How the Russia-Ukraine crisis is impacting markets, business and the economy

Check here to find out how the crisis is impacting markets, Canadian businesses and the financial world

Article content

World stocks are tumbling and oil prices are soaring as the West ramps up sanctions against Russia over the Ukraine invasion.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Check here for live updates on how the crisis is impacting markets, Canadian businesses and the financial world.

4:48 p.m.

Roman Waschuk, former ambassador of Canada to Ukraine, characterized the West’s latest efforts to block Russia from the global financial system as “killer sanctions.”

Waschuk acknowledged in an interview with the Financial Post’s Larysa Harapyn that while the first round of economic sanctions imposed against Russia didn’t do much; however, the second round – which has involved freezing Russian central bank reserves – has packed a punch.

“It would be a significant deterrent to a person in a normal frame of mind,” Waschuk said. “Sadly, I think President (Vladimir) Putin is no longer there… I think he’s living in his own mind.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Waschuk said he supports NATO’s decision to keep the conflict at arms-length given Putin’s nuclear threats. “This is a prudent choice,” he said.

Keep an eye on financialpost.com and the FP’s YouTube channel for the full interview, which will be posted soon.

— Marisa Coulton

4:44 p.m.

Wheat futures jumped on Monday in another sign that Russia’s invasion of Ukraine is stoking fears of a disruption in the global grain supply.

The conflict has destabilized one of the world’s most import grain-growing regions, driving volatility in the market for wheat, corn and other commodities produced in Ukraine and Russia. The two countries account for almost a third of all global wheat exports, and 19 per cent of global corn exports, according to a research note from CIBC.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Expect more volatility,” said Jean-Philippe Gervais, chief economist at the federal agriculture lender Farm Credit Canada.

May contracts for soft red winter wheat at the Chicago Board of Trade shot up about 8.7 per cent on Monday, to US$9.35 per bushel. It was a significant turnaround from Friday, when the price dropped about eight-per-cent to US$8.60 per bushel after peaking at a high not seen since 2008, according to Reuters.

May contracts for corn made a similar rebound after a 5-per-cent drop on Friday, hitting US$6.91 per bushel on Monday — a gain of about 5.3 per cent.

Agriculture leaders have warned that any war-related rise in the price of crops is likely to be offset by simultaneous rises in production costs, especially since Russia is a key player in the global fertilizer market.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“As a farmer, we don’t like volatile times. They’re hard to plan for,” Brendan Phillips, a Manitoba farmer who serves as the vice-chair of the Grain Growers of Canada, said on Friday.

CIBC analysts noted on Sunday that sanctions on Russia have so far spared agricultural exporters, but the invasion still jeopardizes production levels and risks supply chain disruptions.

“Global supply chains do not need additional commotion in the movement of seaborne goods, and freight rates were already spiking,” the CIBC note reads. “So far, the invasion has not caused major specific disruptions to production, but that remains a real possibility as long as fierce fighting continues.”

— Jake Edmiston

4:15 p.m.

Stocks pared their losses and in some cases made modest gains after a volatile day of trading following powerful Western sanctions against Russia as it continued its invasion of Ukraine.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

At the close the S&P 500 lost 10.90 points, or 0.25 per cent, to end at 4,373.68 points, while the Nasdaq Composite gained 60.55 points, or 0.44 per cent, to 13,755.17. The Dow Jones Industrial Average fell 171.82 points, or 0.50 per cent, to 33,886.93.

The TSX was up 20 points to 21,126.

4:08 p.m.

The horrific events in Ukraine may be happening many thousands of miles away from Canada, but they add another layer of uncertainty to the global economy in already uncertain times.

One effect of the invasion is that it could end up exacerbating inflation, and lead to higher food prices around the world.

“There are really three breadbaskets of the world: it’s Russia, Ukraine and Canada,” said Mark Manger, a professor of political science at the University of Toronto’s Munk School of Public Policy where he is director of the global economic policy lab.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Manger said while Canada’s direct trade relationship with Russia is essentially negligible — because they export so many of the same products, including oil and gas, fertilizer, and wheat — the entire world is bound to feel the disruptions that will result from sanctions against Russia, and disruptions to Ukraine’s trade.

