SoftBank shares tumble 9% as tech stocks sell-off continues

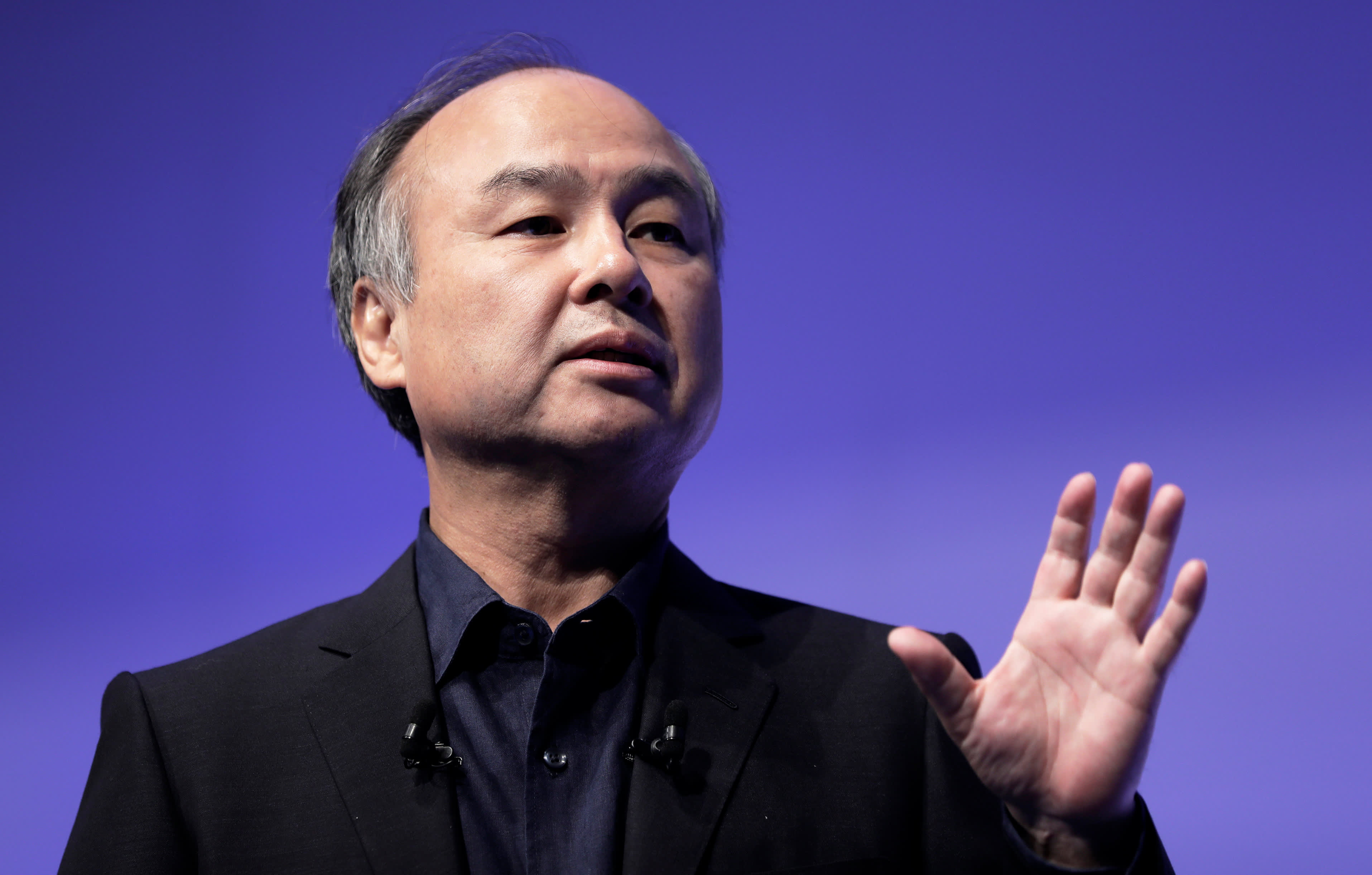

Masayoshi Son, chairman and chief executive officer of SoftBank Group at the SoftBank World 2018 event in Tokyo, Japan.

Kiyoshi Ota | Bloomberg | Getty Images

SoftBank’s share price fell 9% Thursday as investors cashed out of their positions in Asian technology stocks.

The conglomerate, which has invested billions into tech firms around the world, saw its share price drop as much as 9.8% to 4,652 Japanese yen ($40.39) on the Tokyo Stock Exchange — its largest fall fallen since March 2020.

The collapse coincided with a disappointing day of trading for SoftBank’s biggest investment, Alibaba, which saw its share price slide by more than 7% on the Hong Kong stock market. It also comes amid reports that SoftBank might not be able to sell U.K. chip designer Arm to Nvidia for $40 billion due to a number of ongoing regulatory probes.

Elsewhere, Tokyo-headquartered Sony saw its share price drop as much as 8% despite having more predictable revenue and income streams than SoftBank. It’s also forecasting a record-breaking year of profit.

More broadly, Asia-Pacific markets were in the red on Thursday overnight. Japan’s Nikkei 225 fell 3.3% while the Topix was down 2.3%. In South Korea, the benchmark Kospi dropped 3.13% and in Hong Kong, the Hang Seng index and the Hang Seng Tech index dropped 2.56% and 4.61%, respectively. Chinese mainland shares also declined.

Many of the world’s best-known tech stocks saw their market cap’s sky rocket in 2021 but the trend hasn’t continued into 2020, with tens of billions of dollars being knocked off some company’s valuations.

Global markets are reacting badly to the Federal Reserve’s indication on Wednesday that it could soon raise interest rates for the first time in more than three years.

U.S. stocks initially rallied, even after the Federal Reserve news, but sentiment changed overnight. U.S. stock futures fell Thursday morning, indicating a sharply lower open on Wall Street.

— CNBC’s Elliot Smith and Holly Ellyatt also contributed to this article.