Novavax: Covid-19 Vaccine Opportunity Still at Play

With Russia’s attack on Ukraine at the forefront of the current news flow, Covid has been put on the backburner for now.

That said, as has been proven before with the emergence of new variants, it is still too early to say with certainty the pandemic is finally behind us. In any case, over the long run, in similar fashion to the flu, annual boosters to protect against Covid will be required.

So, there is still room for Covid-19 vaccine makers to make their mark, which bodes well for one of the leading coronavirus stocks – Novavax (NVAX), as noted by Jefferies’ Roger Song.

“NVAX’s CV19 vaccine has high efficacy/immunogenicity and clean safety/ tolerability, as well as convenient logistics and well-validated protein-based technology,” the analyst said. “As a result, we believe it could play a meaningful role in the future CV19 vaccine market.”

That “impressive” clinical profile of NVX-CoV2373 stands up well against the two leading mRNA-based vaccines. Technical advantages, like the undemanding shipping/storage requirements are a plus and so is the “well-validated/common” technology, which could be appealing for those with “vaccine hesitancy.”

So far, the vaccine has been authorized for use by more than 30 countries/institutes, including the EU, UK and the WHO. And there’s a big catalyst on the horizon with the company awaiting a regulatory decision from the US. Following several delays, the company finally requested an EUA in January. Another catalyst could be provided by “indication expansions,” with the company overseeing clinical studies including booster, pediatric, Omicron-specific, and combo.

As far as revenues are concerned, assuming a “reasonable share” in the anticipated ~4-5.5 billion of global delivery doses, Song estimates sales of around $4.6 billion based on ~910 million doses in 2022. Taking into account flu-like annual booster/re-vaccination rates, over the long run, Song sees sustained sales of around ~$2.5-4.5 billion.

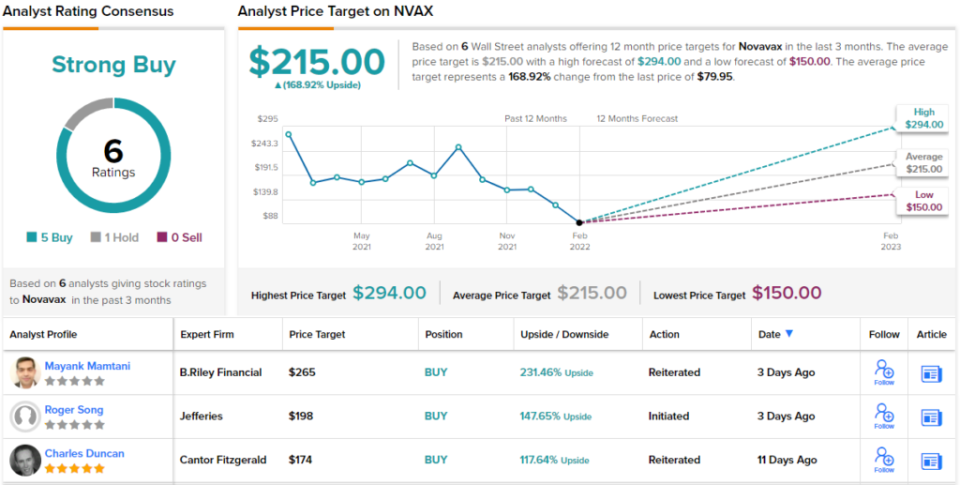

So, what does this all mean for investors? Song assumed coverage with a Buy rating and $198 price target, suggesting shares will climb 148% higher over the one-year timeframe. (To watch Song’s track record, click here)

The Street’s average target is even more bullish than Song will allow; the figure clocks in at $215, and should it be met, investors will be sitting on 12-months returns of 169%. Rating wise, barring one skeptic, all 5 other reviews are positive, providing the stock with a Strong Buy consensus rating. (See Novavax stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.