This ‘cash cow’ value-stock strategy can fatten your portfolio even if you fear the Fed

Value stocks have been outperforming growth stocks over the past six months, in part, because a change in Federal Reserve policy is signaling an extended period of rising interest rates. Within the value world, investors might be best-served by focusing on cash flow.

Click here for an explanation of how the Russell 1000 Index RUI,

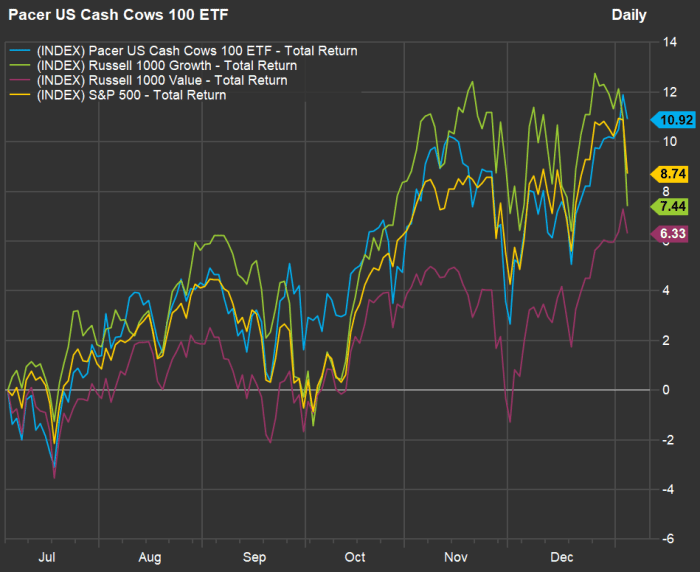

In the low-interest-rate environment through most of the coronavirus pandemic, growth strategies have worked best. But check out this six-month chart showing the total return of the $1.3 billion Pacer U.S. Cash Cows ETF COWZ,

COWZ has beaten all three of the indexes over the past six months, and this action might continue, as stocks trading at high price-to-earnings valuations — including the high-flying tech companies that have led the long bull market — may continue to be more sensitive to rising interest rates than value stocks.

COWZ is rebalanced quarterly to hold the 100 stocks among the Russell 1000 that have the highest free cash flow yields for a rolling 12-month period. The stocks are equally weighted when the portfolio is rebalanced.

Pacer defines a company’s free cash flow as its cash flow from operations after capital expenditures, which include expenses, interest, taxes and long-term investments. That figure for the past 12 months is divided by current market capitalizations each quarter when the exchange traded fund’s portfolio is rebalanced. That means recent high-flyers are likely to be dropped from the portfolio.

Screening the cash cows

The COWZ strategy might appeal to investors who wish to diversify beyond the cap-weighted indexes that are most commonly tracked by index funds. For example, the top five companies held by the $456 billion SPDR S&P 500 ETF Trust SPY,

But some investors want to look at individual stocks. Here are three screens of the 100-stock COWZ portfolio. Each list includes market capitalization (in billions of dollars), dividend yields and a summary of opinions among analysts polled by FactSet:

Fattest cash cows

Here are the 10 largest stocks held in the COWZ portfolio, by market capitalization:

| Company | Ticker | Market cap. ($bil) | Dividend yield | Share “buy” ratings | Closing price – Jan. 5 | Consensus price target | Implied 12-month upside potential |

| Pfizer Inc. | PFE, |

$312 | 2.88% | 42% | $55.63 | $57.87 | 4% |

| Exxon Mobil Corp. | XOM, |

$283 | 5.27% | 38% | $66.75 | $73.47 | 10% |

| AbbVie Inc. | ABBV, |

$240 | 4.15% | 77% | $135.87 | $137.57 | 1% |

| Intel Corp. | INTC, |

$219 | 2.58% | 28% | $53.87 | $54.78 | 2% |

| CVS Health Corp. | CVS, |

$140 | 2.08% | 75% | $105.81 | $113.31 | 7% |

| Bristol-Myers Squibb Co. | BMY, |

$138 | 3.47% | 63% | $62.16 | $71.92 | 16% |

| International Business Machines Corp. | IBM, |

$124 | 4.75% | 28% | $138.22 | $142.74 | 3% |

| ConocoPhillips | COP, |

$100 | 2.43% | 87% | $75.65 | $92.24 | 22% |

| Gilead Sciences Inc. | GILD, |

$91 | 3.93% | 42% | $72.18 | $76.38 | 6% |

| Altria Group Inc. | MO, |

$89 | 7.40% | 39% | $48.64 | $52.69 | 8% |

| Source: FactSet | |||||||

You can click on the tickers for more about each company.

