Tankers diverted from Asia to Europe as gas prices keep rising – live updates

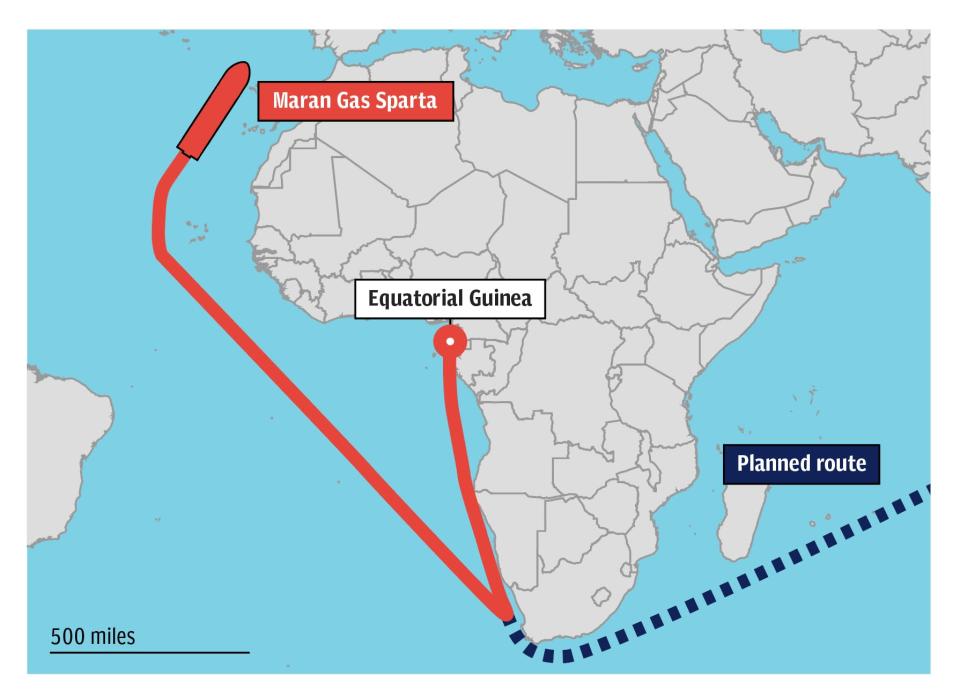

More cargo ships laden with natural gas are being diverted away from China to Europe as traders look to cash in on an unprecedented surge in prices.

Thirteen liquefied natural gas carriers shipping supply mainly from the US and West Africa are re-routing to Europe instead of Asia, according to data from Kpler and Bloomberg. That’s up from about eight ships spotted a week earlier.

Sellers are sending their ships on expensive detours around the globe as they race to make the most of high prices before the energy crisis eases.

Gas prices have extended their gains for the third consecutive day, with benchmark European prices up as much as 9.1pc and the UK equivalent up as much as 9.8pc.

12:53 PM

PCR test requirement dropped after positive lateral flow

The Government has confirmed that the requirement to get a PCR test after testing positive on a lateral flow will be dropped.

The UK Health Security Agency said it changes will come into effect for asymptomatic people from 11 January in England.

However, people with Covid symptoms should still get PCR tests.

The Government is also expected to drop the requirement for pre-departure tests for passengers arriving in the UK following calls from industry groups.

UKHSA has confirmed that the requirement for asymptomatic people testing positive on lateral flow to do confirmatory PCR will be suspended – from Jan 11 in England – devolved administrations possibly sooner.

— Hugh Pym (@BBCHughPym) January 5, 2022

12:49 PM

Facebook launches bid to appeal Giphy ruling

Facebook owner Meta has applied to appeal a competition watchdog ruling that it must unwind its $400m (£295m) takeover of Giphy.

The Competition and Markets Authority (CMA) said in November it had found that the deal would reduce competition between social media platforms and in digital advertising.

The regulator ordered Facebook to sell Giphy – marking the first time it’s blocked a major tech deal.

