The S&P 500 beat both Dow, and Nasdaq in 2021 by the widest margin in 24 years. Here’s what history says happens in 2022.

While the music played, investors kept dancing, paraphrasing a line from former Citigroup C,

Purchasers of U.S. stocks have danced to the tune of a record rise for the broad-market S&P 500 index in 2021 and are eager to glean clues on what follows in the coming year which many expect to be filled with uncertainty even if pandemic worries begin to ebb.

For Wall Street, one interesting question may center on S&P 500 SPX,

It is only the sixth time that the S&P 500 has bested the Dow and the Nasdaq in a year, with the previous occurrences in 1984, 1989, 1997, 2004 and 2005.

Although, it represents a tiny sample size, gains have been healthy in the year following. In fact, all three benchmarks have continued to trend higher. The S&P 500 averages 12.6% returns, the Dow averages a rise of 11% and Nasdaq Composite averages a positive return of 12.8% in those instances.

There is another separate concern harbored by bullish investors about the degree to which the S&P 500 can continue to rise after its 26.89% run-up in 2021. Is there more room to run?

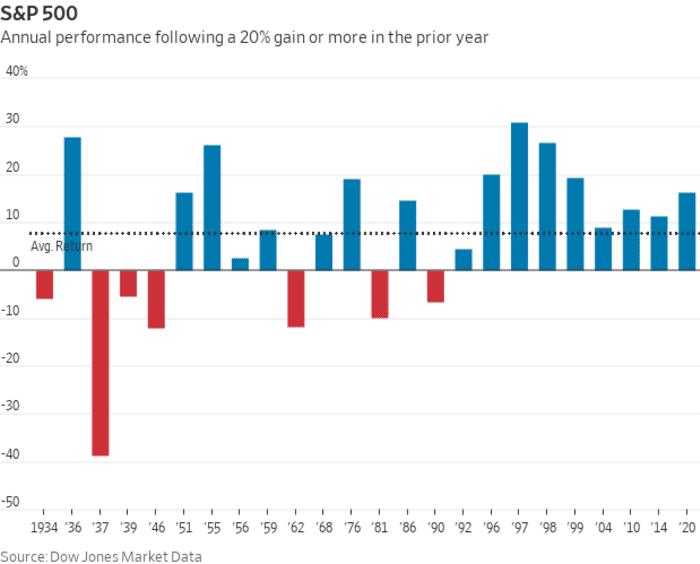

History suggests that after a gain of at least 20% by the benchmark, returns are comparatively muted but not insignificant, with an average rise of 7.7%.

The year after a big rally also tends to be followed by a positive finish for the index in the subsequent calendar year over 70% of the time. Gains have occurred consistently the previous nine times that the S&P 500 has posted a 20% rise or better.

Of course past performance is no guarantee of future results, and 2022, much like 2021, will come replete with idiosyncratic themes, including the struggle with the pandemic, the battle with inflation running at its highest level in 40 years, and Congressional midterm elections due in November. It is hard to guess what will be the driving force but healthy corporate earnings and the promise of better days ahead have been the common bullish denominator in past years.

Optimism may be cooling somewhat though.

A number of Wall Street firms are predicting returns in the high-single digits for the S&P 500 in 2022, if returns are to be had at all, with Credit Suisse forecasting a 5,200 year-end finish for the index, implying a rise of over 9%; and Morgan Stanley is predicting a 4,400 finish, or a nearly 8% decline.

Inflation that has been anything but transitory and a pandemic that some hoped last year would be in the rearview mirror in 2022 are still clouding the outlook.

That said, the market seems to love worry, having scaled a monstrous wall of concerns over the course of the past three years to post double-digit returns.

The question is when will the music stop for the bulls?

Ken Jimenez contributed to this article