How to profit from your losses on those ‘Cathie Wood’ stocks

Americans have lost billions of dollars from their retirement funds in the past year as some of the most popular recent investments have come crashing down to earth.

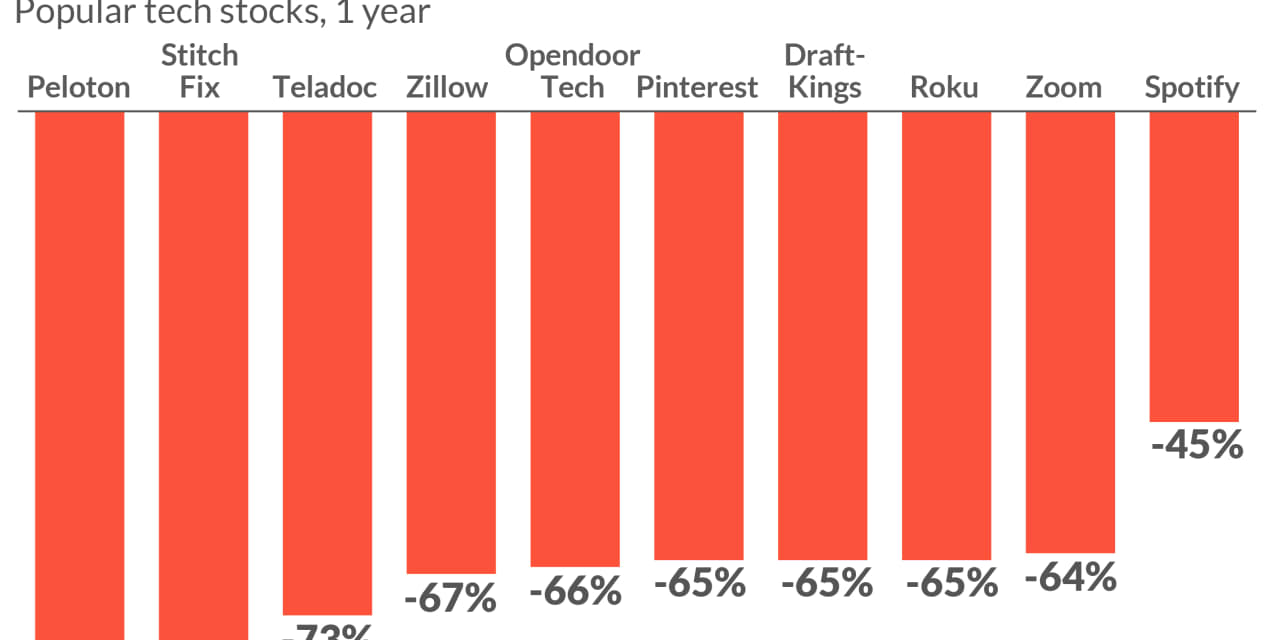

As our chart above shows, many of the most popular stocks have been eviscerated. Most of them were the so-called “stay at home” stocks that boomed during the earlier days of the pandemic, as investors bet on a so-called “great reset” that would transform society overnight.

These include online fashion stylist Stich Fix SFIX,

As so often on Wall Street, yesterday’s party is today’s hangover.

Want to become a better investor? Sign up for our How to Invest series

Will the future be brighter? Possibly. Futuristic “growth” stocks that have fallen 70% or more from their peaks are, by definition, closer to the bottom than they are to the top (although a stock that has fallen 99% can still fall another 100%). The hot money that flooded in has flooded out. Some of these stocks may prove good long-term bets from here, though good luck getting the names or the timing right.

Meanwhile, if you’re among those with huge losses in your retirement portfolio, there are three things you can do about it right now to turn today’s pain into tomorrow’s gain.

Cash in those losses for tax purposes

This only applies if you hold these stocks or funds in a regular, taxable brokerage account—and not in an IRA or equivalent. And it only applies if you actually paid more for these securities than their current value.

But if both of those apply, you can bank an effective financial benefit from your losses by selling your securities. If you do that, you can then claim those losses against your 2022 income taxes. As most people pay a higher rate of income tax than they do capital-gains tax, this can be a useful benefit.

There are two catches you need to watch out for.

The first is that the IRS will only let you use $3,000 worth of losses on each year’s income tax form, so if—for example—you have lost $30,000 on these stocks it could take you 10 years to use up all the losses.

The second is that you have to watch out for the so-called “wash rule.” This means that if you want to claim a tax loss, you cannot just sell the securities and then immediately buy them back again. If you did that, the IRS would consider the transaction a “wash” and you wouldn’t get the tax benefit.

To get around this you need to sell the stock or fund, and then wait more than 30 days before buying it back. The danger is that the stock may suddenly rally while you are sitting on the sidelines—as just happened with Peloton PTON,

Naturally, this tax break is not available to anyone who is still sitting on paper profits, even if you have suffered the agony over the last year of seeing those profits collapse. If you bought, say, Zoom ZM,

Do an IRA rollover

If you are holding these securities in a tax-deferred individual retirement account, of course you can’t take a tax loss. But there may be a way to take advantage of the collapse in values anyway.

If you hold the securities in a traditional, “pretax” IRA, and you were hoping to convert this account to a posttax Roth IRA at some point, this could be the moment.

IRAs come in two styles. In the traditional type, you contribute pretax dollars: The contributions are deducted from your taxable income for the year in which you make the contribution. The downside is that when you come round to taking the money out in retirement you have to pay income tax on it. (There is no freebie.) Meanwhile Roth IRAs work the other way around: You contribute after-tax dollars, meaning you don’t get any deduction in the year you make the contribution, but the eventual withdrawals are tax-free.

The issue of which is better is a vexed one, covered here before.

Doing a conversion might not be the right move for you.

But if you decide it is, you are better off doing one when the IRA is down. Like now.

You can do the conversion by filling out a form at your brokerage company. You have to pay tax on the exchange, in order to convert those pretax dollars to posttax dollars, and the bigger the conversion the more tax you pay. So if you were hoping to do a conversion, the time to do it is when your IRA has taken a pounding. And if you’ve used your IRA to buy some of these hot stocks, this could be a good time to do it.

Look to the future

If you can’t use your losses for tax benefits, then put them to work for you as the cost of experience.

Think of them as your tuition in investing class. They’ll make you a better investor in the future.

Among the key lessons: Invest for the long-term, stay disciplined, limit your speculations, and don’t chase hot fads. Oh, and never, ever confuse “trading” with “investing.”

Someone who allocated only, say, 10% of their portfolio to some of these highfliers is probably nursing pretty limited losses.

And someone who played in these stocks, but remembered to get out when the market turned a year ago, probably also came away with only their fingertips singed.

The people who lost their shirts are the ones who got greedy. As always.

Meanwhile, when it comes to chasing hot fads and the latest hot stock, reflect on this: Anyone who bought Spotify SPOT,