Weekend reads: When tech stocks fade, where do you go?

The monthly jobs report for December showed a decline in the U.S. unemployment rate to 3.9%, even though fewer jobs were created than economists had expected.

How does this influence the Federal Reserve’s thinking on interest rates only two days after stock-market investors were stunned by Fed meeting minutes that showed some members want to not just raise interest rates but also shrink the central bank’s balance sheet?

Gregg Robb wraps up reactions from economists. The low unemployment rate supports expectations that the Fed will start raising interest rates in March, as it has indicated it plans to do.

That can put pressure on the stock market because investors seeking yield will have increasing opportunities in the bond market. Broad pressure on stocks can be especially painful for holders of technology stocks because of their high valuations. Indeed, the tech-heavy Nasdaq Composite was once again leading major indexes lower.

Is it finally time to switch to value stock?

Value stock indexes have outperformed broad indexes so far in 2022. Mark Hulbert explains why value may be the best approach through this year and shares top picks from several newsletters.

Here’s what Wall Street pros have to say.

Finally, Michael Brush makes the case for a good 2022 for the stock market despite all the fear of rising interest rates and shares eight cheap stocks recommended by three investment newsletters.

Stock screens

Cash-cow stocks might appeal to investors worried about market gyrations as interest rates rise.

MarketWatch photo illustration/iStockphoto

There are many ways to screen stocks in search of those that might best meet your investing goals. Here are five lists from this week:

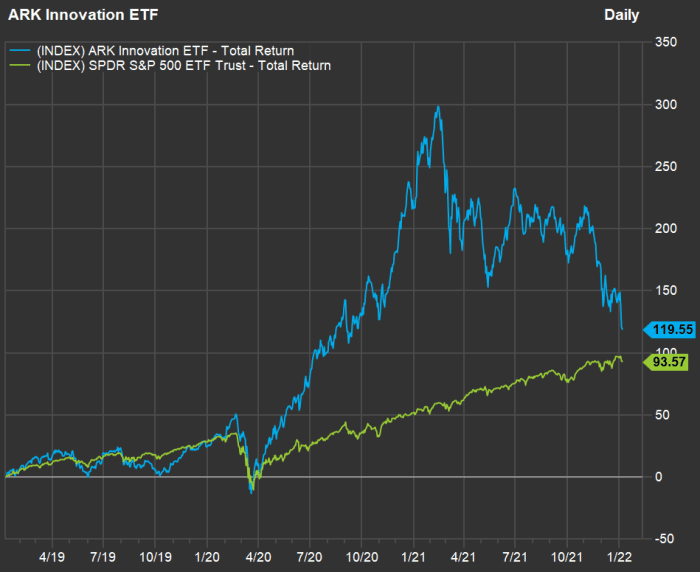

This S&P tortoise may overtake that hare

During 2020, it seemed the Ark Innovation ETF ARKK,

Here’s a three-year chart showing the movement of ARK and the SPDR S&P 500 ETF Trust SPY,

Mark DeCambre writes the ETF Wrap column. This week he discusses what is really a “normalizing policy” for the Federal Reserve, its pressure on technology stocks and exchange-traded funds that might be good alternatives to ARKK as interest rates rise.

What’s going on with bitcoin?

Bitcoin BTCUSD,

In this week’s Distributed Ledger column, Francis Yue explains why cryptocurrencies have plummeted.

More cryptocoverage:

- ‘I’m not nervous in the medium term but we’re going to have a lot of volatility,’ says crypto bull Novogratz, as bitcoin adds to Fed-fueled tumble

- GameStop’s stock soars over 30% after hours, and Reddit crowd cheers, after report of plans for NFT platform

How the metaverse can be used by terrorists

When Facebook changes its name to Meta Platforms Inc. FB,

The metaverse is still being created — it is a virtual environment that may not interest you, but it is important to understand its potential and how it might be exploited to cause harm, as University of Nebraska professors Joel S. Elson, Austin C. Doctor and Sam Hunter explain.

Is this the best job in America?

See which job tops the list in Glassdoor’s annual survey, based on on salaries, employee satisfaction and demand for workers.

Inflation and breakfast

They’re gr-r-reat! Except when inflation is high.

Saul Loeb/Agence France-Presse/Getty Images

Tonya Garcia looks at what may be a potential problem for Kellogg Co K,

Help with a retirement plan

Alessandra Malito writes the Help Me Retire column, assessing how readers’ finances stack up against their retirement dreams. This week she helps a woman whose husband is terminally ill.

Retirement account “leakage” can hurt you over the long run

You might not be familiar with the term “leakage” when it comes to retirement accounts, but you should learn about how harmful it can be to your nest egg, as Alicia Munnell explains.

More retirement coverage:

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.