has been hampered by pandemic-specific challenges, including labour shortages and the increased cost of construction materials as suppliers struggle with supply chain issues. Some developers have been hesitant to commit to new projects.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Though the Bank of Canada is set to begin hiking the overnight interest rate — perhaps as much as five times in 2022 — which influences borrowing costs, it still may not be enough to stem demand for housing. Interest rates are coming off historical lows and Canadians have more savings in the bank. On top of that, the housing market has barely let up even as the federal bank regulator introduced a new stress test for uninsured mortgages.

Another hindrance to affordability is that some economists expect housing starts to recede from 2021 highs this year (but to remain above the pre-pandemic trend), pushing up prices even more. In November, housing starts were at 267,365 units while in November 2019, they stood at 219,921, according to the Canada Mortgage and Housing Corporation.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

-

Canada needs a fresh approach to build desperately needed new homes

-

CMHC to review down payments on investment properties as part of federal strategy to tackle housing risks

-

Toronto, Vancouver home sales smash records in 2021

There are encouraging signs, such as a push at federal and provincial levels to break ground on more housing. Both Ontario and British Columbia have implemented task forces to address the issue. In the last federal budget, Prime Minister Justin Trudeau’s government outlined $2.5 billion and a reallocation of $1.3 billion to speed up and support 35,000 affordable housing units. Ottawa is also looking into putting an end to blind bidding, which has inflated housing prices. Last quarter, the average home in the Greater Toronto Area rose 17.3 per cent from the previous year to $1,119,800, according to the Royal LePage report. In Montreal, prices climbed 19.7 to $532,600 while in Vancouver the house of a home hit $1,253,300, a 17.1 per cent increase.

“While these efforts are all welcome, what will matter most at the end of the day is actual progress in increasing supply in a responsible manner,” Perrault said of government measures. “History suggests that we have not been very good as a country in achieving this. Let’s hope current initiatives mark a solid break from past performance.”

• Email: bbharti@postmedia.com | Twitter: biancabharti

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.