“Our direct trade relationship with Russia is not important enough to be affected,” said Manger, “but of course, that doesn’t mean we’re not affected by this, because the global economy is affected.”

As Ukraine is one of the biggest grain producers in the world, disruptions to production and logistics will “further tighten” wheat and corn markets, pushing prices higher, said analysts at CRU Group, the commodity research firm.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

At the same time fertilizer prices are also expected to rise as supply out of Russia, and Ukraine, faces new constraints.

Higher food prices are a risk, particularly for developing countries such as India, which imports large amounts of fertilizer, said Alex Tuckett, principal economist at CRU Group.

Fertilizer producers in Canada could increase output to try to make up the shortfall, and some producers have already discussed this, but Tuckett said “there are outright supply problems and logistics issues” that would make it difficult to quickly and easily replace that lost production.

“I think there’d be an immediate effect on food prices if grain exports were to fall significantly from Russia and Ukraine,” said Tuckett. “That would tighten cereal markets immediately.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

A rise in fertilizer prices would take longer to effect food prices, but it could also have “dramatic” impact depending how long the conflict stretches on, and how severe sanctions become.

In a note, Tuckett’s group wrote that the effects of sanctions can be hard to predict: In 2018, the U.S. Treasury Department implemented sanctions on the Russian aluminum producer, Rusal, which operates a refinery in Ireland.

“The halting of shipments from that refinery to aluminium smelters in Europe was nearly as disruptive as the halting of metal exports from Russia,” the CRU analysts wrote.

— Gabriel Friedman

3:45 p.m.

Canada is banning all imports of Russian oil as part of its actions against the country’s invasion of Ukraine, Prime Minister Justin Trudeau said Monday.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The Russian crude oil import ban targets “an industry that has benefited President Putin and his oligarchs greatly,” he said.

Trudeau also said Canada would send anti-tank weapons and “upgraded ammunition” to Ukraine.

Canada has already fast-tracked immigration of Ukrainians, provided weapons and aid and enacted severe sanctions on Russian financial institutions, Trudeau said at a press conference.

“Our message is clear, this unnecessary war must stop. Now, the costs will only grow steeper and those responsible will be held accountable.”

Deputy Prime Minister Chrystia Freeland said sanctions preventing Canadian financial institutions, including the Bank of Canada, from transacting with the Russian Central Bank, along with preventing Russian banks from using the SWIFT payment system are working to hobble Russia financially.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

“These measures will cut Russia off financially from the Western world,” she said. “They will render useless much of the war chest that Vladimir Putin has amassed in his central bank.”

3:19 p.m.

Trading on Moscow Exchange’s stock and derivatives sections will remain close on Tuesday, the Russian central bank said on Monday, extending the suspension of trading amid a full-blown financial crisis triggered by Western sanctions.

3:16 p.m.

- Dow Jones Industrial Average down 1.4%

- S&P 500 down 1.21%

- Nasdaq Composite down 0.68%

- TSX down 0.41%

2:35 p.m.

Why China may prove a fair-weather friend

As international sanctions mount against Russia over the invasion of Ukraine, there’s a big question out there, what’s China going to do?

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

While Beijing’s relations with the United States have been deteriorating for years, relations with Russia have become increasingly chummy.

Since the attack China has refused to condemn the Russian actions or even call it an invasion.

But while it looks as though China is lining up with Russia this support has limits, argues Neil Shearing, chief economist for Capital Economics.

Shearing says China can help out through trade and finance but it’s unlikely to do anything that risks a further rupture with the West such as wholesale breaking of sanctions.

“That wouldn’t be in China’s economic interests – access to global financial markets is more valuable than anything Russia can offer.”

“This isn’t to say that economic interests will always win out. But Xi has much stronger reasons than Putin to avoid a complete rupture in relations with the West.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

2:13 p.m.

Ukraine President Volodymyr Zelenskyy appealed to the European Union to immediately permit the country into the economic bloc and signed an application letter for entry on Monday.

“Our goal is to be with all Europeans and, most importantly, to be equal,” Zelenskyy said in a video. “I am confident that it is fair. I am confident that we have deserved it. I am confident that this is all possible.”

Membership in the EU would provide protections to Ukraine and further pull it away from Russia’s encroachment. The process to enter, however, is long and arduous.

