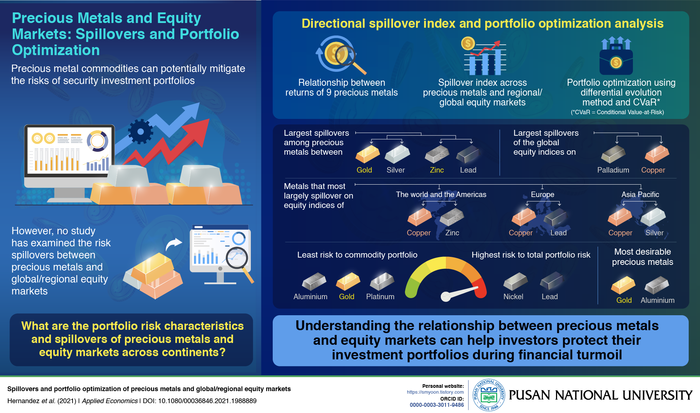

The new research, thus, assessed the relationship between the returns of nine precious metals: gold, silver, palladium, platinum, nickel, lead, zinc, copper, and aluminum. Furthermore, it analyzed the “spillover index” between these metals and regional/global equity markets and performed a portfolio optimization using a differential evaluation method.

The findings revealed that the largest spillovers among precious metals occur between gold and silver and between zinc and lead, while the largest spillovers of the world, the Americas, Europe, and Asia Pacific equity indices are on palladium and copper.

According to the study, metals that most largely spillover on the equity indices of the world and the Americas are copper and zinc, on the equity indices of Europe are copper and lead, and on the equity indices of Asia Pacific are copper and silver. Additionally, nickel and lead add the highest risk to total portfolio risk, while platinum, gold and aluminum add the least risk to the portfolio of commodities. The most desirable metals for investment were found to be gold and aluminum.

“Understanding the relationship between precious metal and equity markets across continents and the world, as well as the role of precious metals in financial investment, is relevant for investors looking to protect their investment portfolios during financial turmoil and market downturns,” Seong-Min Yoon, co-author of the study, said in a media statement.

In Yoon’s view, these findings can also help portfolio investors with portfolio risk management and the creation of hedging strategies. In addition to this, he believes that financial policymakers can benefit from this study by gaining relevant insight on how the inclusion of precious metals can help them with important financial investment decisions.