SoFi joins the meme-stock party — does that mean the parents have come home?

We’re not saying that retail investors are getting a little stale with their choices of meme stocks, but we are saying that the hottest new thing is a fintech lending platform that wants to be a bank and is run by a former Goldman Sachs GS,

Social-media traders were buzzing over SoFi Technologies Inc. SOFI,

The stock opened almost 20% higher on Wednesday morning before trading at roughly six times its average volume to close up 13.7%. According to data from HypeEquity, mentions of SoFi’s ticker on Reddit were up more than 1,500% in a 24-hour period.

Despite actual news being an impetus for the move, that huge trading volume and social-media attention make SoFi very meme-ish indeed.

The approval gives SoFi the banking business that CEO Anthony Noto –a former senior banker at Goldman and CFO of Twitter– has been chasing since he took over at the beginning of 2018, and a turn-key way for SoFi to lower its cost of capital which is — not to be wonky — a huge thing for a company that lives and dies on the rates it can offer customers on its wide array of loan instruments.

By being able to offer checking and savings accounts while simultaneously gaining access to the Fed’s discount window, SoFi is now a hybrid thing, an online student-loan refinancer that can also sell you a fixed-rate CD.

To many Reddit “Apes” who have been a little burned by the recent performances of ur-memes like GameStop GME,

“Well, SoFi is now both a growth stock and a bank,” proclaimed user No_Rule_1716 on subreddit r/WallStreetBets. “It’s a great solid investment with billions of cash on the balance sheet.”

“This is great news a bank already a leader in digital transformation,” celebrated user BeginningProgress921 on subreddit r/SOFIStock.

The notion that SoFi might be sensitive to a short squeeze was also popular on social media, but Ortex data showed that roughly 11% of SoFi’s free float was sold short, making targets of a squeeze pretty slim pickings.

What was difficult to find on social media or anywhere else was the notion that SoFi’s rise highlighted another meme stock’s continued fall, and potentially put them on a course to find each other in the wilderness and build a new life together.

Purple prose aside, shares of Robinhood HOOD,

Robinhood, as some right remember, had harbored dreams of becoming a bank itself, giving it the types of capital advantages and stability that SoFi will now enjoy. On the other hand, SoFi is lacking what many financial services giants (Goldman, JPMorgan JPM,

SoFi’s market cap at Wednesday’s market close was $9.7 billion, according to Dow Jones data, while Robinhood’s remained at almost $12.4 billion, making the notion that Noto could buy Vlad Tenev and Co. nearly impossible.

But based on SoFi’s new profile, and Robinhood’s plummeting value, how long will it take in a rising-rate environment for these two to notice that they want what the other one has?

Hot new couple alert indeed…

Dark days for the Mother Memes

Now, we’re not going to kick more dirt in the eyes of the truly diamond-handed apes who are still HODLing the big memes, because that’s not cool and also they don’t deserve it as we are entering 2022 open to the notion that value investing is a noema/noesis thought experiment more applicable to Wittgenstein than Buffett.

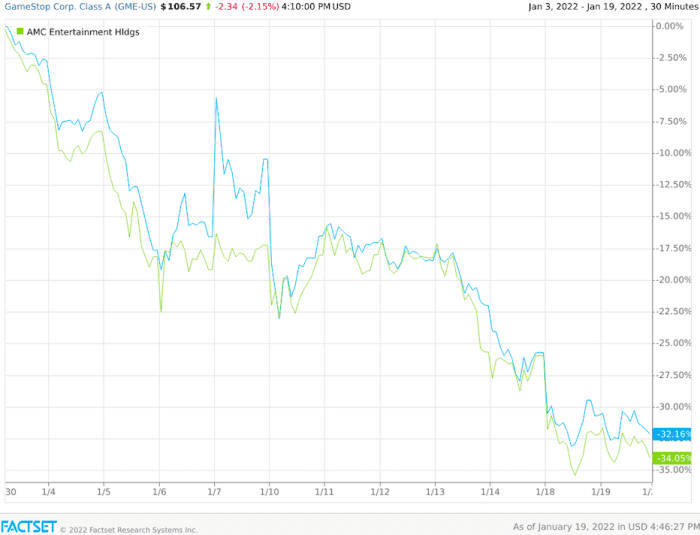

That said, here’s a chart of both stocks in 2022:

FactSet

That’s not great.

By no means does this chart mean that neither stock is bouncing back, but AMC is now under $20 for two consecutive days for the first time since May 2021’s short squeeze, and GameStop is holding onto the $100 level.

For the latter, Tuesday’s blockbuster announcement that Microsoft MSFT,

According to a note from Jeffries’ analyst Stephanie Wissink, the merger could pose a “walled garden risk” for GameStop if Microsoft elects to do things like make Activision’s blockbuster games available only on the tech giant’s Xbox gaming system, which would impact GameStop’s bottom line.

What it does mean is that this is either the biggest buyable dip these stocks have seen since meme stocks became a thing, or it’s time to take what’s still on the table and rotate out into other corners of the market that are fertile for a second guerilla action.

SoFi is one example, but it’s pretty high-profile by meme-stock standards, meaning the “hedgies” might see them coming.

Regardless, the next few weeks are shaping up to be big ones for the Mother Memes as we careen towards the one-year anniversary of the big short squeeze.