So long to a wild 2021, and welcome to a more normal 2022

Well, 2021 is over and now we can look forward to a hopefully very boring 2022…or maybe not if you’re the stock market.

An insurrection at the Capitol in Washington, a new President, an old Federal Reserve Chairman, a new COVID variant, Archegos, bond auctions that were actually interesting, an elastic labor market, rising inflation, soaring crypto prices, constant chatter of a central bank taper, plummeting crypto prices, geopolitical tensions, Ray Dalio not helping, another COVID variant, the deaths of “Screech,” Larry King, Colin Powell and Betty White, gas prices going ape, Elon Musk being even more like “Elon Musk,” the Turkish lira, tapering becoming real, and — of course– meme stocks.

Through all the madness of 2021, we laughed, we cried, and the stock market went up and up and up.

The Dow Jones Industrial Average DJIA,

In fact, if you had to encapsulate the year 2021 as an emotion, it would look like this:

But for investors, the year looked more like this:

So what about 2022, or –as some are now calling it– Monday?

The most popular sentiment as of this week is that 2022 will be a relative return to normal from the pandemic and political maelstroms of the last two years.

“As hiring continues, spending grows, and businesses hire and invest, the economy will be normal,” wrote Brad McMillan, Chief Investment Officer for Commonwealth Financial Network. “The government is normalizing policy on the same expectations. When you look at the macro picture, the overarching theme is 2022 will bring us back to something like normal.”

For many, that return to normal will come as a relief, even with reduced bond purchasing and three probable interest rate hikes by the Federal Reserve and inflation at a 40 year high that may now be more difficult to control.

In that scenario, market “normos” would mean getting back to fundamentals, looking at data like employment and wage growth and corporate earnings without having to factor in a global pandemic or a capricious Capitol Hill.

After a few years of wild valuations and an almost religious belief in economic and earnings growth, investors might take a normal 2022 as a chance to reassess their feelings towards the rocket ships of 2021: Tesla Inc. TSLA,

A return to normal will also allow many investors to stop worrying as much about meme stock names like GameStop GME,

While action around meme stocks has cooled since January’s chaotic short squeezes, the rancor left behind has not and Apes on social media remain hellbent on seeing hedge funds fall and market structure change to rebalance what they see as a game that has become too overtly rigged against the little guy.

That might result in changes to market practices like payment for order flow, but it will also more likely result in a new breed of self-educated investors fanning out across the wider market to impact a variety of names and sectors as the market rebalances in the new boredom of the new normal.

To see the effects of how fiscal and monetary policy tightening will impact meme stocks, one will need to look no further than the options market,

“With the exclusion of index options, meme stocks accounted for 21.4% of total options volume in 2020 and declined to 10.1% in 2021,” read the findings of a December report from Cboe Global Markets. “Overall options volume in meme stocks declined from 2020 to 2021, but there are still a number of days where these stocks make up more than 25% of total options volume.”

That may in turn spell trouble for Robinhood Markets Inc. HOOD,

But overall, a more normal and less volatile environment in 2022 will just be a lot less fun.

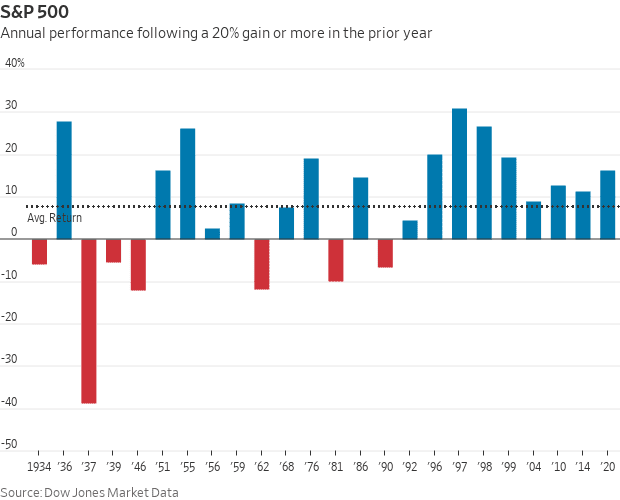

According to Dow Jones data, when the S&P 500 gains 20% or more in a calendar year, it averages a gain of 7.7% the following year with a median return of 10.2%.

In keeping with our theme, that would look like this:

That’s not nothing, but it’s definitely a lot more “normal.”

See you on Monday, when things are less fun and money starts to feel less cheap.