CATL, LG, Panasonic deployed record GWh of passenger EV battery capacity in 2021

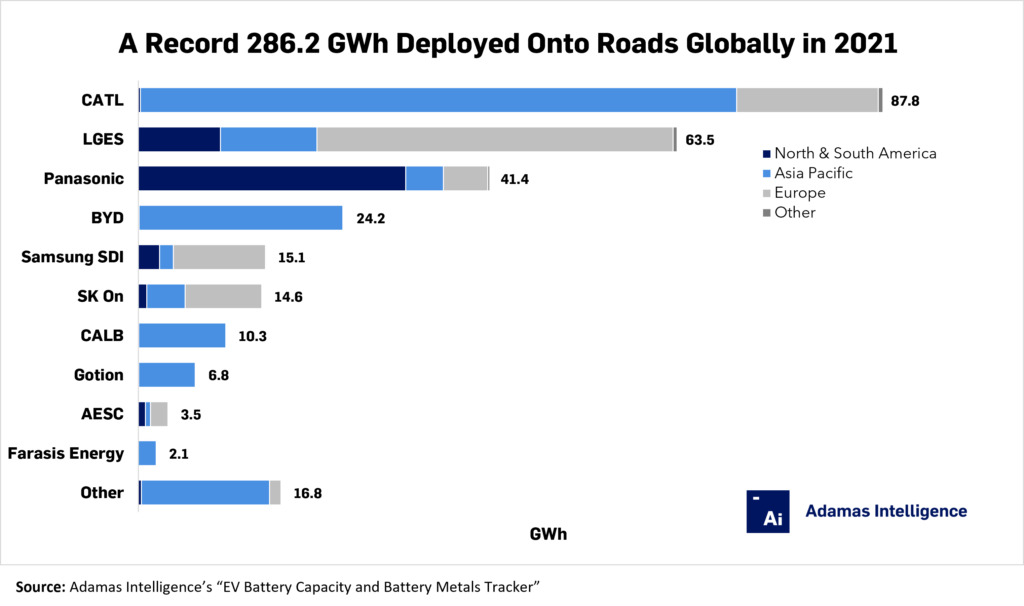

LG Energy Solution, on the other hand, claimed a distant second place with a record 63.5 GWh deployed onto roads globally or 22% of the global total. The Korean company grew 72% over 2020 thanks in large part to the presence of Tesla in China, plus a handful of European and North American automakers.

Adamas’ document places Panasonic in third place with a record 41.4 GWh deployed onto roads globally or 14% of the global total, up 39% over 2020 on the back of roaring Tesla sales growth coupled with modest sales growth from Toyota, Lexus, Honda, Mazda and a couple of other EV makers that it supplies.

Despite their individual positive performances, CATL, LG Energy Solution and Panasonic claimed 67% of the global market in 2021 versus a combined 71% the year prior.

Looking at specific automakers, the report found Tesla was the main client of the top producers combined as 21% of all passenger EV battery capacity deployed onto roads by CATL went into MIC Tesla Model 3s and Model Ys, while the figure was 19% for LG Energy Solution.

For Panasonic, 87% of all passenger EV battery capacity deployed onto roads went into Tesla battery electric vehicles of all kinds, making it by far and large the cell supplier’s widest channel to market for the calendar year.

“In 2021, the average plug-in EV (i.e., BEV/PHEV) sold with Panasonic cells had a battery pack capacity of 58.4 kWh versus a lower 52.8 kWh for CATL and 49.5 kWh for LG Energy Solution,” the dossier reads. “As such, CATL had to equip 1.1 plug-in EVs and LG Energy Solution 1.2 EVs for every one equipped by Panasonic simply to match the latter’s market share, making the former two’s market-leading performance in 2021 all the more impressive.”