‘They’re behind the curve’: Bay Street hawks who called for January rate hike react to BoC’s decision to stay put

‘We’re scratching our heads’

Article content

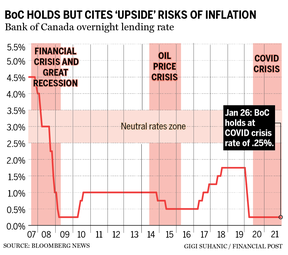

The Bank of Canada balked at calls for an increase to the overnight interest rate in its Jan. 26 policy decision, opting to keep rates on hold but setting the course for hikes, perhaps as soon as March.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Ahead of the January meeting, some economists advanced their forecasts for liftoff. But after Wednesday’s announcement, they in turn balked at the Governing Council’s latest communication.

Here’s what the hawks had to say:

Jean-François Perrault, chief economist at Bank of Nova Scotia, by phone:

“It’s difficult to see now how they would justify a hike in March, which is the next decision. Really, what information are they going to have that they don’t have now that would compel them to move? Because if anything, in March, you’re going to get the crappier (data) from January, which are obviously affected by Omicron.

“They’re already saying we expect five per cent inflation in the first part of the year, so it’s not like it’s inflation that’s going to drive them to move. So we’re scratching our heads, saying ‘okay, what are the triggers that are going to lead them to raise interest rates and when are those going to line up?’

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“I think they’re behind the curve. I think they do need to move in March but I’m not sure how they’re going to be able to justify that given what they’re saying today.”

Perrault expects a hike to come in March now.

Taylor Schleich, rates strategist at National Bank of Canada, by phone:

“I’m hesitant to call it a policy mistake, but it certainly appears like the bank is on the back foot in the fight against inflation. So I think the more prudent move would have been to increase interest rates today and get that get that fight against inflation started.

“I think the fact that they’re shifting their positioning is more important than the fact that they abandoned their guidance multiple times. They’re adapting to the inflation outlook. Inflation has been stronger than we thought. As a central bank with price stability as their primary mandate, you should expect them to do that. So it’s a good thing.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“Where it becomes a little bit trickier is if inflation just continues to surprise to the upside. If you look at the trajectory for their inflation forecasts in 2022, it continued to be marked up and up and up. So I think the bigger risk is that inflation continues to rise and the bank is behind the curve and Canadians question how effective the bank is at taming inflation.”

Schleich expects a hike to come in March now.

-

Bank of Canada holds interest rates at 0.25% but hints of hike to come

-

Live updates: Why did the Bank of Canada hold and what’s next?

-

Fed to raise interest rates ‘soon’ as it pivots toward fighting inflation

-

What a Bank of Canada rate hike could mean for mortgages and the housing market

Veronica Clark, economist at Citigroup Inc., in a note:

“The decision was surprising to us, although it does not change the general trajectory for higher rates over the year. Failing to raise rates in January could mean a faster-than-quarterly pace of hikes will be warranted, as there is less flexibility to be gradual now.

“The BoC still seems very focused on controlling inflation, as governor (Tiff) Macklem stressed in the press conference, and thus it seems strange to us to fail to raise rates when all the previously outlined requirements for a hike are met.

“Still, we struggle to see what waiting one more meeting will practically do to support the recovery. If anything, it increases the risk of needing to raise rates faster which could be more destabilizing.”

Clark expects a hike to come in March now.

• Email: [email protected] | Twitter: biancabharti

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.