Mounting Risks for S&P 500 Are Under the Surface, BofA Analysts Say

(Bloomberg) — More risks may be building for U.S. equities than meets the eye, Bank of America Corp. analysts said.

Most Read from Bloomberg

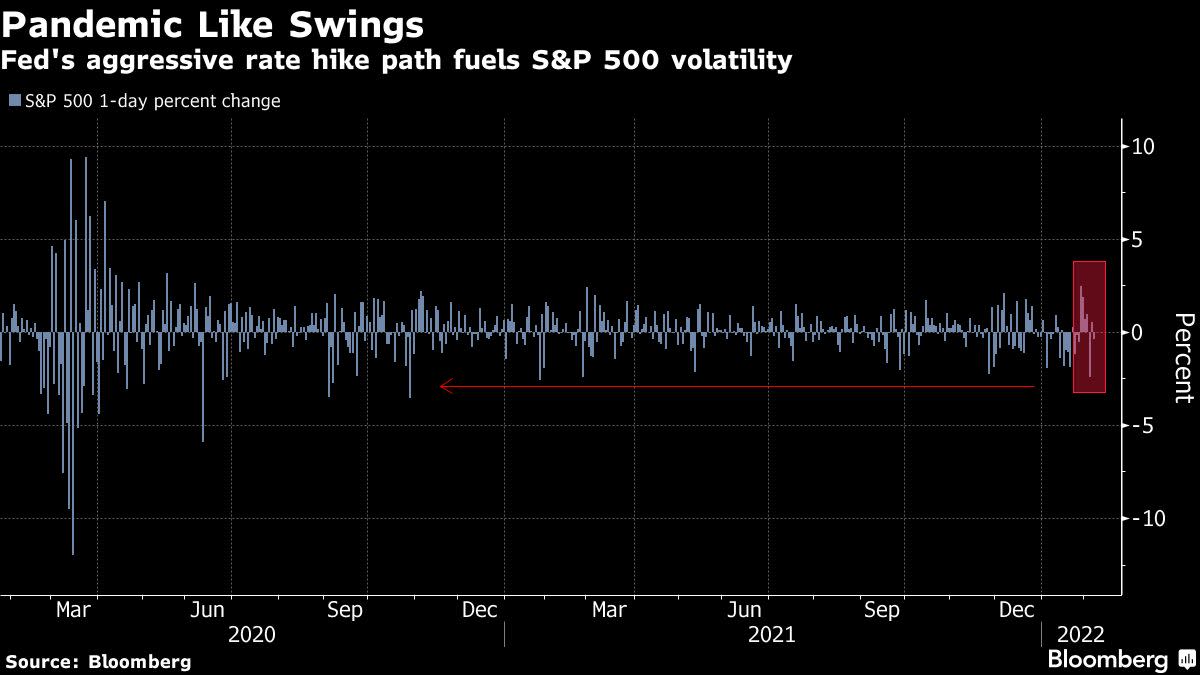

This year’s extreme intraday market swings and fluctuations in single stocks’ value show there’s “turbulence” under the surface, equity derivatives analysts led by Gonzalo Asis said in a note on Tuesday. These gyrations have been exacerbated by the collapse in liquidity levels for S&P 500 e-mini futures to near all-time lows last seen during the 2020 Covid selloff.

“A tug of war is taking place in U.S. equities, with strong earnings and economic growth facing the least market-friendly Fed in decades,” wrote Asis. “Shockwaves from the ongoing tug of war are being felt strongly in intraday and single stock vol.”

Nervous investors have been rapidly reducing their bets on growth stocks that fueled the S&P 500’s rally over the last decade as the Federal Reserve prepares to raise rates to tame inflation. Higher interest rates hurt pricier tech stocks that are valued on future growth expectations.

Facebook parent Meta Platforms Inc. plunged 26% Thursday on the back of woeful earnings results, and erased about $251.3 billion in market value in the biggest wipeout in market value for any U.S. company ever.

Asis and his colleagues highlighted that the last time U.S. equities bounced back from a rout of more than 10% without the help of the Fed was in February 2018. But that rebound didn’t last long, with U.S. stocks collapsing by the end of that year.

This time around the Fed might not step in to support the stock market until a drop of 15% or lower from current levels, BofA said.

“If inflation is the main constraint for the Fed put, then the highest inflation readings since the early 80s suggest the Fed put is the most constrained it has ever been,” the strategists said.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.