The Competition Appeal Tribunal said Meta had lodged an application for review on December 23, challenging the ruling on six grounds.

12:38 PM

Sony to develop electric cars and unveils Vision-S 02 01 CES

Sony is gearing up to join the electric car race, with the Japanese electronics giant setting up a dedicated division despite never making a vehicle, writes James Titcomb.

Kenichiro Yoshida, chief executive, said the company would launch Sony Mobility in the spring and “explore entry” into the industry.

Speaking at the CES technology show in Las Vegas, he also showed off a new prototype SUV in addition to an existing model it has been testing for just over a year.

Sony, best known for its PlayStation games consoles, cameras, movie studio and record label, has little heritage in making cars.

However, it has a lucrative business in image sensors that are likely to become increasingly important for safety features and ultimately self-driving technology, as well as making autonomous robots and drones.

12:16 PM

Tankers turn around as more gas heads to Europe

Gas traders are diverting their ships towards Europe as they look to capitalise on soaring prices across the continent before the crisis subsides.

Many sellers are paying for expensive detours – including one ship that was sent back through the Panama Canal, doubling its charges. But the huge spike in European prices means they can still earn more than in Asia.

In just one example of this trend, West African cargo onboard Maran Gas Sparta, a vessel chartered by Shell, has been called back to Europe after it was on the cusp of passing the Cape of Good Hope.

12:04 PM

US futures dragged down by tech stocks

US futures are trading marginally lower, with a sell-off in tech stocks suggesting there may be more pain for Silicon Valley.

Futures tracking the tech-heavy Nasdaq fell 0.4pc, while the S&P 500 and Dow Jones were little changed.

Markets got another reminder of the continuing threat to global growth from the pandemic as Hong Kong reimposed social curbs and halted flights from eight countries.

Meanwhile, a selloff in tech stocks extended to Asia, sending a gauge of Chinese names listed in Hong Kong toward a six-year low. Traders are now caught in a quandary over deepening fears on global growth combined with a faster tightening by the Federal Reserve.

11:56 AM

Ministers set April deadline to solve energy crisis

The Government is giving itself until April to find a solution to soaring gas prices as consumers brace for a new price cap on utility bills.

Regulator Ofgem is set to announce a new price cap on 7 February, but ministers believe they have a couple more months to gauge whether assistance is needed to help mitigate the impact, Bloomberg reports.

Business Secretary Kwasi Kwarteng will meet with energy bosses today. Measures under discussion include an industry proposal for loans to help suppliers delay some of the April increases, as well as cuts to VAT charged on utility bills.

How Govt navigates the cost of living issue will define 2022. Will require significant reform of the retail energy market, changes to how clean infrastructure is funded, action on carbon pricing and mainstreaming net zero in levelling up relaunch to maintain political support.

— Josh Buckland (@jbuckland13) January 4, 2022

11:43 AM

PCR test delays force pub and restaurant workers to isolate for almost two weeks

Pub and restaurant staff are being forced to isolate for almost two weeks because of delays in Covid PCR tests, industry leaders have warned ahead of an expected relaxation of the rules.

Hannah Boland has more:

Clive Watson, chairman of City Pub Group, said that the current requirement to get a PCR confirmation of coronavirus symptoms was playing havoc in his company. Martin Williams, chief executive of Gaucho owner M Restaurants, called the regulations “terribly unhelpful”.

Anyone who does not have Covid symptoms but gets a positive lateral flow result, accounting for about 40pc of cases, must then get a confirmatory PCR test.

They must isolate for 10 days after the PCR, but delays in the testing system means that it can take as many as four days to get a slot – effectively condemning people to as many as 14 days indoors.

Hospitality companies have reported coming under huge strain, battling worker absences over the festive period amid confusion among the public over when they need to start their isolation periods and lengthy delays to results.

Mr Watson said the current rules meant staff “can be off on average 12 to 13 days”.

