American Express launches its first digital checking account for rewards-hungry consumers

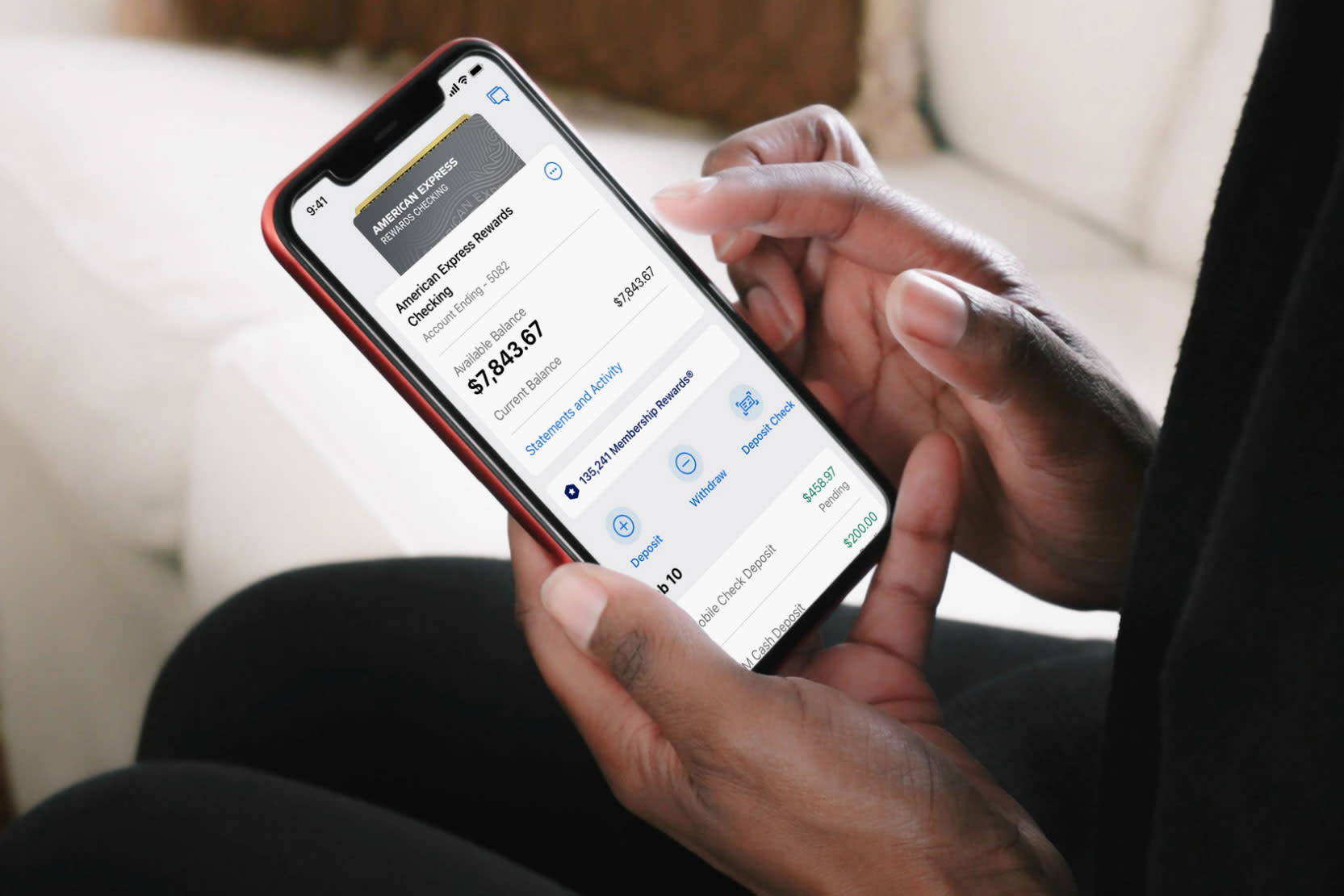

American Express Rewards Checking

Source: American Express

American Express, known for its array of perks-laden cards, is jumping into the highly competitive arena of digital checking accounts.

The company on Tuesday launched Amex Rewards Checking to its U.S. customers. Any non-business card member in good standing is eligible for the no-fee, no minimum balance account, according to Eva Reda, Amex general manager for consumer banking.

While there is no shortage of options for Americans seeking a checking account, from fintech disruptors to big banks, Amex thinks their card members will find the offer enticing. That’s because customers who enjoy racking up points on transactions can use the account’s debit card to earn one reward point for every $2 spent, as well as a 0.50% annual yield on balances.

“The reason we are putting together this really nice APY and the rewards is to absolutely maximize the loyalty we can get from those customers,” Reda said. “The time just feels right based on where customers’ heads are, who’s using the product and how mass this sort of a solution is quickly becoming.”

American Express called it the company’s first checking account for consumers. Last year, the firm rolled out an account for small business owners called Kabbage Checking. (The bank has offered online savings accounts since 2008, according to Reda). The company had more than 56 million U.S. cards in circulation last year, though it doesn’t give a breakdown between consumer and business users.

The accounts will be integrated into the Amex app and provide perks including purchase protection on debit purchases and round-the-clock customer service, said Reda. Of particular interest for the card company is luring millennial and Gen Z users to adopt the account, she said.

“There is no question in my mind that some portion of our customer base are going to decide this is their primary account, and others who are going to try it out and start out with this as their second or their third account,” Reda said.