Affirm stock slammed after early earnings release shows revenue outlook misses

This replaces an earlier report that incorrectly reported how second-quarter revenue compared with analyst expectations. It has been corrected.

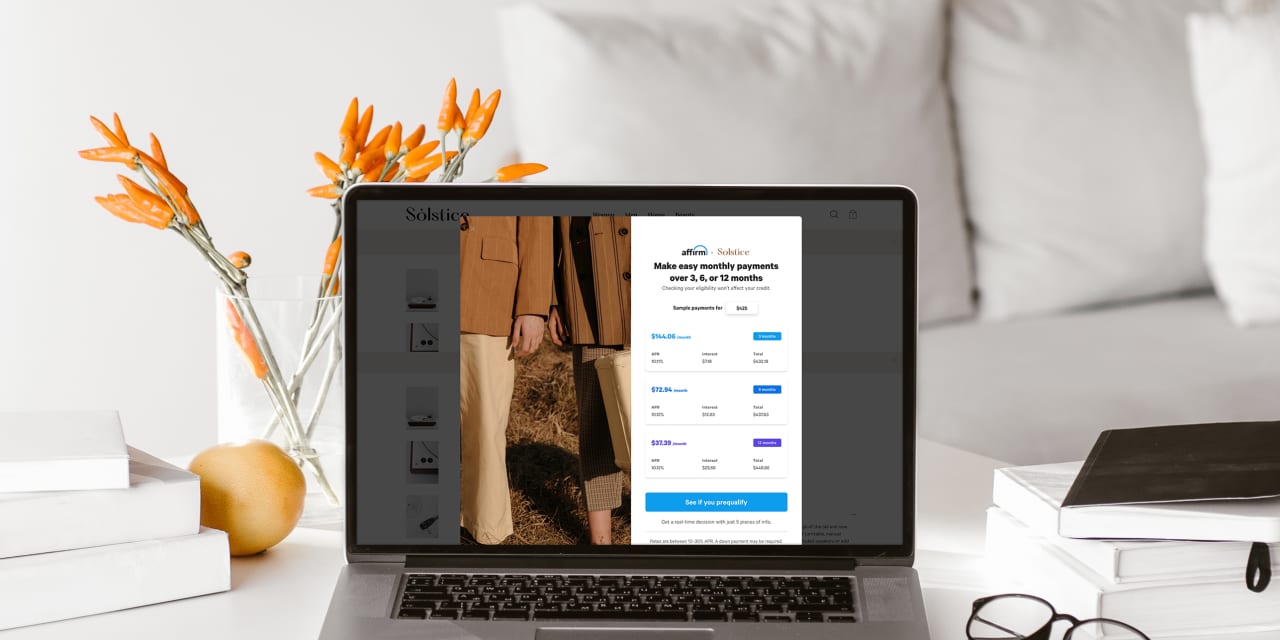

Shares of Affirm Holdings Inc. were plunging in Thursday afternoon trading after the buy-now pay-later company posted its latest earnings results more than an hour earlier than scheduled, showing higher-than-expected volume but a lower-than-anticipated revenue outlook.

The company reported a fiscal second-quarter net loss of $159.7 million, or 57 cents a share, compared with a loss of $26.6 million, or 38 cents a share, in the year-prior quarter.

Affirm AFRM,

Revenue rose to $361.0 million from $204.0 million, while analysts surveyed by FactSet had been looking for $329 million on average. Affirm reported gross merchandise volume of $4.5 billion, up from $2.1 billion a year earlier and ahead of the FactSet consensus, which was for $3.7 billion.

The company saw 150% growth in active consumers.

The stock plunged as much as 33% intraday after the results before paring losses to be down 20% in Thursday afternoon trading. Affirm’s shares had been up as much as 11.9% earlier Thursday, prior to the report’s initial release, after the company tweeted out aspects of its financial results ahead of time before deleting them.

“Due to human error, a small portion of Affirm’s fiscal Q2 results were inadvertently tweeted from Affirm’s official Twitter account earlier today,” the company later tweeted.

For the current quarter, Affirm expects gross merchandise volume of $3.61 billion to $3.71 billion, while analysts had been expecting $3.5 billion. The company also anticipates revenue of $325 million to $335 million, whereas the FactSet consensus was for $335.5 million.

The stock has tumbled 54% over the past three months, while the S&P 500 index SPX,