11:09 AM

Piracy streaming app Popcorn Time shuts down

It was once the bane of Netflix’s existence, but for Popcorn Time the credits have finally rolled.

Founded in 2014, the app made watching pirated films and TV shows almost as easy as using a legitimate streaming service and quickly became a hit.

The following year Netflix warned investors about the rise of the platform, with boss Reed Hastings stating that “piracy continues to be one of our biggest competitors”.

While Popcorn Time’s creators deserted the service shortly after its launch, the app’s code was open-source, meaning others could pick up the mantle.

A goodbye note posted by Popcorn Time, with an illustration of a bag of movie-theater popcorn with X marks for eyes, proclaims “R.I.P.” at the top of the page. The site also contains a chart of interest over time measured in online searches for the app, similar to the one Netflix sent to investors in 2015.

10:55 AM

InterContinental rises after UBS upgrade

InterContinental Hotels is one of the biggest risers this morning, gaining 3pc to push towards the top of the FTSE 100.

It comes after UBS raised its recommendation from neutral to buy, with analysts Bilal Aziz saying the stock was seen as the strongest industry play in an inflationary environment.

Meanwhile, Redburn raised its recommendation to neutral from sell.

10:44 AM

Boeing wins £460m UK army contract

Boeing Defence has secured a £460m contract to provide logistics services to the UK armed forces worldwide.

The five-year contract covers services including inventory, transport, engineering and general ledger management, ensuring the UK can successfully deploy military personnel and equipment globally.

The Ministry of Defence said the deal will support 675 jobs across the UK supply chain, including 300 at Boeing’s sites in Milton Keynes and Bristol.

It added that the contract was expected to deliver £54m in efficiency savings.

10:32 AM

Stanlow refinery records best fuel sales in 18 months

The company behind the Stanlow oil refinery has posted its strongest fuel sales in 18 months as it emerges from a pandemic crisis that left it on the brink of collapse.

Essar Oil said its December sales were the strongest in a year and a half across both fuels and petrochemicals, with demand now back to 95pc of pre-Covid levels.

Stanlow, which supplies around one sixth of the UK’s road transport fuels, was plunged into crisis during the pandemic as fuel demand slumped and a funding shortfall left it struggling to repay deferred taxes.

Essar said it had secured new funding arrangements worth $1.1bn (£800m) last year and said around 80pc of VAT deferred payments have now been made in line with a schedule agreed with HMRC.

Deepak Maheshwari, chief executive of Essar, said:

Over the last quarter, the company has been able to strengthen its financial performance due to improvements in the product market and delivery of reliable and stable operations at Stanlow.

We have also closed the defined pension benefit scheme for future accruals, which will provide long-term security of competitiveness for the company. Going forward, we will invest in projects such as HyNet which will enable the country’s transition to a low carbon economy.

10:23 AM

Together Energy latest supplier to face collapse

A local authority-backed energy supplier with 170,000 customers is reportedly facing collapse within weeks after failing to secure new funding.

Together Energy, which is 50pc owned by Warrington Borough Council, is likely to run out of money this month without an emergency cash injection, Sky News reports.

Professional services firm Alvarez & Marsal has carried out a hunt for new funding, but the prospect of a deal is now said to be remote.

Together Energy could be the latest victim of a protracted energy crisis that has claimed more than two dozen victims in recent months. If it does go bust, it will be the 26th firm to cease trading since August.

10:11 AM

FTSE 100 turns positive as oil stocks gain

The FTSE 100 has reversed its early losses to push up 0.3pc, driven largely by gains for oil majors.

BP and Shell pushed 1.4pc and 1pc higher respectively, extending gains from yesterday after production cartel Opec said it would maintain its output increases.

The blue-chip index had started the day on the back foot as a new year rally driven by travel stocks ran out of steam.

But focus will be back on the airlines and hotel groups today amid reports the Government will scrap the pre-departure test requirement for vaccinated travellers entering the UK.

Following a sluggish start, the mid-cap FTSE 250 is now up 0.1pc, with Cineworld leading the risers.