Then read Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page.

Highest-yielding cash cows

Here are the 10 stocks in the COWZ portfolio with the highest dividend yields as of the close on Jan. 5:

| Company | Ticker | Market cap. ($bil) | Dividend yield | Share “buy” ratings | Closing price – Jan. 5 | Consensus price target | Implied 12-month upside potential |

| Antero Midstream Corp. | AM, |

$5 | 9.05% | 0% | $9.94 | $10.28 | 3% |

| Lumen Technologies Inc. | LUMN, |

$13 | 7.81% | 14% | $12.80 | $11.30 | -12% |

| Altria Group Inc. | MO, |

$89 | 7.40% | 39% | $48.64 | $52.69 | 8% |

| Exxon Mobil Corp. | XOM, |

$283 | 5.27% | 38% | $66.75 | $73.47 | 10% |

| Dow Inc. | DOW, |

$43 | 4.80% | 36% | $58.35 | $65.48 | 12% |

| International Business Machines Corp. | IBM, |

$124 | 4.75% | 28% | $138.22 | $142.74 | 3% |

| LyondellBasell Industries NV | LYB, |

$32 | 4.70% | 52% | $96.27 | $111.30 | 16% |

| H&R Block Inc. | HRB, |

$4 | 4.53% | 33% | $23.86 | $25.80 | 8% |

| Xerox Holdings Corp. | XRX, |

$4 | 4.29% | 0% | $23.33 | $17.60 | -25% |

| AbbVie Inc. | ABBV, |

$240 | 4.15% | 77% | $135.87 | $137.57 | 1% |

| Source: FactSet | |||||||

Wall Street’s favorite cash cows

Finally, here are the 12 stocks in the COWZ portfolio with the highest percentage of “buy” or equivalent ratings among analysts polled by FactSet. This group includes a dozen stocks, not 10, because three were tied with 82% “buy” ratings:

| Company | Ticker | Market cap. ($bil) | Dividend yield | Share “buy” ratings | Closing price – Jan. 5 | Consensus price target | Implied 12-month upside potential |

| Grand Canyon Education Inc. | LOPE, |

$3 | 0.00% | 100% | $85.78 | $103.75 | 21% |

| Loyalty Ventures Inc. | LYLT, |

$1 | 0.00% | 100% | $31.97 | $63.00 | 97% |

| Targa Resources Corp. | TRGP, |

$12 | 0.74% | 91% | $54.06 | $67.05 | 24% |

| Laboratory Corp. of America Holdings | LH, |

$27 | 0.00% | 89% | $286.57 | $349.85 | 22% |

| ConocoPhillips | COP, |

$100 | 2.43% | 87% | $75.65 | $92.24 | 22% |

| Lithia Motors Inc. | LAD, |

$9 | 0.48% | 86% | $292.93 | $464.58 | 59% |

| LKQ Corp. | LKQ, |

$17 | 1.70% | 85% | $58.72 | $65.50 | 12% |

| Diamondback Energy Inc. | FANG, |

$21 | 1.69% | 85% | $118.11 | $137.30 | 16% |

| Olin Corp. | OLN, |

$8 | 1.52% | 83% | $52.69 | $74.00 | 40% |

| Nexstar Media Group Inc. Class A | NXST, |

$6 | 1.88% | 82% | $149.14 | $187.67 | 26% |

| Boyd Gaming Corp. | BYD, |

$7 | 0.00% | 82% | $62.38 | $83.80 | 34% |

| Victoria’s Secret & Co. | VSCO, |

$5 | 0.00% | 82% | $56.10 | $82.73 | 47% |

| Source: FactSet | |||||||

Don’t miss: These tech stocks have fallen 20% to 51% from their 52-week highs

Sign up: For intel on all the news moving markets before the day starts, read the Need to Know email.