The Wall Street Journal reported Monday that member-state ambassadors met to discuss whether Ukraine could be offered member status, but those talks were inconclusive. Some states, like France, are wary of accepting new members and worry about drawing members into continent-wide conflict by inserting itself in eastern Europe.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

— Bianca Bharti

1:45 p.m.

Ottawa today banned all Canadian financial institutions from doing business with Russia’s central bank, an unprecedented sanction for a G20 country.

It also imposed an asset freeze and dealings prohibition on Russian sovereign wealth funds.

“Canada and its allies continue to take concerted action to ensure that Russia’s invasion of Ukraine will be a strategic failure. This has never been done before at this scale – today we are taking a historic step by directly censuring Russia’s central bank. Canada is firmly on the side of the heroic resistance of the people of Ukraine and we will continue to take further action to ensure President Putin does not succeed,” Chrystia Freeland, Deputy Prime Minister and Minister of Finance, said in a press release.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

1:33 p.m.

Worst-case scenario — World III

Bay Street economist David Rosenberg used his widely read morning newsletter to set out his worst-case scenario for where the Ukraine conflict might lead: “It involves a World War III, and I am not being hyperbolic,” he wrote.

To be clear, a global conflagration isn’t necessarily the bet on which Rosenberg would put his money. His best-case scenario is a diplomatic resolution, which is still probably the more likely outcome.

Rosenberg’s worst-case sees China going for Taiwan, North Korea testing South Korea’s resolve; and Iran, newly empowered by US$100 oil, baiting Israel and its other rivals in the Middle East. Rosenberg’s assessment of history is that Winston Churchill stood up to stop Hitler’s advance. He doesn’t see such a leader today. “Nobody like that exists, and all the world’s strongmen, with all their own grievances, know it too,” he wrote.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

If we’ve learned anything over the past couple of years, it’s the folly of banking on best-case scenarios. The future Rosenberg painted was dark, but within what now counts as the realm of possibility.

And what does the economist recommend for investors? Read on

— Kevin Carmichael

1:26 p.m.

This just in — Shell has joined BP is saying it will exit all its Russian operations, including a joint venture at a major liquefied natural gas plant, following Russia’s invasion of Ukraine.

The decision comes a day after rival BP abandoned its stake in Russian oil giant Rosneft in a move that could cost over US$25 billion.

Shell will quit the flagship Sakhalin 2 LNG plant in which it holds a 27.5 per cent stake, and which is 50 per cent owned and operated by Russian gas giant Gazprom.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The company also plans to end its involvement in the Nord Stream 2 pipeline from Russia to Germany, which it helped finance as a part of a consortium of companies.

— Reuters

11:50 a.m.

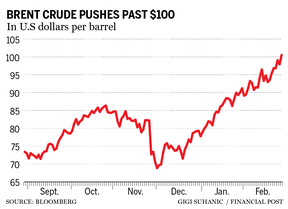

Update on the ever-rising price of oil

Brent crude rose US$2.32, or 2.4 per cent, to US$100.25 this morning after touching a high of $105.07 a barrel in early trade.

U.S. West Texas Intermediate (WTI) crude was up US$3.09, or 3.4 per cent, at US$94.68 after hitting US$99.10 in early trade.

11:36 a.m.

More than $20 million in crypto donations pour into Ukraine

Cryptoassets have been emerging as an important funding tool in the Russia-Ukraine crisis as Ukraine raised as much as US$22.2 million in digital assets since the beginning of the Russian invasion, according to data from U.S.-based crypto analytics firm Elliptic.

The figures, updated on Monday morning, represent over 23,000 cryptoasset donations raised by the Ukrainian government and other non-governmental organizations (NGO) supporting Ukraine’s military donations. One such NGO was Come Back Alive, which raised several million dollars.

The official Twitter account of the Ukraine posted a tweet over the weekend asking for crypto donations with an address linked within. The posted addresses have since seen 18,561 transactions and raised US$14.8 million. Elliptic added that one NGO saw a single US$3 million bitcoin donation.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Bitcoin represents the majority of cryptocurrencies being donated (56 per cent) with Ethereum in second place (32 per cent). Stablecoins and other cryptoassets like non-fungible tokens (NFTs) have also been sent to the Ukrainian government’s Ethereum account.