09:52 AM

Pre-departure tests ‘to be scrapped’ for UK return

Pre-departure testing will no longer be required for passengers returning to the UK, the Government is expected to announce later today.

Sky News reports that the review of travel restrictions will scrap the restrictions put in place a month ago to tackle the spread of the omicron variant.

It comes after trade body Airlines UK and Manchester Airlines Group called for the removal of all testing rules, saying they had little impact on the spread of omicron and were wreaking financial havoc across the industry.

Under current rules, fully vaccinated travellers must take a pre-departure test before heading to the UK and self-isolate until they receive a negative result from a post-arrival test.

People who are not fully vaccinated must self-isolate for 10 days after they arrive.

09:46 AM

Watchdog swoops on Capita’s £62m software deal

The competition watchdog has served an initial enforcement order over Capita’s planned £62m sale of its emergence services business to NEC Software Solutions.

The order prevents NEC from fully combining the business while the regulator considers the deal.

Capita inked the deal to offload its Secure Solutions and Services division, which provides managed services to the emergency services and justice sectors, in October in an effort to bolster its balance sheet.

Shares in Capita fell 2pc.

09:36 AM

Gas prices keep climbing as Russia cuts supplies

Gas prices are on the rise once again, extending gains for a third consecutive day as shipments from Russia remain limited.

Benchmark European prices rose as much as 9.1pc after rallying more than 10pc on both Monday and Tuesday. The UK equivalent gained as much as 9.8pc.

Prices are bouncing back after a sharp drop at the end of the year as pipeline volumes of Russian gas to Europe languish at their lowest level in at least seven years.

Russian supplies via Ukraine remain subdued, while the Yamal-Europe pipeline is still flowing in reverse from Germany to Poland.

The squeeze on supplies comes just as temperatures start to fall again across Europe, while tensions on the Russia-Ukraine border remain high.

09:23 AM

Playtech delays vote on £2.1bn Aristocrat offer

Playtech has said it’s delaying a shareholder vote on a £2.1bn takeover offer from Australian gambling giant Aristocrat as talks progress over a rival bid from JKO Play.

The London-listed software company, which was founded by billionaire Teddy Sagi, said the meeting previously scheduled for 12 January will be pushed back to 2 February.

Meanwhile JKO, which is led by former Formula 1 owner Eddie Jordan and former Ladbrokes executive Keith O’Loughlin, has asked for more time to develop the terms of its potential offer.

Playtech’s directors continue to recommend unanimously that shareholders vote in favour of the Aristocrat offer, but a rival approach from JKO could derail this bid.

In a separate statement Aristocrat said the regulatory approval process for its offer remained on track, adding it was committed to competing the acquisition “as quickly as possible”.

09:09 AM

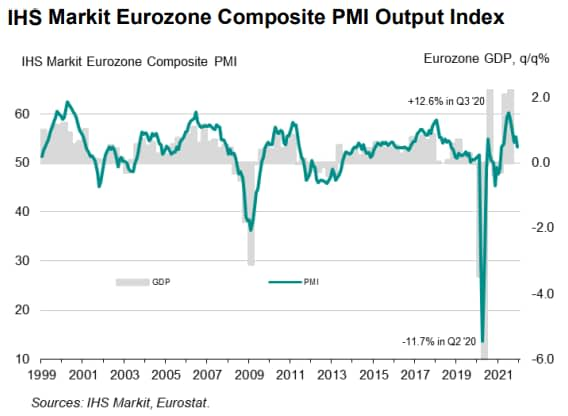

Eurozone growth slows to nine-month low

Economic growth in the eurozone slowed to a nine-month low in December amid a resurgence in Covid cases.

The IHS Markit PMI index for the region fell to 53.3m last month, down from 55.4m in November, representing the slowest expansion since March.

The rapid spread of the omicron variant took a particular toll on the service sector, restricting increases in both activity and new business.

