‘We absolutely believe Ether’ surpassing bitcoin’s total market value ‘can happen this year,’ says ETF expert: ‘The bull case is an Etherum ETF in 2022’

Hello there! The Invesco QQQ Trust QQQ,

In fact, the Dow Jones Industrial Average DJIA,

It is anyone’s guess but it seems that many of those bets are being expressed through ETFs of late, after a bumper year for the market segment.

In any case, Benchmark Investments CEO Kevin Kelly tells ETF Wrap that bitcoin is the past and Ether is the future of funds.

Send tips, or feedback, and find me on Twitter at @mdecambre or LinkedIn, as some of you are wont to do, to tell me what we need to be covering.

Read: What is an ETF? We’ll explain.

The good

| Top 5 gainers of the past week | %Performance |

| KraneShares CSI China Internet ETF KWEB, |

14.0 |

| VanEck Oil Services ETF OIH, |

8.7 |

| Emerging Markets Internet & Ecommerce ETF EMQQ, |

7.4 |

| iShares China Large-Cap ETF FXI, |

7.3 |

| SPDR S&P Oil & Gas Exploration & Production ETF XOP, |

7.0 |

| Source: FactSet, through Wednesday, Jan. 12, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…and the bad

| Top 5 decliners of the past week | %Performance |

| KraneShares Global Carbon Strategy ETF KRBN, |

-6.4 |

| Global X Robotics & Artificial Intelligence ETF BOTZ, |

-3.4 |

| iShares U.S. Home Construction ETF ITB, |

-3.2 |

| NorthShore Global Uranium Mining ETF URNM, |

-3.1 |

| Global X Uranium ETF URA, |

-2.7 |

| Source: FactSet |

The flippening?

Forget about bitcoin BTCUSD,

If Ethereum’s market value overtakes that of bitcoin, then “the flippening” will have happened, which is the term that crypto enthusiasts use to refer to that shift, according to a post at the Flippening Watch blog. The closest Ether has gotten is when a narrowing of values in 2017 but since then it has struggled to challenge bitcoin.

“We absolutely believe that a flippening can happen this year,” Kelly told MarketWatch.

“We believe that as the digitazation of the world continues to happen, Ethereum is the network for that, Kelly said.

Kelly says that the growth of private blockchains, nonfungible tokens, or NFTs, the emergence of decentralized finance, or DeFi, among other factors are making Ether, which tends to power all of those, the asset to beat.

“So over the next one, three, five years, we believe that the growth in blockchain applications will be unprecedented and Ether will absolutely have its role in that,” he continued.

That has implications for the ETF world, which has been fixated on a bitcoin spot ETF after the ProShares Bitcoin Strategy ETF BITO,

Kelly predicts that an Ether futures ETF could happen this year, in a bull case but sees his base case as next year.

“I believe the bull case [for an Ether-linnked ETF] is 2022 and the base case is 2023 and the bearish case is 2024,” he said.

Meanwhile, the ETF expert has rolled out a trio of more traditional ETFs listed on NYSE’s Arca platform.

- Kelly CRISPR & Gene Editing Technology ETF. Trading under the ticker XDNA, the gene-editing ETF offers exposure to “next generation of healthcare by investing in companies disrupting the genomic and life science industries.” The fund seeks to track the Strategic CRISPR & Gene Editing Technology Index, which measures the performance of developed market companies that specialize in DNA modification systems and technologies.

- Kelly Hotel & Lodging Sector ETF. The lodging ETF uses the ticker HOTL and offers exposure to companies focused on hotel and lodging management and operations, lodging platform services, timeshare properties and real estate throughout the developed world.

- Kelly Residential & Apartment Real Estate ETF. RESI aims to track the Strategic Residential & Apartment Real Estate Sector Index, which targets the entire residential and multifamily real-estate industry: single-family residential homes, apartment buildings, student housing and manufactured homes.

The first two ETFs charge an expense ratio of 0.78%, which translates to an annual costs of $7.80 for every $1,000 invested, with RESI 10 basis points lower. Kelly is a former managing director at Horizon ETFs.

Rates bets

We asked Todd Rosenbluth, head of mutual fund and ETF research at CFRA, what’s interesting in the world of ETFs in the early part of 2022, with so much focus on inflation and rising interest rates. Here’s what he had to say:

With interest rates likely to be rising in 2022, rate-hedged fixed income ETFs are likely to garner attention.

He said ETFs like ProShares Investment Grade Interest Rate Hedged ETF IGHG,

IGHG carries an expense ratio of 0.30%, LQDH’s is 0.24, while LQD’s is 0.14%. LQD is the biggest by far at $37 billion in assets, with the other two at about $1 billion a piece. Performance wise, IGHG is up 0.2% in young year, but the iShares products are down modestly.

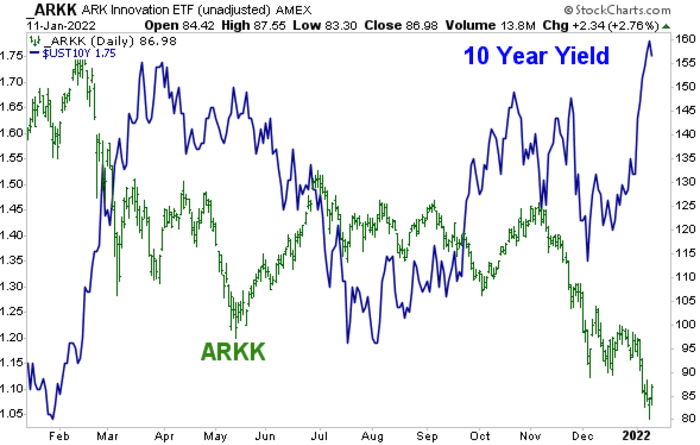

Visual of the week

ARK’s 10-year yield anchor

Frank Cappelleri, a market technician and executive director at Instinet, says that while ARK InnovationARKK, Cathie Wood’s flagship disruptive innovation ETF has had trouble since last February, “it is fared WORST during periods of rising rates. That is been especially clear since early December.”

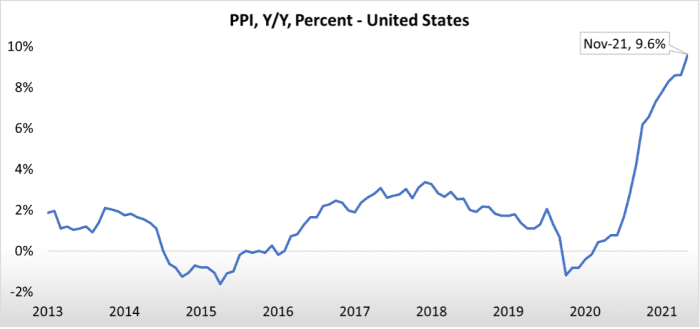

and a bonus on inflation

“We think advisors should be rebalancing their portfolios to prepare for structurally higher inflation in the years to come,,” writes the folks at Astoria.

Popular ETF reads

—That is a Wrap