Intel provides full-year outlook above Wall Street estimates

Intel Corp. forecast a 2022 outlook above Wall Street estimates Thursday, after the chip maker provided its promised outlook for the year at an investor meeting.

Intel INTC,

Chief Financial Officer David Zinsner forecast earnings of $3.50 a share on revenue of $76 billion for 2022, with a gross margin of 52%, and “slightly” negative cash flow of $1 billion to $2 billion.

For the year, analysts had been estimating earnings of $3.42 a share on revenue of $74.99 billion heading into Thursday’s event.

“I’m a meet-beat-raise sort of guy,” Gelsinger had said earlier during his keynote, stressing the same sentiment for the company after the outlook was presented.

When Intel reported earnings in late January, Zinsner, formerly CFO of Micron Technology Inc. MU,

In January, Intel executives forecast gross margins of 52% for the first quarter, which is expected to translate into adjusted earnings of 80 cents a share, though that was before Intel announced it would buy Israel-based chip maker Tower Semiconductor Ltd. TSEM,

The only full-year metric Zinsner had provided during earnings in January was a forecast for gross margins of 51% to 53% for the year. At the conference, he said that should last until 2024, with a range of 54% to 58% from 2025 onwards.

Zinsner also forecast free cash flow of 20% of revenue by 2026.

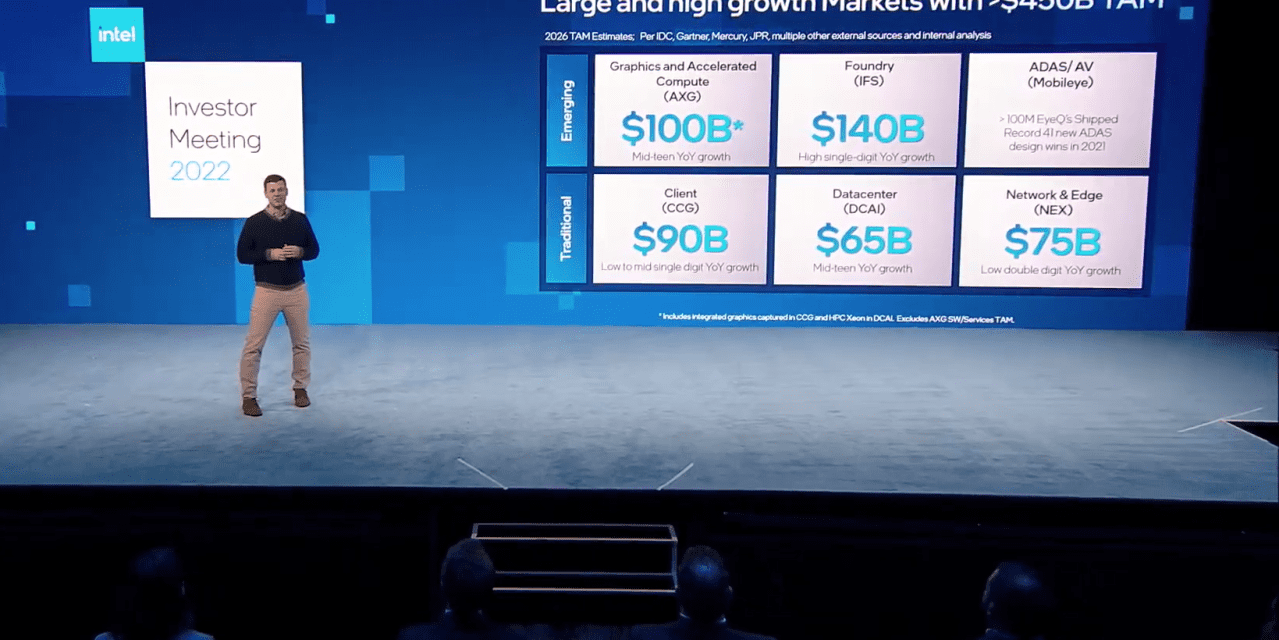

Sandra Rivera, who heads Intel’s data-center group, forecast mid-to-high single-digit growth out to 2023, with that becoming growth in the mid-teens out to 2026.

Michelle Holthaus, who heads the chip maker’s PC business, called for low-to-mid single-digit growth going forward.

Elsewhere in the chip sector, not even a near-perfect earnings report and outlook saved Nvidia Corp. NVDA,

For more: Look back at earnings results from Nvidia as well as AMD

As of the close of markets Thursday, Intel shares are down 23% over the past 12 months, while the PHLX Semiconductor Index SOX,