Meanwhile, manufacturing output growth remained subdued as supply-related disruptions continued to impede production schedules.

Joe Hayes, senior economist at IHS Markit said:

The accelerated expansion in output we saw in November unfortunately turned out to be brief. Amid a resurgence of Covid-19 infections across the euro area, growth slowed to the weakest since March in December.

In Germany, where measures to combat Covid-19 have been more stringent than other monitored euro area countries, levels of economic activity broadly stagnated in December. Nonetheless, slower growth was seen across the board.

09:00 AM

Ryanair passenger numbers drop amid omicron travel curbs

Ryanair has reported a fall in passenger numbers between November and December as fresh restrictions prompted by the omicron variant dented travel.

The budget airline said numbers fell 7pc to 9.5m last month – the lowest level since July. It ran 62,200 flights in December, with load factor slipping to 81pc from 86pc the previous month.

Ryanair had warned on profits just before Christmas as it slashed passenger forecasts due to omicron. It cut its guidance for this month by a third as restrictions were imposed on British passengers flying to Germany and France and all EU passengers to Morocco.

The airline now expects a full-year net loss of between €250m (£209m) and €450m, compared to a previous range of between €100m to €200m.

08:49 AM

Tesco wins supermarket battle in key Christmas trading period

Tesco has grown its market share to the highest level since January 2018 as it outperformed rivals in the key Christmas trading period.

Tesco’s grocery sales slipped 0.9pc over the 12 weeks to December 26 compared to last year’s lockdown boom, according to the latest data from Kantar. However, they’re up 10.1pc on a two-year basis.

Its grocery market share rose 0.6pc to 27.9pc – its highest level in four years.

Rivals Sainsbury’s, Asda and Morrisons saw their sales fall by 4.4pc, 3.9pc and 6.5pc respectively compared to last year.

Total UK grocery sales stood at £31.7bn over the 12 week period, down 3pc on last year but up 8pc versus 2019.

Fraser McKevitt, head of retail and consumer insight at Kantar, said: “The data suggests that while there weren’t formal rules in place across the UK this year, many people celebrated at home again due to omicron.”

08:37 AM

FTSE risers and fallers

The FTSE has slipped this morning after hitting 22-month highs on Tuesday as the new year rally runs out of steam.

Life insurance and banking stocks are the biggest drag on the index, with HSBC and Prudential down 0.6pc and 0.8pc respectively. National Grid is leading the laggards with a fall of 1.1pc.

Meanwhile, Ocado is the biggest riser, gaining 3.8pc following an upgrade by analysts at Berenberg. London Stock Exchange Group has also added 2.5pc after an upgrade from Citigroup.

The domestically-focused FTSE 250 is trading flat.

08:24 AM

Mazars fined £250,000 over audit failures

Mazars has been slapped with a £250,000 fine over failures in its audit of a local government authority’s 2019 accounts.

The Financial Reporting Council (FRC) said Mazars’ work “fell far short of the applicable standards and regulations and had the potential to undermine confidence in the standards in general of registered auditors”.

The accounting watchdog proposed a penalty of £314,000, but this was reduced by 20pc after Mazars co-operated with the investigation and made certain admissions in the case.

The FRC said the auditor has also made written undertakings to improve the quality of its work.

08:17 AM

China’s Huarong slumps after $6.6bn bailout

Shares in troubled Chinese asset manager Huarong plummeted as trading resumed following a state-backed bailout of almost $6.6bn (£4.9bn).

The company’s Hong Kong listed shares had been suspended for nine months after it delayed its 2020 annual results, spooking markets.

When Huarong eventually published its figures in August, it revealed a record $16bn loss. Former chairman Lai Xiaomin was executed last year after being found guilty of corruption.

Shares slumped more than 50pc after they resumed trading today.

08:05 AM

Poundland chief Andy Bond steps down

The chief executive of Poundland’s parent company has said he’s stepping down later this year due to health issues.

Andy Bond, the former boss of Asda, said he will leave Pepco at the end of March and remain an adviser to the board until the end of the year.

