Market Wrap: Cryptocurrencies Fall as Sentiment Turns Bearish

Cryptocurrencies and equities continued to suffer Tuesday amid increasing geopolitical tensions.

Western nations prepared to launch sanctions against Russian financial interests after efforts to de-escalate the conflict between Russia and Ukraine soured over the past few days. On Tuesday, U.S. officials declared Russia’s movement of troops into the eastern, separatist region of Ukraine as “the beginning of an invasion.”

Bitcoin (BTC) and ether (ETH) were roughly flat over the past 24 hours, compared with a 7% drop in XRP and a 5% loss in SHIB. Most alternative cryptocurrencies (altcoins) underperformed BTC on Tuesday, suggesting a lower appetite for risk among crypto traders.

Some analysts expect choppy price action to persist over the short term, although market panic could eventually fade.

Typically, S&P 500 stock index sell-offs because of geopolitical events have been short-lived, according to a report by Deutsche Bank. The firm’s research shows the median sell-off was -5.7%, lasting around three weeks, before reaching a trough, and then another three weeks to recovery from prior levels.

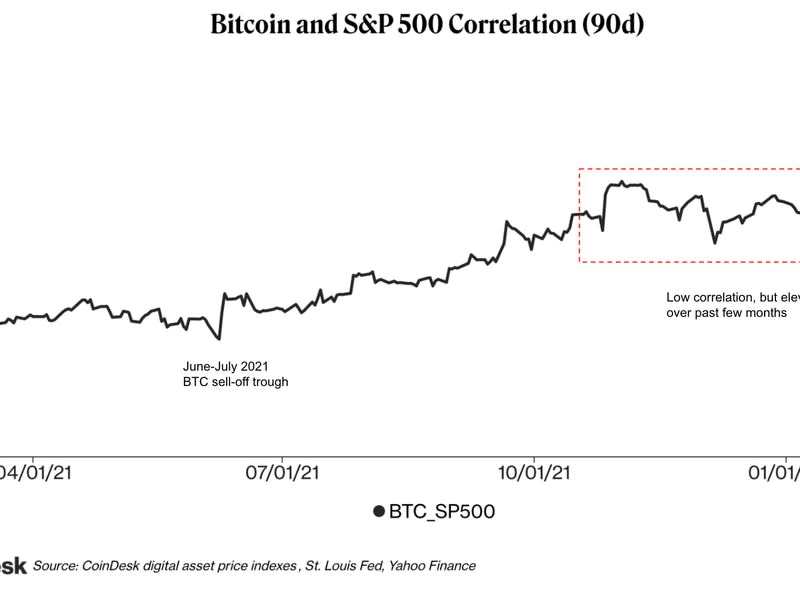

Given the rising correlation between BTC and the S&P 500, some traders are patiently waiting for the decline across speculative assets to settle.

Latest prices

●Bitcoin (BTC): $38032, −0.73%

●Ether (ETH): $2613, −1.73%

●S&P 500 daily close: $4305, −1.02%

●Gold: $1903 per troy ounce, +0.22%

●Ten-year Treasury yield daily close: 1.95%

Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices.

Technicals show short-term support for BTC at $37,000, although stronger support is around $30,000. For now, upside appears to be limited toward the $40,000-$45,000 resistance zone.

But the path forward for bitcoin could be volatile.

“We’ve been seeing aggressive volatility selling with every BTC spike,” QCP Capital, a Singapore-based crypto trading firm wrote in a Telegram announcement.

The firm expects BTC to grind lower with the possibility of a short squeeze on positive headlines. However, “these spikes in spot price would probably be met with aggressive spot selling, capping the topside,” QCP wrote.

Bearish sentiment

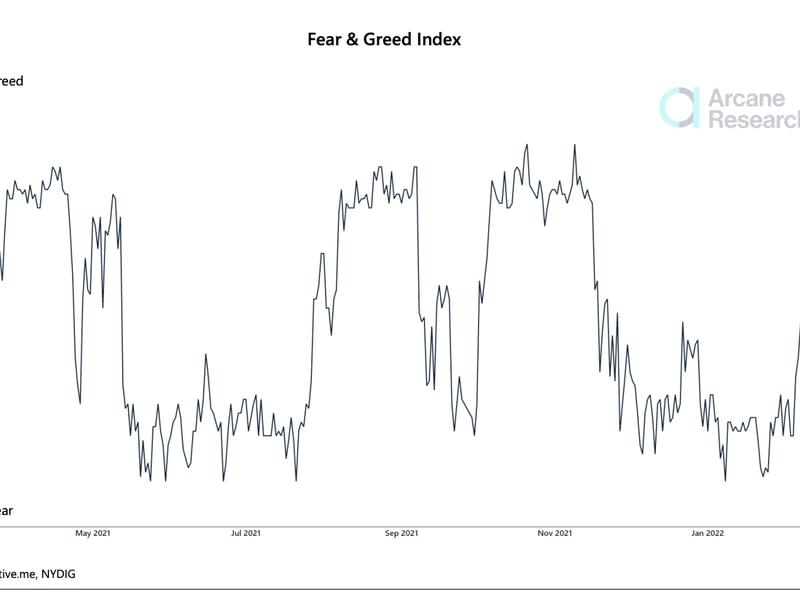

The bitcoin Fear & Greed Index entered “extreme fear” territory last week. Similar to equities, crypto markets are experiencing an uptick in bearish sentiment, driven by macroeconomic and geopolitical concerns.

In the bitcoin futures market, sentiment remains bearish, but not extreme. “Liquidations still remain idle, once again suggesting that traders are careful with leverage,” Arcane Research wrote in a Tuesday report.

And blockchain data show low network activity among bitcoin users.

“This week, the degree of on-chain activity is languishing at the lower-bound of the bear market channel, which can hardly be interpreted as a signal of increased interest and demand for the asset,” Glassnode wrote in a blog post.

Altcoin roundup

-

SAND token joins broader crypto market in gloomy outlook: SAND, the native token of the Ethereum-based virtual-reality platform The Sandbox, dipped below the widely tracked 200-day moving average (MA) on Tuesday, joining peers from other crypto sub-sectors in signaling a gloomy market mood, according to CoinDesk’s Omkar Godbole. Read more here.

-

Tether slashes commercial paper holdings by 21%: Tether has reduced its commercial paper holdings by $6.2 billion over the last quarter in 2021, according to its latest attestation report. The largest stablecoin issuer by total supply cut its assets held in commercial paper from $30.5 billion in the period ending in September to $24.2 billion in December. Tether also drastically reduced its cash assets, from $7.2 billion to $4.2 billion, according to CoinDesk’s Helene Braun. Read more here.

-

Small economies dislike stablecoins: For example, Taiwan’s central bank is not a big fan of the Taiwan dollar being used to settle transactions that don’t have a nexus to Taiwan, something a stablecoin is specifically designed to do, according to CoinDesk’s Sam Reynolds. Read more here.

Relevant news

Other markets

Digital assets in the CoinDesk 20 ended the day lower.

There are no gainers in CoinDesk 20 today.

Largest losers:

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive, and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.