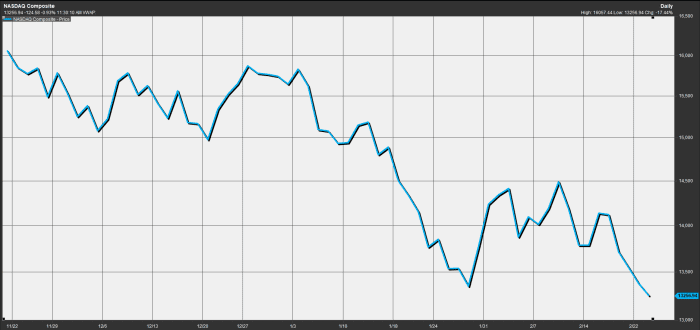

Here is the level to watch as Nasdaq Composite nears first bear market in nearly 2 years

The Nasdaq Composite was trading sharply lower Wednesday as investors focused on the simmering Ukraine-Russia conflict, pulling the technology-laden index toward its first bear market in about two years.

After logging a correction in late January, the Nasdaq Composite COMP,

The Nasdaq hasn’t fallen into a bear market since March 12, 2020, during the height of the COVID pandemic selloff.

However, the mood on Wall Street has soured substantially in the face of higher inflation and expectations that the Federal Reserve next month will commence a series of interest-rate hikes that will kneecap the bullish upswing in stocks during a period of rates that were at or near 0%.

Read: A bear market is coming, and with it ways to make money not seen in 40 years, says this strategist

The benchmark 10-year benchmark Treasury note TMUBMUSD10Y,

Higher yields have been blamed for the selloff by many tech and other so-called growth stocks whose lofty valuations were based on profit and cash flow expected far in the future. Higher yields mean the present value of those future flows are worth less.

Meanwhile, tensions in Eastern Europe could threaten to drive inflation even higher and provide further cause for monetary policy makers to raise borrowing costs to cool the economy if prices for commodities, including everything from wheat to crude oil run higher.

The bearish factors have combined to drive the Nasdaq Composite substantially lower but also are weighing on the Dow Jones Industrial Average DJIA,