Crypto payments have been a faster way to process cross-border donations and side-step financial institutions that may be attempting to block payments to these Ukrainian groups.

— Stephanie Hughes

11:23 a.m.

It’s extremely likely Russia will default on its external debts and its economy will suffer a double-digit contraction this year after the West launched sanctions unprecedented in their scale and coordination, the Institute of International Finance said today.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

The IIF estimates that half of the foreign reserves of Russia’s central bank are held in countries which have imposed asset freezes, severely shrinking the firepower policymakers have to support the Russian economy.

— Reuters

10:38 a.m.

Dream of G20 going up in smoke

When Canada’s Paul Martin and America’s Lawrence Summers decided in the spring of 1999 that the world’s legacy powers and emerging economies such as China and Brazil needed a place to talk, they drew up a roster for what would become the G20.

The G20 was supposed to bring stability, but five days into Russia’s invasion of Ukraine, it feels naive to think that a group that includes the United States, China, Russia, the United Kingdom, Saudi Arabia, and Turkey ever would have been able to accomplish much, writes the Financial Post editor-in-chief Kevin Carmichael.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

Over the weekend, the United States, the European members of the G20, and Canada imposed “restrictive measures” that they said would stop Russia’s central bank from “deploying its international reserves in ways that undermine the impacts of our sanctions.” European Commission Ursula von der Leyen emphasized the point on Feb. 27, stating that the commission will “ban the transactions of Russia’s central bank and freeze all its assets, to prevent it from financing (Vladimir) Putin’s war.”

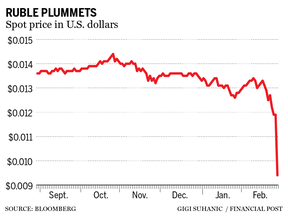

The founders of a group created in the aftermath of a rouble crisis has now triggered one. The Russian currency collapsed by some 40 per cent, more than during the country’s financial crisis in 1998.

Canada is a small player in this scene. “The Bank of Canada does not hold any of the Russian central bank’s reserves, nor does it transact with any Russian banks,” spokesman Paul Badertsher said in an email. “The Bank of Canada has also notified the Russian central bank that we will not facilitate any transactions for them.”

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

But what looks like the death of the G20 as a serious global body must be a disappointment to the globalists in Ottawa who thought they had helped to create something special. It looked that way for a little while. Then history got in the way, forcing the group to choose sides. Now they are fanning flames rather than dousing them.

— Kevin Carmichael

10:16 a.m.

President Joe Biden’s administration on Monday banned American people and companies from doing business with the Bank of Russia, the Russian National Wealth Fund and the Ministry of Finance.

This is just the latest in sanctions aimed at cutting off Russia financially.

“Our objective is to make sure that the Russian economy goes backwards if President Putin decides to continue to go forward with an invasion in Ukraine, and we have the tools to continue to do that,” a senior U.S. administration official said on Monday.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.

Article content

This weekend Canada, the European Commission, France, Germany, Italy, the United Kingdom, and the United States issued a joint statement condemning Putin’s “war of choice” and attacks on Ukraine, and committed to ensuring the removal of “selected Russian banks” from the SWIFT system.

The Financial Post’s Barbara Shecter explains why SWIFT is the financial “nuclear option” when it comes to punishing Putin. Read more here

9:55 a.m.

Whoa, Russia’s central bank hiked its interest rate from 9.5 per cent to 20 per cent this morning before the ruble started trading.

The biggest rate increase in almost 20 years did little to save the currency which plunged nearly 30 per cent as traders struggled to price the currency amid an initial lack of liquidity.

9:33 a.m.

Stocks are falling off the bell this morning as investors assess the fallout from a new set of sanctions imposed by the Western countries on Russia over its invasion of Ukraine.

The Dow Jones Industrial Average fell 188.13 points, or 0.55 per cent, at the open to 33,870.62 and is now down more 400 points.

The S&P 500 opened lower by 30.48 points, or 0.70%, at 4,354.17, while the Nasdaq Composite dropped 123.80 points, or 0.90%, to 13,570.83 at the opening bell.

The TSX is down 121 points at 20,984.

Gold is up US$23 at US$1,911.

Additional reporting by Reuters, Bloomberg.

Advertisement

Story continues below

This advertisement has not loaded yet, but your article continues below.