He steps down after 10 years with the European retailer, which owns discounting stores under the Pepco, Poundland and Dealz brands across the continent, including seven as chief executive and listing the company on the Warsaw Stock Exchange last year.

Mr Bond will be replaced by chief operating officer Trevor Masters, a former executive at Tesco.

08:01 AM

FTSE 100 slips at the open

Following Tuesday’s new year rally, the FTSE 100 has started the day marginally on the back foot.

The blue-chip index has edged a fraction into the red at 7,503 points.

07:56 AM

Hong Kong bans indoor dining after 6pm

Hong Kong is rolling out fresh restrictions for the first time in almost a year amid fears the city is on the brink of a major winter Covid outbreak.

Indoor dining will be banned after 6pm while some venues will be closed completely, according to local media reports.

There will also be a return to social distancing rules that were in place a year ago and eased after Chinese New Year 2021, while flights from eight countries – including the UK and US – will be banned from 8 January.

It comes after the financial hub this week reported the first local Covid case that officials were unable to trace to its source.

Hong Kong leader Carrie Lam said the increase in cases in the city was drastic and was putting a strain on public hospitals.

07:47 AM

Travel firms call for Covid testing to be scrapped

Travel groups have called for all remaining Covid testing for passengers to be scrapped to help ease the financial pressure on the industry.

Trade body Airlines UK said current measures had dented demand and hurt consumer confidence, warning that extending the rules any longer would be financially disastrous.

Manchester Airport Group added that its research had showed pre-departure testing had little or no impact on the spread of the omicron variant.

Boss Tim Hawkins told BBC Radio 4: “We are beyond the point where international travel restrictions can play a role in managing that peak and if there is no benefit to it then we shouldn’t be doing it and we should take those measures out.”

Ministers are thought to be discussing changes to Covid testing rules for both travel and domestic use as the country battles widespread staff and test shortages.

The Telegraph revealed the requirement for follow-up PCR tests will be removed in an effort to shorten isolation periods.

Read more on this story: Covid testing rules to be relaxed to solve staff shortages

07:36 AM

Goldman says Bitcoin $100,000 a ‘possibility’

Good morning.

Wall Street has been notoriously sceptical of cryptocurrencies, but there’s some bullish forecasting from Goldman Sachs on the prospects for Bitcoin.

The bank said the $100,000 price milestone often touted by advocates of the digital coin is very much a possibility as it continues to win market share from gold.

Goldman said that while Bitcoin’s consumption of natural resources may be a barrier to institutional adoption, this wouldn’t hurt demand for the asset.

Bitcoin is currently trading at around $46,000, having hit a new high of $69,000 last year.

5 things to start your day

1) New energy crisis talks as cold snap sends gas prices soaring Business Secretary is scrambling to avoid another string of supplier collapses following last year’s crisis

2) Best-paid Clifford Chance partner takes home record £3.2m Profit share for the magic circle firm’s highest-earning lawyer jumped by a fifth last year amid a deals boom

3) Twitter bans popular news aggregator Politics For All The social media company said the decision was due to violations to its audience manipulation rules

4) Sterling nudges €1.20 as prospect of February interest rate rise mounts Pound hits two-year high against the single currency and gains ground against the dollar

5) British Lithium moves a step closer to UK production The company is now able to make 5kg of cost-effective lithium carbonate a day in a boost for the electric car industry

What happened overnight

Markets struggled in Asia on Wednesday following a tepid lead from Wall Street, with inflation and expected interest rate hikes returning to the key focus of concerns as Omicron fears fade for now. Wellington, Taipei and Jakarta rose along with Manila where trading resumed after being cancelled on Tuesday owing to a technical glitch. Tokyo was flat with the yen holding losses at a four-year low against the dollar.

Coming up today

-

Corporate: No scheduled updates

-

Economics: Final services and composite PMI (eurozone, France, Germany, US), ADP employment change, FOMC minutes (US)